Perhaps the biggest economic surprise over the past two years has been the surge in inflation. Higher prices are directly impacting everyday individuals and companies as consumer prices and input costs rise. All major inflation measures tracked by economists are at their highest levels since the early 1980s and have remained so longer than many anticipated. While this directly impacts all businesses large and small, it also presents the opportunity to ask strategic questions that could help support growth in the years to come.

Global challenges, local impact

Several factors have driven inflation higher, most of which have been discussed widely in the national media. The rapid economic recovery, government stimulus, strong consumer spending, supply chain disruptions and other issues are what caught many economists off guard. More recently, geopolitics have also played a role with the war in Ukraine pushing energy prices higher, directly affecting consumers at the pump.

The Federal Reserve (the Fed) has been cautious in raising rates, but has indicated future rate increases are likely. During the decade following the global financial crisis of 2008, the Fed was able to focus on maintaining high employment without worrying about an overheating economy. Today, the record amount of monetary and fiscal stimulus, including the Fed’s $9 trillion balance sheet, only worsens the inflation problem.

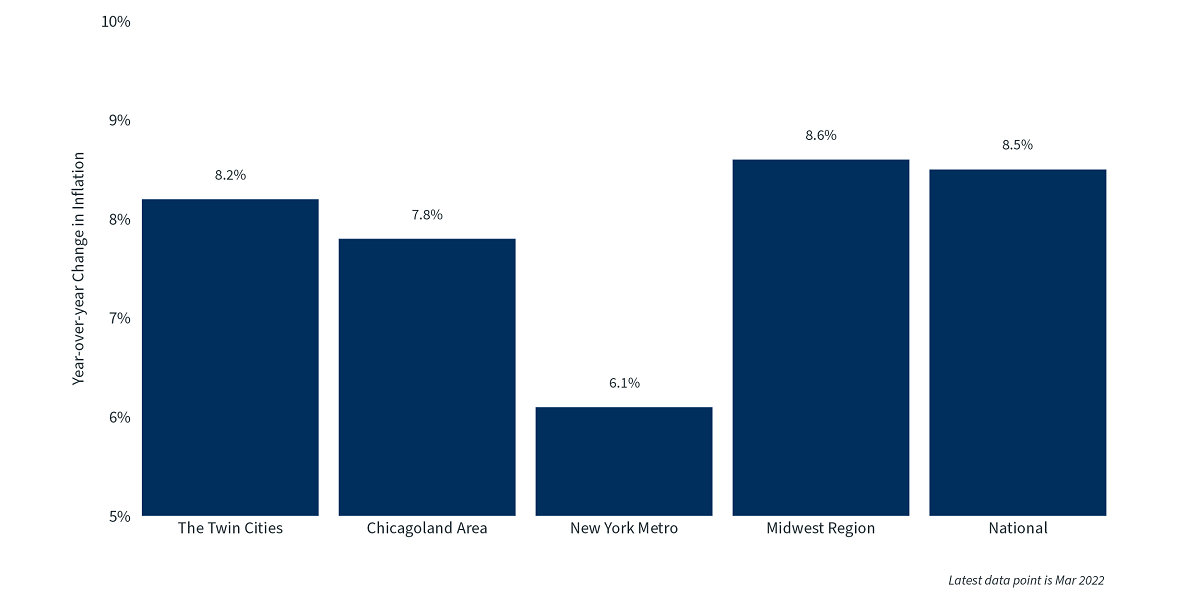

This has impacted the Midwest no less than other parts of the country. In fact, the spikes in energy and agricultural commodities have arguably affected the region more. According to the Consumer Price Index, a commonly cited measure of inflation, consumer prices across the Midwest rose by 8.6% in March 2022, compared to the prior year.

The Twin Cities experienced 8.2% inflation, higher than many other large metro areas across the country. These price increases directly affect the cost of producing, manufacturing, distributing and selling goods across all industries. To manage this, there are three strategic questions that businesses of all sizes should ask.

