It has been my experience that when working with successful individuals who are at the cusp of retirement, they typically experience a range of emotions. These can range from excitement of what is to come next, to nervousness about the unknown. As a result, they begin asking some very pointed questions: My career has defined me for so many years, how will others view me now that I’m retired? What will I do to fill my time? Will I miss the social aspect of my job? Will I be successful in maintaining my lifestyle after retirement? These are all valid concerns, and clearly there are many more questions that soon to-be retirees” will ask themselves. As a Wealth Advisor, I feel it is critical to really understand these issues. I find that by providing clarity around financial aspects of their lives, it can help them successfully address the non-financial concerns that they have.

I want to share a few thoughts on important financial considerations when one is getting close to retirement:

You should have a solid strategy for cash flow

Income can come from many different sources, with the most common being social security, pension payments, deferred compensation arrangements and annuities. There are multiple payment options you may choose within each of these sources but they need to be coordinated among each other, along with retirement savings funds.

Timing, or when to begin taking these income streams can be critical in maximizing the benefit. There is flexibility to determine 1) when to begin receiving income, which of course will impact the benefit amount, and 2) how that income will be impacted at the time of the retiree’s passing. This creates the need to consider each of the survivor benefit options and understand how each may impact a surviving spouse or family in the event of a pre-mature passing. In any case, retirement modeling should be run to help select the most effective options based a retiree’s specific circumstances.

These income sources rarely cover all cash flow needs when planning to achieve the desired retirement lifestyle. So naturally we look to then determine a cash flow strategy from investments and lifetime savings. The drawdown strategy from these accounts is very important as I’ve seen first-hand many ineffective plans that do not effectively account for inflation and also do not address tax-efficient methods for withdrawal. Focusing on taxes is especially important as there can be a noticeable drag from unwise planning.

How to invest for a steady cash flow?

When positioning a portfolio to provide a “retirement paycheck”, there are a couple of strategies that are most commonly used - Investing for income. Investing for income focuses on purchasing assets that generate a high level of income such as higher yielding bonds, preferred stocks, Master Limited Partnerships (MLP’s) and annuities.

This may have been a useful method at one time, but there are two issues that are now problematic.

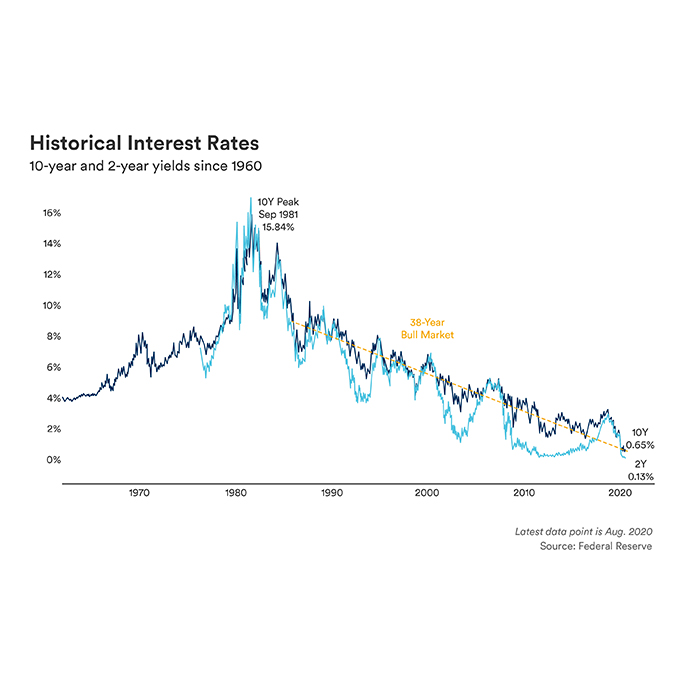

First, not all markets are equal and do not provide the same levels of income. Today, we are experiencing a historic low interest rate environment and the ability to achieve reasonable levels of income may require either a relatively large portfolio or purchasing higher risk fixed income securities. As you can see in the graph below, interest rates over the past 40 years have continued to fall. With recent moves in Federal policy, we have seen these rates fall even more sharply over the past few months. Second, investing for income can be ineffective against inflation over time. In other words, retirement typically lasts for many years, and a dollar generated today will only be a fraction of its value in 30 years.

I encourage and challenge clients to consider a total return strategy that utilizes multiple asset classes to achieve a targeted portfolio return. In this case, a retiree’s portfolio will provide cash flow that is made up of both income (from interest and dividends) along with capital appreciation. To be effective, a portfolio needs to be coordinated with the following:

Cash Bucket.

Three to six months of spending reserves to provide a cushion for market fluctuations.

Dividends and Interest.

Distributed to provide for a portion of retirement spending.

Liquidations – Liquidating principal to make-up any remaining spending not covered by dividends and interest.

Long-term Capital Appreciation

. Capital appreciation is very different from year to year, with some years being negative. However, over the long run, we know with some certainty that capital appreciation will achieve a particular return. This appreciation will accomplish two very important goals, which are to keep the portfolio healthy as it will replenish principal liquidations, and offset inflation, which erodes a portfolio over time.

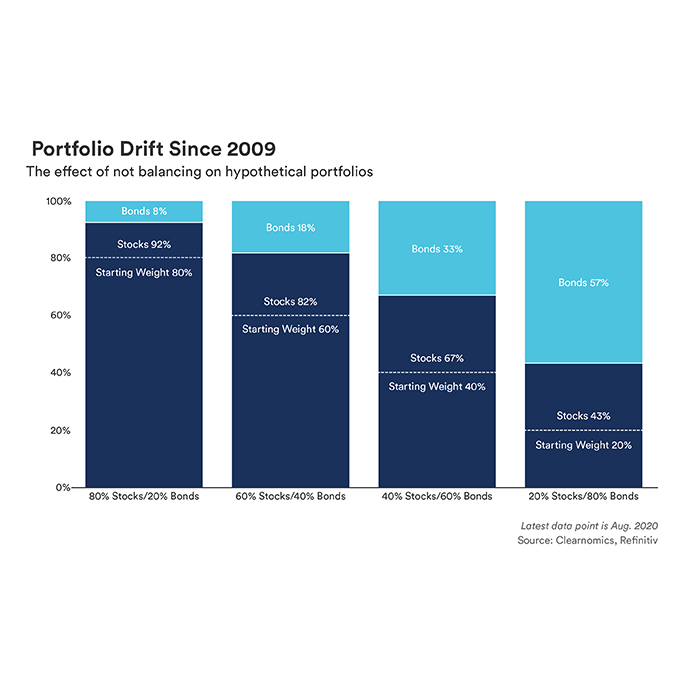

Rebalancing.

As appreciating assets in the portfolio increase, the asset mix between appreciating assets and income producing assets will become disproportionate. Therefore, it is critical to continuously trim appreciating assets and redeploy those proceeds to income producing assets during each rebalance. This will keep the portfolio’s overall risk profile in check and will increase the portfolio’s income over time.

If designed properly and monitored regularly, this strategy can provide an inflation-adjusted cash flow and investment returns that will last through retirement, which will help you achieve your desired lifestyle. I recommend speaking with a wealth advisor to create a custom strategy for cash flow during your retirement years.