The inflationary environment of the last two years has created challenges across the agribusiness landscape. Food prices, for instance, have increased over 20% for everyday consumers, putting the agriculture and food production industries at the forefront for many Americans. Inflation is not limited to the final prices of goods and services, however, as it impacts every step of the supply chain, including the cost of labor. In this challenging market and economic climate, what should agribusiness leaders consider as they grow their businesses, protect their margins and strengthen their balance sheets?

The economic backdrop

Agriculture and food production have always played important roles in the economy. This importance has only been amplified with food security becoming a concern both nationally and globally due to the pandemic, the war in Ukraine and more. These recent events underscore that how well the industry performs affects the broader economy, and vice versa.

In total, the agriculture and food sectors of the economy, excluding restaurants and grocery stores, made up 2.6% of U.S. GDP in 2022. This share has declined as technology and financial advancements have boosted productivity, allowing agribusinesses to do more with less. From 2000 to 2021, the number of employees across these industries declined roughly 15%. While greater productivity is a positive, it has raised the bar in terms of the level of efficiency needed to stay competitive.

This has occurred even as the overall industry has grown, and the needs of the population have increased. Over the past two decades, the inflation-adjusted output of agribusiness industries, excluding restaurants and grocery stores, has increased 46%, according to the Bureau of Economic Analysis. That means industry leaders must continue to take advantage of technology and finance trends to remain competitive and grow their businesses to meet ever-growing demand.

Current challenges to the industry

The agribusiness industry continues to face many economic headwinds, ranging from a historically tight labor market to the rising cost of capital. First, the current labor market is one of the strongest in history with the national unemployment rate hovering around 3.5%. The prime age employment to population ratio, a measure of employment that is less affected by demographic trends, is currently at its highest level since 2001.

These statistics show that finding qualified workers has never been more challenging. This may be especially true in rural areas due to geographic distance and the smaller supply of labor. For this reason, the Midwest job market is even stronger than nationwide averages, with unemployment rates in Minnesota and Wisconsin near 3.0% and 2.6%, respectively.

Second, overall consumer prices have increased 31% over the past 10 years while average weekly wages for production and nonsupervisory employees have increased 45%. This trend is even more pronounced for farm wages, which have increased 52% over the last 10 years. Within agribusiness, farm production and food processing, these increasing labor costs have pushed the share of salary and benefits costs up from 35% to 40%. This increase in employment costs does not appear to be slowing.

These trends suggest that the challenge of finding and retaining qualified workers is likely as difficult as it has ever been, both due to the supply of workers and the cost to employers. However, once qualified workers are hired, agribusiness employers appear to be willing to pay a premium to retain these workers and invest in their productivity. Thus, it’s important for agribusiness leaders to consider how to best enable and enhance employee productivity with technology and financial solutions.

Rising costs of financing

Weighing the financing and capital needs of a business is a critical task for all leaders. This task has only grown more complex as interest rates have risen rapidly. In just 18 months, the Federal Reserve has raised policy rates by 5.25% to fight inflation. Fortunately, recent data suggest that price pressures have moderated over the past year, with the national headline consumer price index decelerating to only 3.2% from a high of 9.1% in 2022.

Despite this progress, the Fed would like to prevent inflation from resurging, as it did in the late 1970s. As a result, Fed officials have signaled their commitment to keeping rates “higher for longer” in policy press conferences. That means, if and when the Fed does reach the end of its tightening cycle, interest rates could remain elevated for quite some time.

