Like most people, I do my shopping online. I even seek online medical advice for minor ails because it is quick and easy. For business owners who value speed and convenience, it is only a matter of time before they would turn to online lenders for their business lending inquiries. After all, time is money.

But is an online lender the way to go? The answer is - it depends.

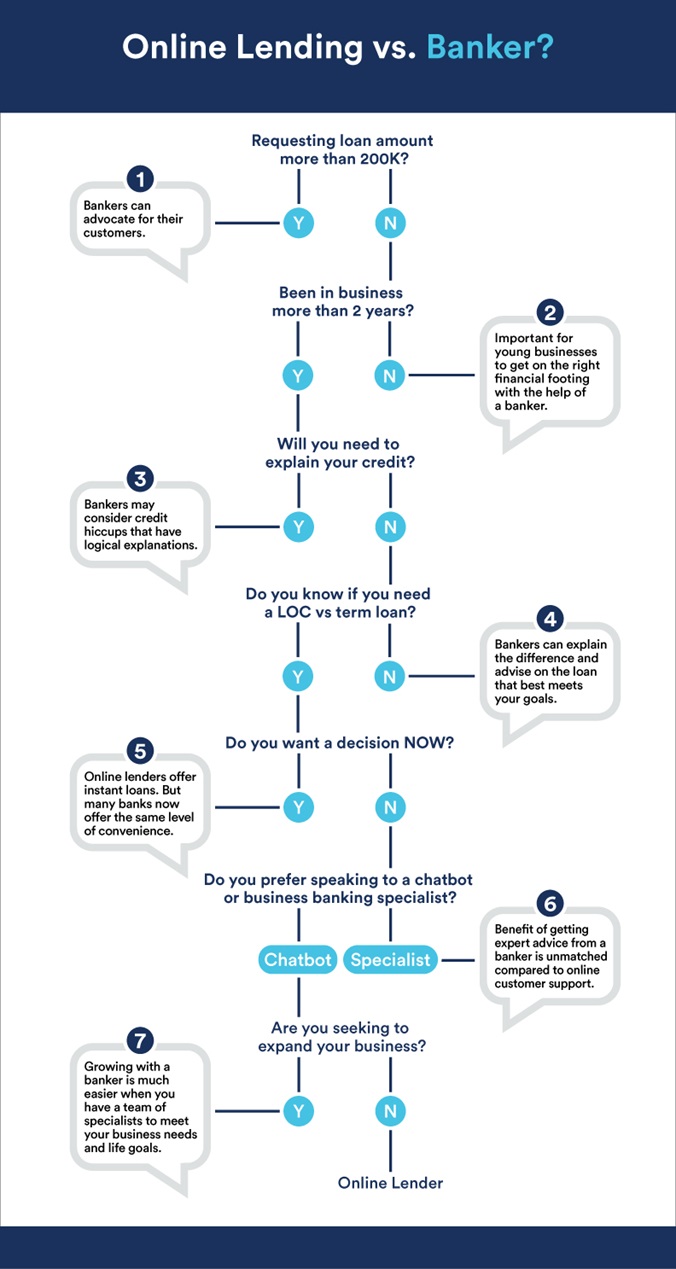

With so many online lending options available, many business owners are often unsure of the best course of action. To help them make better lending decisions, here are seven tips to provide insights into the best lending option, based on different business goals and situations:

A banker can help navigate the best product for your specific need as well as negotiate on your behalf. In online lending, the rate, term and products are pre-set. With larger loan amounts, this could cause the business owner to incur thousands of dollars in interest over the course of the loan without having someone negotiate for them.

Online lenders are largely based on your personal credit score, so chances are many startups will qualify for a loan through them. However, just because they can get approved this way does not mean they should. Setting up your company on the right financial footing from the beginning is imperative to long-term success and a banker can be an excellent resource.

If your credit is not in good shape, odds are you will be declined. For relationship-focused banks, the bankers may consider credit hiccups that have logical explanations, and the owner may qualify for a loan that an online lender would have denied.

A line of credit and a term loan both have their purposes in lending, but if you do not know which one makes the most sense for your specific situation, you could end up with a loan that does not meet your stated purpose.

Online lenders offer instant decision making, but many banks are offering the same convenience to their customers. Check with your bank regarding their decision times prior to applying with an online lender.

Many online lenders have excellent customer support. But if you prefer having access to a specialist who understands your broader business needs and offer guidance, then working with a banker is an obvious choice.

If you have a growth mindset, having all your banking at one institution can be an unrealized advantage. It is a lot easier to expand your business when you have the guidance of a banker who can grow with you. With access to bankers and financial advisors with different specializations, working with a bank allows you to build a team of experts to meet your business and life goals.

Online lending can be a preferred choice because of its ease and immediacy. Similarly, many traditional banks today offer digital solutions with a level of convenience on par with online lenders, but with the added benefit of a specialist who can offer business advice. Whether you opt for an online lender or with your bank, knowing you have a banking partner who doubles as your strategic business partner is an invaluable resource you cannot afford to miss out on.