Additional writing credit to Chad Freiberg.

Financial news has been abuzz with rumors of a possible recession because of the flattening of the Treasury yield curve. What does this mean for public entities holding larger money market balances, and is this simply fear mongering or an indication to change investment strategies? To answer these questions, it is important to have a basic understanding of the Treasury yield curve, how it is measured, and what the changes in the curve mean for municipalities or public entities’ investment decisions.

The importance of the yield curve

The Treasury yield curve is a collection of interest rates on U.S. Treasury bonds across a range of maturities. It is a graphical representation of the relationship between maturities and yields on equal credit quality bonds. This line plots different interest rates for bonds against varying maturities and becomes the benchmark for many types of debt, including bank lending rates. It is also used to predict changes in economic growth. By analyzing the difference between yields on longer-term and shorter-term Treasuries, the shape of the yield curve is a good indicator of the direction of economic activity in the market.

Normally, the Treasury curve is positively sloped, which means long-term interest rates are higher than short-term rates. This is typically due to the term premium that investors are required to hold longer-dated assets. The opposite, an inverted yield curve can occur when the Federal Reserve tightens monetary policy to put the brakes on a growing economy or increasing inflation worries. Since inversions often precedes recession, an inverted yield curve is viewed as a leading indicator of an upcoming economic downturn.

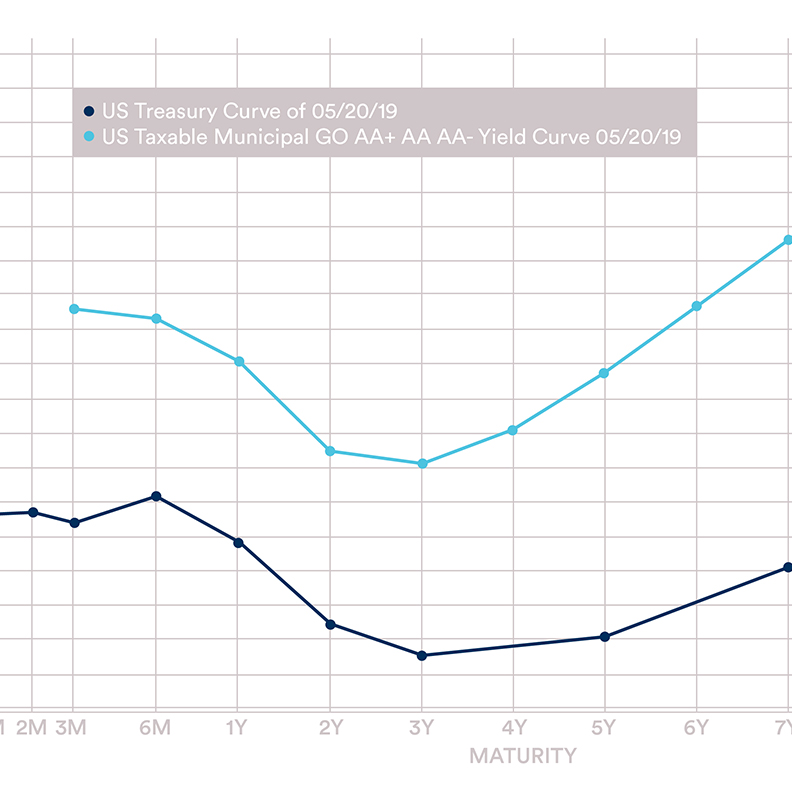

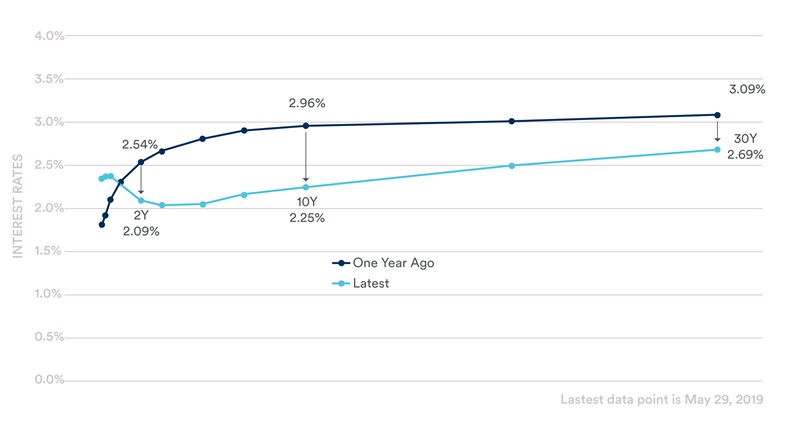

The current shape of the yield curve in May 2019 is basically flat to slightly inverted; there is now little difference between short and longer-term yields (see graph above). The current market belief is that slower growth and inflation are not demanding a higher risk premium for longer term bonds. However, several parts on the front end of the yield curve recently inverted slightly, raising some cause for concern.

