- Security

- Scams

Recognizing Common Scams

Fraudsters are becoming more sophisticated all the time, so it’s important to be on alert for these common scams.

In many cases, fraudsters are looking to steal your identity. They will try anything to do so, including impersonating well-known organizations and reaching out to potential victims by phone, email or text with a fake customer message, often about a billing problem or something urgent. These phony requests will typically ask for personal identifying information (such as a name, Social Security number or date of birth) with the intent of committing fraud.

How identity theft leads to fraud Payment fraud occurs when an individual uses one of several payment devices to commit fraud and steal your money. If someone has stolen your credit card or deceptively obtained sensitive information, you’re much more likely to fall victim to this type of fraud.

Payment fraud can include:

Check fraud: Check fraud includes counterfeit checks, altered checks and forged signatures.

Wire fraud and ACH fraud: Wire and ACH fraud occur when a fraudster uses one of these transfer methods to obtain money based on false representation or promises.

Card fraud: Card fraud is theft or fraud committed using a credit or debit card. The fraudster may use the card to obtain products or services or to withdraw money from your account.

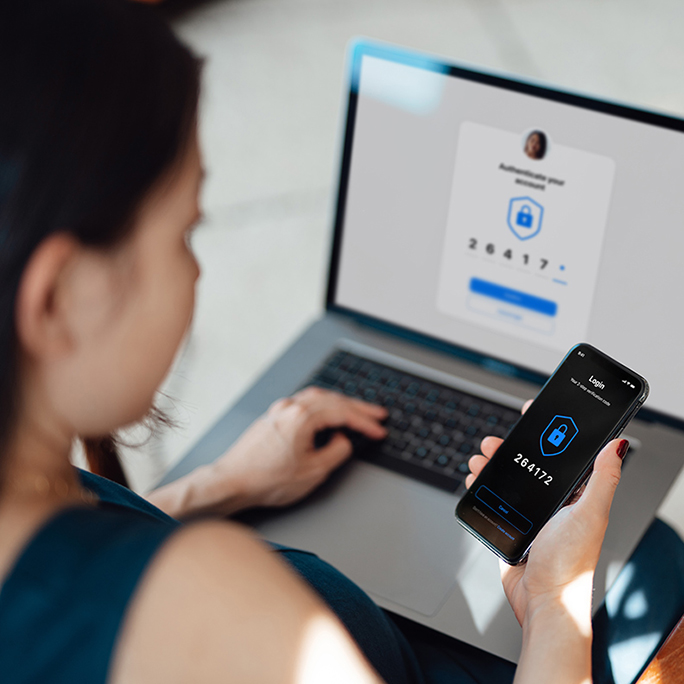

Mobile fraud: Mobile fraud can include attempted or successful fraudulent transactions carried out in a mobile environment, either through a mobile application or through the browser of a mobile device.

Common scams Fraudsters go after personal information in a variety of ways, typically in an effort to commit payment fraud. These are some of the common scams to look out for, but new schemes pop up frequently, so it’s always a good idea to be cautious when any type of communication seems suspicious.

Digital payment apps scams

Some scammers may try to trick you into sending them money through a mobile payment app. This a common tactic because it’s hard for you to get your money back once it’s sent.

Card cracking scams

In a card cracking scam, the scammer convinces the victim to share their debit card or bank account information to withdraw fraudulent check deposits. The storylines can vary: For example, the scammer may tell you someone needs help buying a car but needs an account to deposit a check and withdraw the funds.

Imposter scams

Scammers may pose as a family member, friend or business representative in need of something urgent. You will typically be contacted by phone, email or social media and told to take immediate action.

Tech support scams

Tech support scams typically involve a scammer who tries to trick you into giving them remote access to your computer or to pay them for unnecessary services. The scammers often use high-pressure tactics to get you to act quickly and may even threaten to delete your files or disable your computer if you don’t comply.

Online loan scams

A loan scam involves a loan being offered under false pretenses. The scammer often hooks their target by making a big promise they can’t deliver on, or by hiding the actual cost of the loan. Loan scammers even use fake company logos, false caller ID numbers and other tricks to impersonate legitimate agencies and gain trust.

Online job scams

This scam involves soliciting people for a "lucrative" position that allows them to work from home or as an independent agent.

QR codes scams

These scams hijack normally safe QR codes and send you to phishing websites that steal your financial information or other personal information.

Text scams

Scammers send fake text messages to trick you into giving them your personal information, such as a password, account number or Social Security number.

Confidence or romance scams

These scams occur when a criminal adopts a fake online identity to gain a victim's affection and trust. The scammer then uses the illusion of a romantic or close relationship to manipulate and steal from the victim. They will seem genuine, caring and believable, and the effort to gain trust could last months or years. The scammer then uses the relationship to persuade the victim to give money, personal and financial information, or items of value to the scammer. Fraudsters may refer to an overseas lottery or inheritance, or ask for check cashing assistance, and they often ask for money via prepaid cards or wire transfers.

Online account takeover

An account takeover is a type of identity theft in which a criminal steals the valid online banking credentials of a business or individual and then uses those credentials to initiate funds transfers out of the account. Cybercriminals generally purchase a list of credentials via the dark web. They use these credentials to deploy bots that automatically access travel, retail, finance and social media sites to test password and username combinations and attempt to log in. Attackers arrive at a list of verified credentials and make a profit by selling these credentials to other people or by defrauding the account.

Learn more about avoiding fraud

If you suspect that you’re a victim of fraud, please visit this page for information on how to report the incident. And to keep yourself safe, here are tips for protecting your information online and when using a mobile device.