Consumer price index1

#1 How can we manage debt more effectively

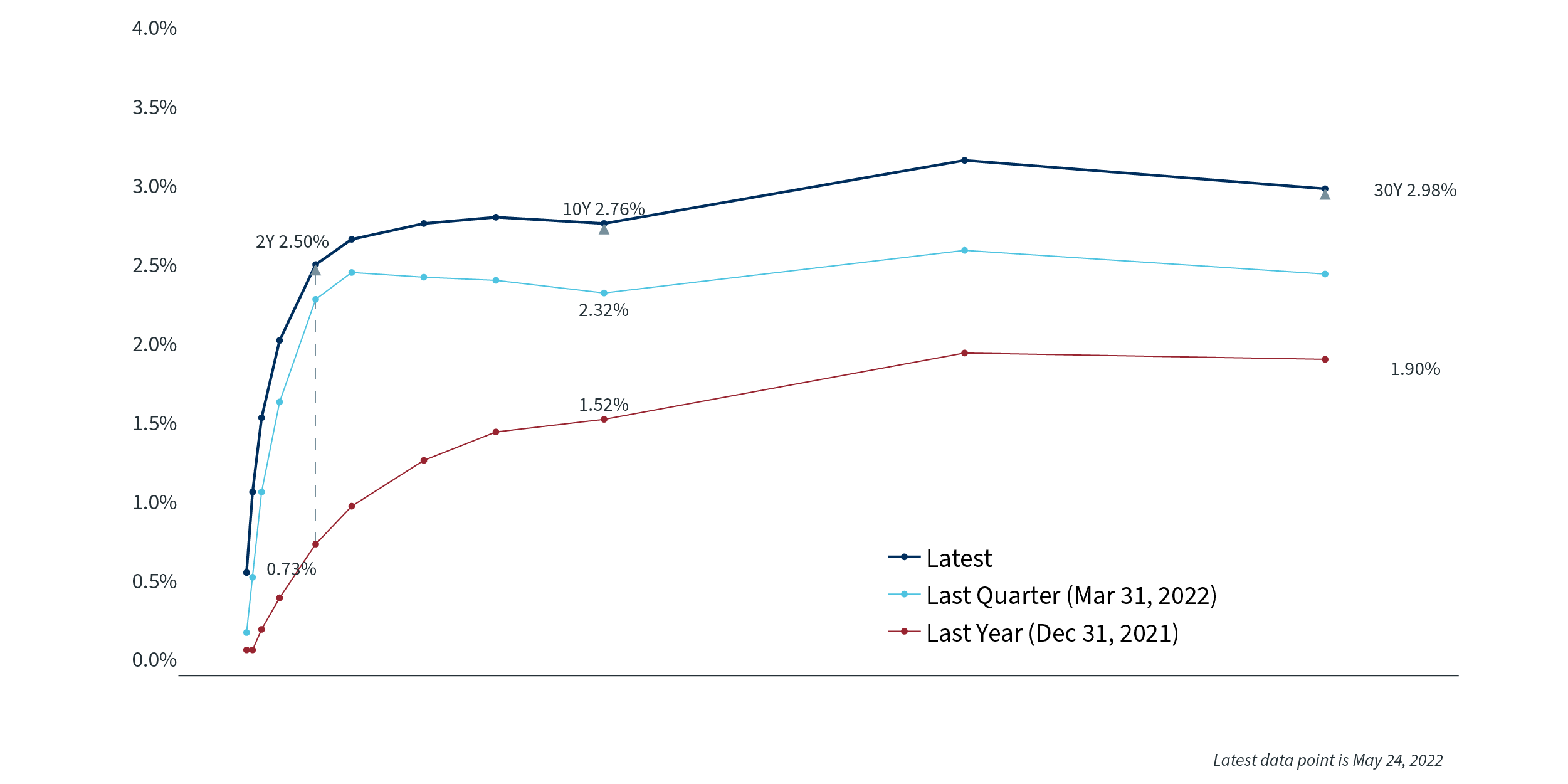

Rising inflation has pushed interest rates higher. The 10-year Treasury yield, for instance, rose above 3% in recent weeks, the first time since 2018. The 30-year fixed mortgage rate now averages 5.6% across the country, up from 3.3% at the start of 2022 and 2.8% at its lowest point in 2021. From a financial markets perspective, the yield on investment-grade bonds has climbed to 4.3% from 3.4%, and to 7.6% from 6.9% for high-yield issues. Clearly, the cost of borrowing has grown rapidly.

