The commercial real estate (CRE) industry has faced some challenges in recent years that have softened demand while raising operating and financing costs. These include higher interest rates, an economic slowdown, the hybrid work environment, a tight labor market and more. Despite these challenges, CRE presents opportunities as the economy rebounds and interest rates stabilize. This is especially true for CRE companies with strong banking partners that have access to customized, creative solutions. What market and economic factors are impacting CRE today?

Although CRE is a broad category that encompasses diverse property types that serve many industries, much of the national news surrounding CRE has focused exclusively on office vacancies. Not only do these stories make for attention-grabbing headlines, but in many cases, they are specific to return-to-office and hybrid work policies in major cities, which ignores the broader opportunity for CRE across distinct parts of the country. The Midwest and the Twin Cities, for instance, have a greater concentration in steadily growing areas such as manufacturing, in contrast to the tech-heavy office usage of the San Francisco Bay Area or financial services in New York City.

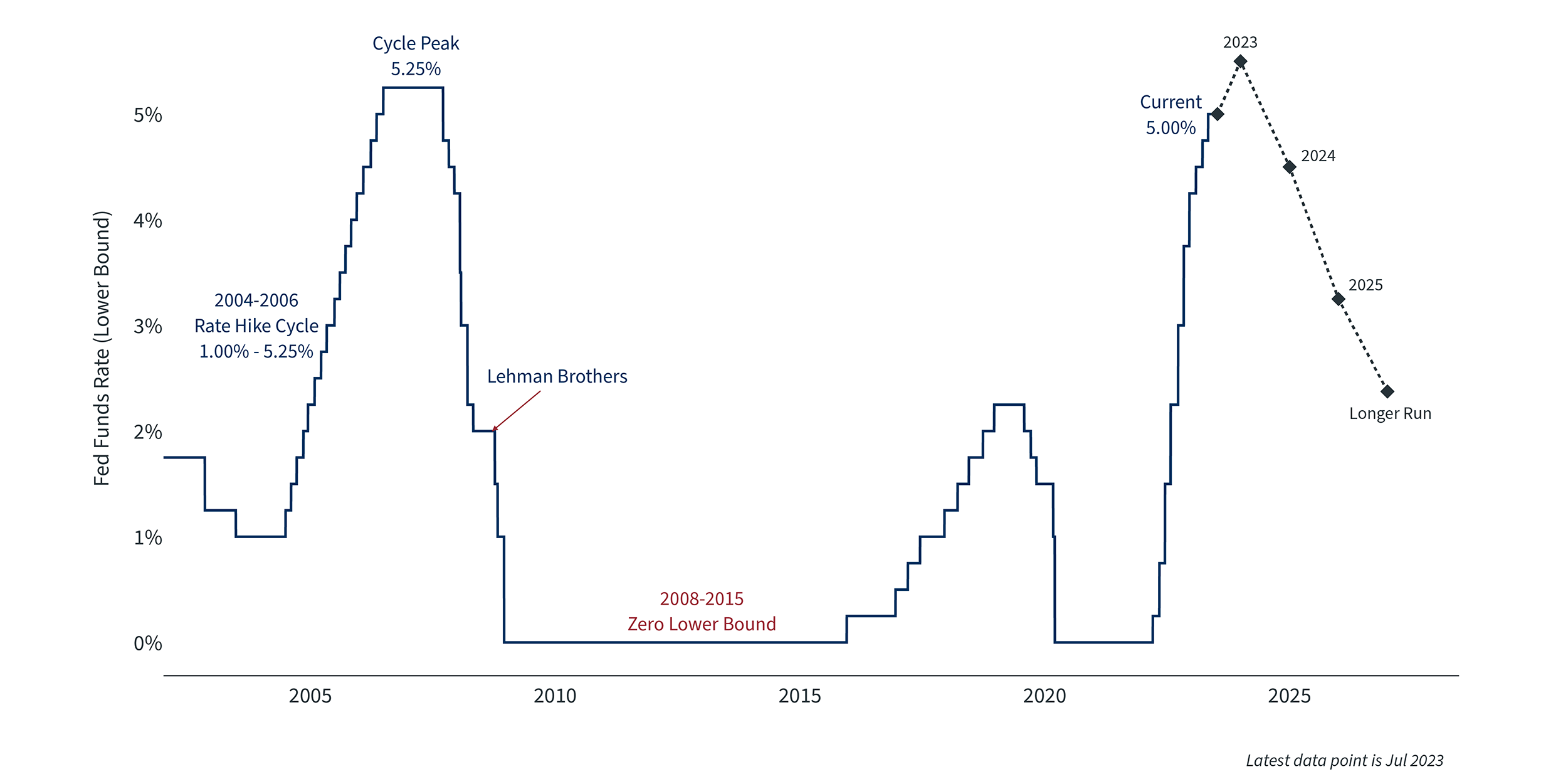

Interest rates could be higher for longer1

Opportunities and risks across CRE sectors

The offices segment of CRE continues to face higher vacancy rates. Recent CoStar data shows that national office vacancies rose to an all-time high of 12.9% in the first quarter of 2023, up nearly 3.4% since the end of 2019. Vacancy rates depend heavily on the type of office space. For example, medical and life sciences offices, where remote work is less common and with fast-growing demand, have outperformed traditional office space. Rather than worrying about returning to the office, the challenge for these types of businesses has primarily been competing for qualified professionals in a historically tough labor market.

