For most businesses, 2022 has required increased operational and financial discipline. Business leaders across the country have had to navigate a historic environment of rising costs and tightening labor markets, and this has been no less true in the Upper Midwest. Even as sectors such as tech experience significant layoffs, many other areas of the economy, including commercial and manufacturing businesses, continue to hire (if they can find qualified workers). What perspective on the economy do business leaders need in order to prepare for the year ahead?

Inflation rose to historic levels in 2022

Inflation has dominated the macroeconomic landscape. This year marked a significant shift in the four-decade pattern of falling inflation. From the early 1980s until the pandemic, broad price levels were exceptionally stable across the economy, a period that is often referred to as “The Great Moderation.” Long-term trends such as technological advancements and globalization allowed prices to fall even further. This allowed interest rates to remain low throughout this period, fueling business investment and government spending, and allowing central banks to keep monetary policy loose. It's against this backdrop that the sudden and dramatic rise in inflation has been a shock to the economy. This past summer, inflation across the country peaked at a year-over-year rate of 9.1%, as measured by the Consumer Price Index. This marked the highest level since the “stagflationary” era of the late 1970s and early 1980s. The rapid inflation of the past year or so was driven by many factors that are now household topics, including supply chain disruptions, consumer spending, fiscal stimulus and Federal Reserve stimulus. The good news going into 2023 is that there are signs that inflation could be easing, even if prices remain elevated. Energy prices, for instance, have declined since the war in Ukraine began at the start of the year. The price of oil has fluctuated but, as of the beginning of December, Brent crude was trading just above $80 per barrel, a significant decline from $128 in February. Gasoline prices have also fallen to around $3.24 per gallon on average across the country, a steep decline from the $5 or more many consumers were paying. For businesses, this lowers transportation costs and reduces price pressures across a variety of important expenses.

The Fed is expected to raise rates further

The bad news is that with inflation still above 7%, the Fed is likely to continue raising rates. Why is inflation harmful, and why is the Fed potentially risking a recession in order to combat it? Inflation would already be a challenge if it were only about higher prices for many of the items mentioned above. However, inflation creates other complex issues as well. Specifically, unstable prices create difficulties in making strategic decisions. Not knowing what your input costs may be over periods as short as months or quarters makes it challenging to decide how to staff a business or invest in new equipment or buildings, even if demand and sales are otherwise rising. This is just as true for households that may need to budget more tightly if prices rise too far and too fast, or if it’s not clear how they should plan for major expenses.