Analyzing data over the last 40 years shows that once an inversion occurs, a recession typically follows between 8 to 24 months down the road. That does not mean a recession is right around the corner. However, the recent weaker economic data is showing some signs that the odds of a recession or a rate cut have been increasing. A common measure of the yield curve is the difference between the 10-year and two-year Treasury rate. The 10-year U.S. Treasury minus the 2-year U.S. Treasury yield difference briefly broke 10bp, which means it is still positive, but the curve has steepened slightly. The flattening of the Treasury curve since last year is difficult to ignore, but we believe the rally is a little ahead of itself, even in the near term with the Fed being patient to future adjustments for the federal funds rate. The flattening of the Treasury curve since last year is difficult to ignore, but we believe the Fed will attempt to remain patient. However, the Fed may cut rates sooner if trade tension continues to escalate and the economy weakens further.

Opportunities and risks for government entities

This type of yield curve environment can bring challenges for many public entities and their investment decisions. At first glance, short term investments might seem like the go-to in a flat yield curve with little possibility of yield pickup soon. However, investing reserve dollars in short-term investments can lead to public entities missing their long-term planning goals. What might seem like a conservative approach initially may turn out to be more aggressive. This is because the portfolio could take on a large amount of unintended reinvestment risk if interest rates move lower. This opens the portfolio to the risk of not being able to match longer-term liabilities or longer-term goals down the road. Since economic conditions, and the rate and scale of federal activity can affect parts of the yield curve differently, public entities should continue to focus on their fiduciary responsibility of investing reserves to their long-term objectives.

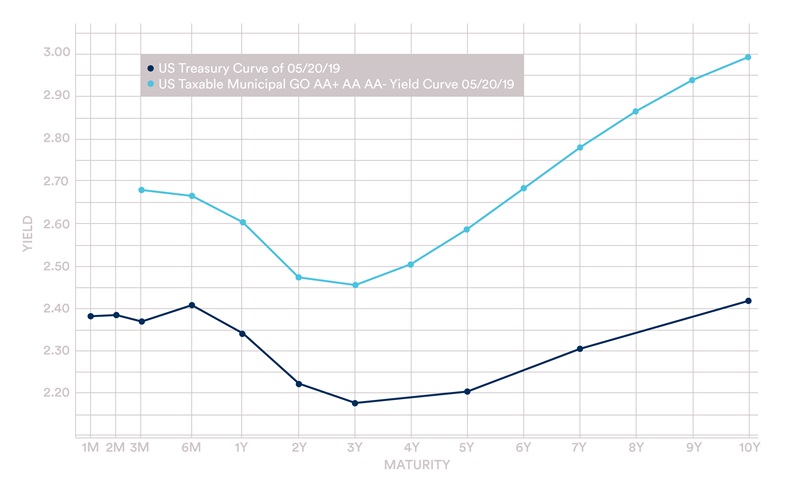

Even with a flat Treasury yield curve, each fixed income sector still has its own curve and offer its own set of unique opportunities. Outside of the Treasury market, there are usually additional spread opportunities, or differences in yield, between one type of security and Treasury bonds. For example, for public entities that can buy high quality municipal bonds, recent AA-rated taxable municipal bonds in the intermediate part of the curve have been yielding around 20-50bps over comparable Treasuries. Taxable municipals typically offer favorable spreads to Treasury and agency bonds, with more call protection than many comparable agency bonds while offering higher yields as well as predictable returns with a high credit profile (see graph). Even a flat yield curve can offer opportunities as one can lock in rates with longer term maturities that are significantly higher than risk free assets.

Recommendations

Investing in today’s market can be challenging, even without accounting for a flat yield curve. However, many opportunities still exist, especially for longer term reserve dollars that may not be needed in the next several years. Simply watching and waiting for rates to rise again could be a mistake. Over the long-term, cash has under-performed compared to intermediate term bonds. There is also no guarantee that rates will rise again since the Fed has signaled a pause for the near-term. In actuality, the cost of waiting or only investing in shorter term investments is a risk that needs to be balanced with the obligations of the public entity.

In this type of yield curve, we recommend building a well-diversified portfolio using a mix of allowable asset classes authorized under state statute and investable guidelines. We continue to search the market for opportunities while participating in new competitive deals and opportunities in the secondary market. In building diversified portfolios, we look to balance risk across maturities, sectors, issuers, credit quality while focusing on liquidity. Implementing this within a laddered strategy will help limit reinvestment risk and generate a higher rate of return compared to money market alternatives in both rising and falling interest rate environments.