This directly affects funding costs, project hurdle rates and debt issuance, which in turn impacts future cash flows. For businesses that have enough cash on hand, slight increases in interest rates can usually be managed.

This is especially true for larger, more established businesses that can also benefit from current economic conditions. For businesses with shorter track records or financial histories, or those that rely on variable rate loans, some projects may have to be put on hold.

This highlights the importance of effective debt management across all phases of the business cycle and company growth. Practices such as knowing your monthly budget, having a clear view of current debts, and consolidating to achieve better rates and lower monthly payments are all timely in this environment.

Treasury yield curve2

#2 How can we control expenses and adjust prices

Many input costs are rising due to the prices of commodities and natural resources. For all firms, it’s impossible to escape higher energy prices. Oil prices have been volatile due to the conflict in Ukraine with WTI oil hovering above $110 per barrel. Gasoline prices have increased to over $4.40 on average for regular unleaded, from a low of $1.77 in 2020. Clearly, this eats into consumer pocketbooks and business margins. It goes without saying that preventing these costs from eroding profitability is more important than ever.

The most direct solution is to raise prices in order to pass along some of these costs. The Federal Reserve’s Beige Book summarizes what some businesses have done in Minnesota, North and South Dakota, Montana, and parts of Wisconsin. The latest report mentions that “two-thirds of District firms responding to a survey said they increased their selling prices in March from a month earlier, while 70 percent reported that their non-labor input prices increased from February.”

At Bremer, we have had many conversations with commercial and manufacturing customers who have successfully passed along increased costs to their customers. A common theme from CFOs has been how the increased “kitchen table conversations” regarding inflation has made it easier for trade partners to accept and digest these increased costs..

Beyond increased prices, many commercial entities are adjusting business strategy due to expense increases. For instance, one manufacturing company has considered building additional production facilities closer to the final destination of its product in their largest growth markets to reduce fuel costs. This requires an analysis of industrial real estate prices, the cost of building new facilities, the risk of an economic downturn, staffing and more. These expenses have also gone up, so this strategy requires a longer time horizon, but if deployed correctly can reduce fuel expense while investing in longer term growth and capacity. In situations where these projects have been under consideration for some time, higher prices may be the final push needed to get them over the finish line.

#3 How can we improve our hiring and staffing strategy

Rising inflation coupled with the strong economy has made it more difficult to hire. This is a daily challenge for many businesses, and the economic data confirm that not only are there fewer available workers, but wage requirements are higher, too. The national average of hourly earnings rose to $27.12 in April 2022, according to the Bureau of Labor Statistics’ monthly jobs report.

A similar report showed that the compensation costs of private industry workers in Minneapolis jumped 5.1% over the 12 months that ended in March 2022, higher than the national increase. In total, Minneapolis experienced the fifth highest increase in total compensation across major cities ahead of Chicago, Detroit, Houston, New York and others. The Federal Reserve’s Beige Book further confirms that the labor supply is tight across Minnesota and surrounding states, a fact that all business owners already know. According to the report, “labor availability was considered poor by a majority of employers, with little expectation of near-term improvement.” Jobs have been difficult to fill, and higher salaries have been required to avoid poaching and resignations.

Like other inflation-related challenges, meeting staffing and employment needs may also present opportunities. For some businesses, increasing capital investment by buying new equipment or by implementing new forms of automation could help to address these challenges in the medium-term. After all, increasing the productivity of each worker can directly boost margins and offset cost increases in other areas. This is especially important in industries where hiring shortfalls are expected to persist and the existing workforce continues to get closer to retirement.

Opportunities amid the challenges

While rising inflation is a challenge for many businesses to overcome, especially after four decades of subdued price increases, there are also reasons for optimism. Many expect inflation to begin to temper over the next year as supply chains improve, energy prices stabilize and markets adjust to the Fed. In the meantime, there are clear questions all businesses can ask as they make strategic adjustments to the current environments and better position their companies for the future.