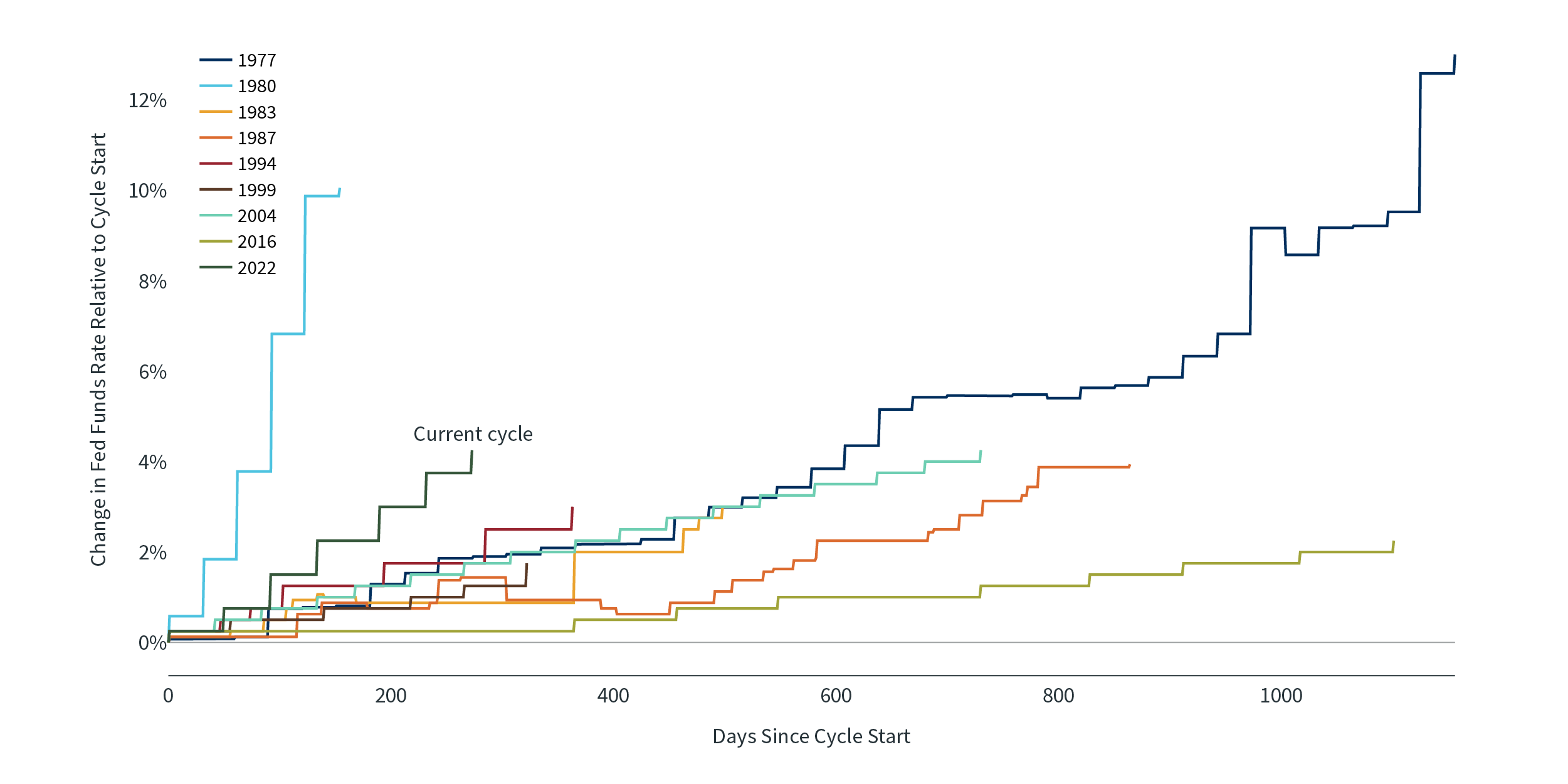

The Fed is hiking rates at one of the fastest paces in history1

For this reason, the Fed has communicated that it takes inflation very seriously but finds itself between a rock and a hard place. On the one hand, raising rates too quickly can quell economic growth and, at the extreme, cause a recession. However, raising rates too slowly can allow inflation to grow unchecked. With the benefit of hindsight, many have argued that the Fed kept monetary policy too loose during the pandemic recovery, which allowed price pressures to build. Market-based expectations are for the Fed to raise the federal funds rate to around 5% by mid-2023, an increase from 4.25% today. Regardless of the exact level, it’s clear that business operators should be prepared for tighter financial conditions in the months ahead.

Inflation in the Midwest shows greater decline

Broad inflation measures have fallen across the country but remain high. In the Midwest, this decline has been more pronounced. Headline consumer inflation for the region peaked at 9.5% in June, according to the Bureau of Labor Statistics (BLS), which publishes the Consumer Price Index, but has since dropped to 6.8%, below the national level. This moderation in inflation is a positive sign for the regional economies of Midwest states and is consistent with other data. Additionally, the “core” consumer inflation rate for the Midwest, which excludes food and energy, has moderated to 5.5% from its high of 6.4% in January. In a similar pattern, the Twin Cities have seen their price increases moderate faster than the rest of the country. In the Minneapolis-St. Paul area, inflation is only reported every other month, but November marked the first time since 2020 that prices had declined over a two-month interval. This slowed the year-over-year change in prices to 5.3%. Even if the economy does slow due to Fed rate hikes, easing price pressures might still be a welcome sign for many consumers. This is especially true because even with layoffs in certain sectors concentrated in other parts of the country, the Upper Midwest is experiencing historical lows in unemployment. The unemployment rates for Minnesota, Wisconsin and North Dakota are 2.1%, 3.3% and 2.3%, respectively — the lowest in the country.