Similarly, industrial properties are experiencing historically low vacancies, exerting upward pressure on rents and property values. Elevated demand for these properties and growth in this area have led to large increases in industrial property construction, which could lead to a glut of space in the future. Still, steady industrial activity has made this sector attractive despite concerns of a recession.

Retail space is also doing well with a vacancy rate of only 4.2%, the lowest of any sector. Consumer spending has remained surprisingly robust with the national unemployment rate near historic lows and Midwest unemployment even lower. Strong consumer demand has fueled business growth and further demand for retail spaces, but has also resulted in higher inflation.

Low unemployment has made it difficult to hire in other sectors as well, specifically in senior housing and hospitality. Hiring for these jobs naturally depends on having skilled workers available in each specific geography. However, with the aging U.S. population and longer life expectancies, demand for senior housing is only expected to increase. Similarly, consumers are increasingly spending on services such as restaurant dining and vacations, increasing the demand for qualified hospitality workers. In turn, this has helped these CRE sectors.

Finally, multifamily housing remains strong. The sector has even benefitted from rising interest rates with average mortgage rates hovering between 6% and 7% since the fourth quarter of 2022. Higher mortgage rates have increased the cost of homeownership, resulting in strong rental lease numbers. However, just like the industrial property market, new supply is coming online which could eventually place pressure on rent prices.

Higher-for-longer interest rates will require customized, creative financing solutions

Given the challenges and opportunities across sectors, higher interest rates remain a top concern within CRE. At its June meeting, the Fed decided to hit pause on rate hikes after more than a year of rapid monetary policy tightening. However, some consider the Fed's latest decision to be a "hawkish pause" since policymakers still anticipate two additional rate hikes later this year. Thus, CRE leaders should expect interest rates to remain higher for longer.