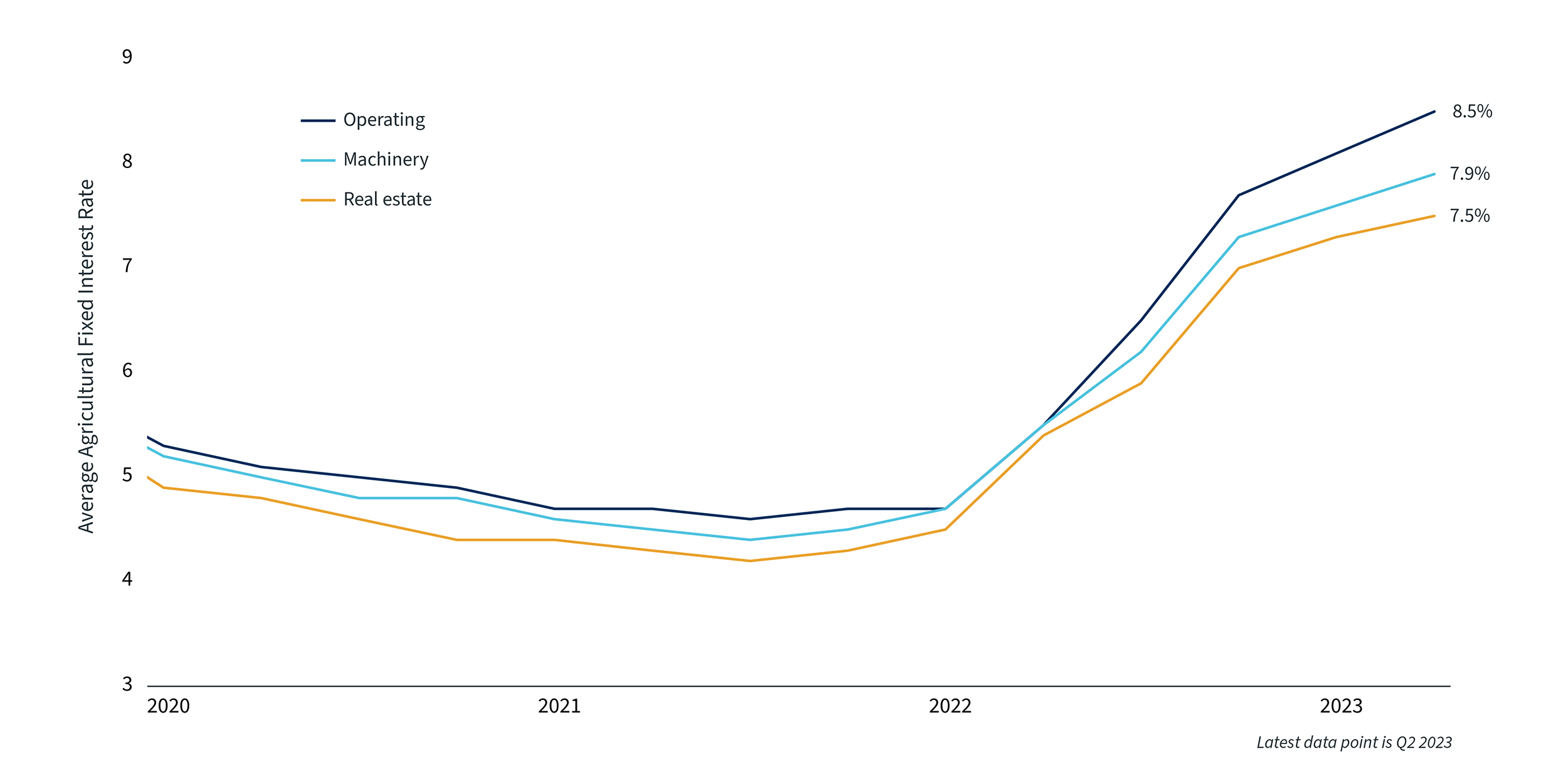

Average Agricultural Fixed Interest Rates 1

This uncertainty around interest rates complicates the strategic decisions that agribusiness leaders must make because the industry is naturally capital intensive and requires a long-term outlook. At the same time, investing in new plants, equipment, processing lines, land and more is critical for ongoing growth. Fixed interest rates for operating, machinery and real estate loans are at their recent peaks of 8.5%, 7.9% and 7.5%, respectively, according to the Minneapolis Fed’s Agricultural Credit Conditions Survey.

When viable growth opportunities are identified, it is important for leaders to act. Hoping for interest rates to fall, or trying to predict what the Fed may do next, can lead businesses to miss out on important maintenance and growth projects that are critical for enhancing productivity. Equally important is the need to manage the financing and capital needs of the business, because high interest rates can have a significant impact on an organization’s earnings and balance sheet. Balancing these risks and opportunities is more important than ever in a volatile interest rate environment.

Finding opportunities while managing risk

Agribusiness leaders can continue to grow their businesses, increase productivity and defend margins even during these challenges by leveraging financial and technological innovations. Owners and operators should lean on trusted partners to help automate and optimize existing processes, which can help to not only boost operational efficiency, but perhaps even improve quality.

For example, with a tight labor market and rising costs, there has never been a better case for automating office tasks and payroll operations. Automating existing tasks doesn’t just allow employees to accomplish more but can allow them to focus on a wider variety of more complex decisions. Similarly, the optimization of existing tasks can reduce the demand on employees and improve processes.

Additionally, higher interest rates make treasury services and cash flow management even more critical. Improving working capital can free up funds for operations and growth, while also helping firms take advantage of higher bank deposit rates. Financial technologies can reduce payment costs while also increasing the security of payment systems. This is critically important because paper checks, which are still common throughout the agribusiness industry, are often utilized by criminals to commit fraud.

Perhaps most importantly, a strong banking partner can provide agribusiness leaders with a wealth of knowledge and perspective to manage economic uncertainty while taking advantage of opportunities. The agribusiness industry has a long history of successfully navigating difficult and rapidly changing economic conditions. Enhancing productivity through technology and financial solutions is one way business leaders can continue to do so in the years to come.