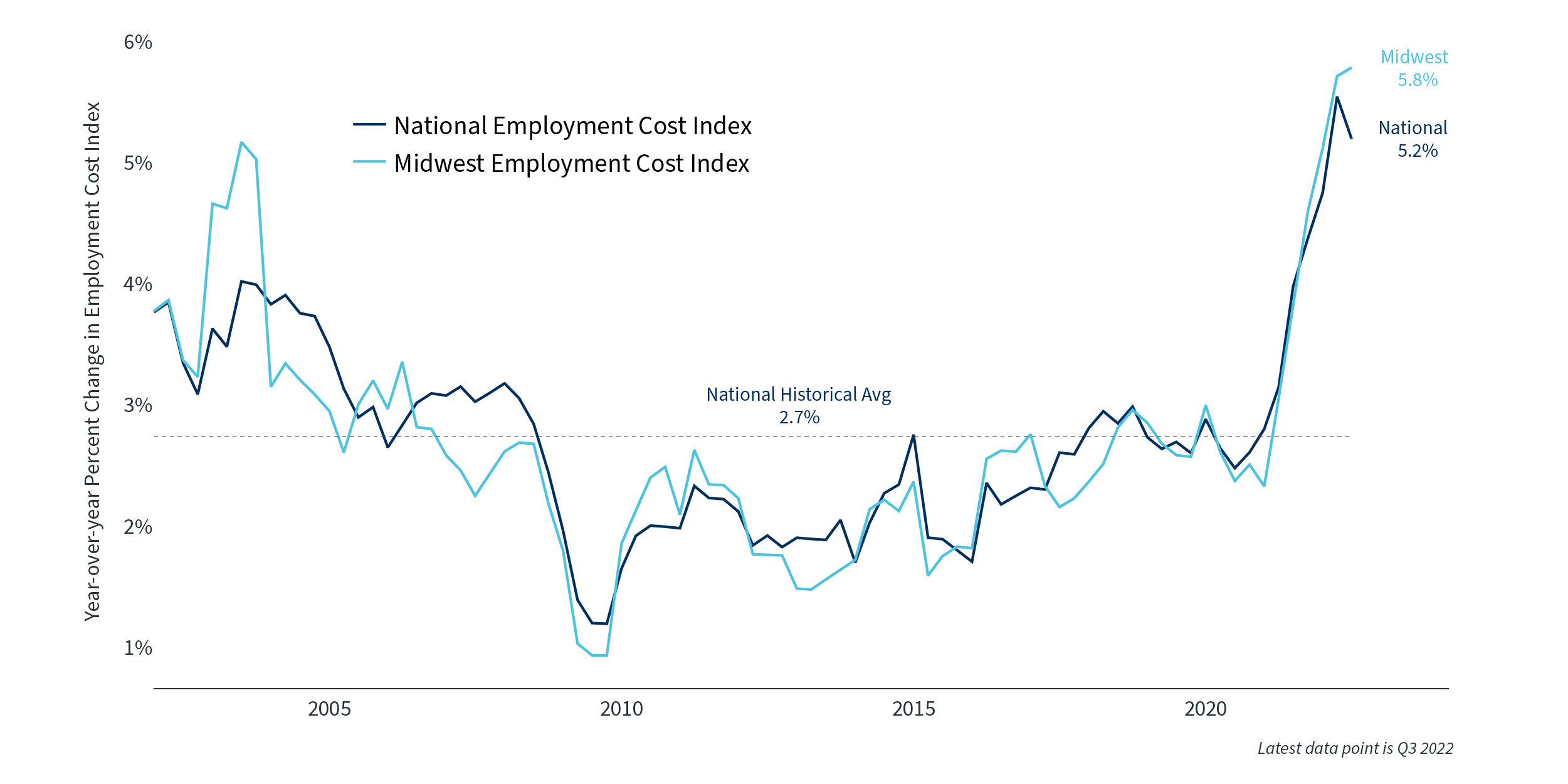

The employment cost index has risen faster in the Midwest than the rest of the country 2

There continue to be many more job openings than unemployed individuals, even as some businesses have rethought their staffing needs and put a freeze on hiring. The challenge of hiring and retaining capable workers has pushed the total cost of employing a private industry worker, as measured by the Employment Cost Index, to an all-time high for the region. This cost measure reached a peak of 5.8% year-over-year in the third quarter, while the national rate of increase in employment costs decelerated last quarter. The Minneapolis-St. Paul metropolitan area displayed a similar trend in the third quarter. The total cost of compensation for private industry workers in the Minneapolis-St. Paul area ticked up 0.1 percentage points to a 5.7% year-over-year increase. These increases in employment costs are a significant issue for employers across the region. In fact, 44% of manufacturing executives listed “attracting and retaining a qualified workforce” among their two biggest challenges, according to the 2022 Minnesota State of Manufacturing Survey.3 This level of concern was only matched by the challenge of “increasing costs of materials” for their products. In contrast, and perhaps surprisingly, only 4% of manufacturing executives listed “rising interest rates” as one of their biggest challenges.

Strategic decisions for the year ahead

Many of the trends that defined 2022, including inflation, tight labor markets and rising interest rates, will likely continue throughout 2023. Fortunately, these factors will not come as a shock and could continue to ease. Business leaders should still be prepared to tackle these challenges by keeping an eye on expenses. In times of financial uncertainty, preserving core business operations is a priority. Consider finding ways to reduce fixed overhead by converting fixed costs to variable. Review options to increase financial flexibility on non-core assets and think about which costs can be delayed or eliminated. Consider divesting underperforming assets or non-core assets as a potential source of cash. Business leaders should also evaluate strategic financing opportunities. Ensure your financing remains viable by engaging with your financial partners early and often. Clear communication is key to a successful relationship with financial service providers. Be prudent with loan programs, resist the urge to use ready lines of credit to cover losses and be mindful of allowing leverage to creep up in times of economic uncertainty. Review your payables and receivables to see if there are opportunities to maximize your payment cycle. With accounts payable, work with your vendors on options such as longer payment terms, if possible. This works well if you pay by ACH, check or expedited payment with a terms discount. You can also request incentives for early payment or payment in full. In addition, get your invoices out faster and consider electronic invoicing if you’re not utilizing it today. Make the payment process easy for your customers by offering multiple ways for them to pay you. Finally, if you’re well positioned financially, consider new areas of investment and expansion. After all, while challenging economic times may be difficult to navigate, they inevitably create opportunities just as they did in 2008 and 2020. Businesses that can maintain discipline and perspective may be better positioned to plant the seeds of tomorrow’s growth.