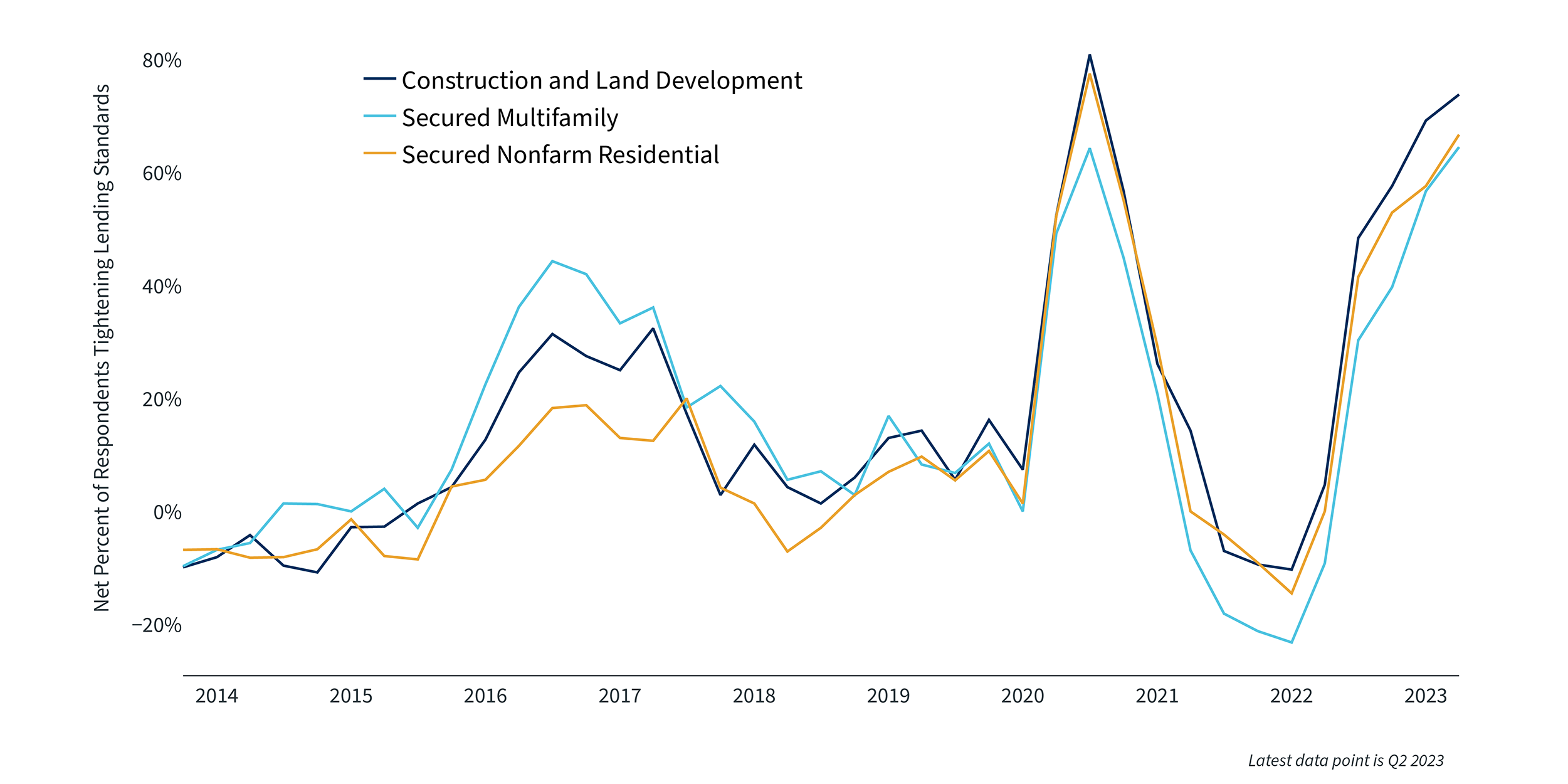

The Fed’s Senior Loan Officer Survey suggests lending standards are tight1

Financial stability concerns from the first half of the year could further decrease the supply of credit. The Federal Reserve’s Senior Loan Officer Survey reports that during the first quarter of the year, banks of all sizes reported stricter standards for all types of CRE loans. Given the industry’s upcoming refinancing needs, especially for loans made over the past few years at much lower interest rates, tighter credit conditions will likely be a difficult hurdle. Many projects will need to recapitalize maturing and floating rate loans, and some may struggle to meet covenant tests due to higher rates.

In the face of these challenges, a trusted banking partner can help CRE companies create customized, creative solutions to their strategic financing needs. In general, banking partners can provide investors with expert advice and can advocate for borrowers. For instance, they can help to understand the duration risk of a loan portfolio and propose a range of possible solutions for borrowers, even if interest rates remain elevated.

Banking partners can also tap a wealth of experience in navigating difficult economic periods to best understand the strengths of each property. This can help to find commonality between banks and borrowers, resulting in multiple solutions that create financing flexibility. Given the speed at which the macroeconomic climate has changed, and the urgency by which borrowers may need unique financing solutions, it’s more important than ever for CRE leaders to consider all their options with the help of a trusted partner.