Over the past four years, the economy has struggled as supply chains have been disrupted, prices have increased and interest rates have climbed. Economic uncertainty has challenged business leaders across industries, forcing many to rethink their strategies. Maintaining and expanding operations has been challenging as well with the historically tight labor market making it difficult to recruit and retain workers. While these challenges have impacted all sectors, they have been particularly acute within manufacturing.

The economic outlook in manufacturing

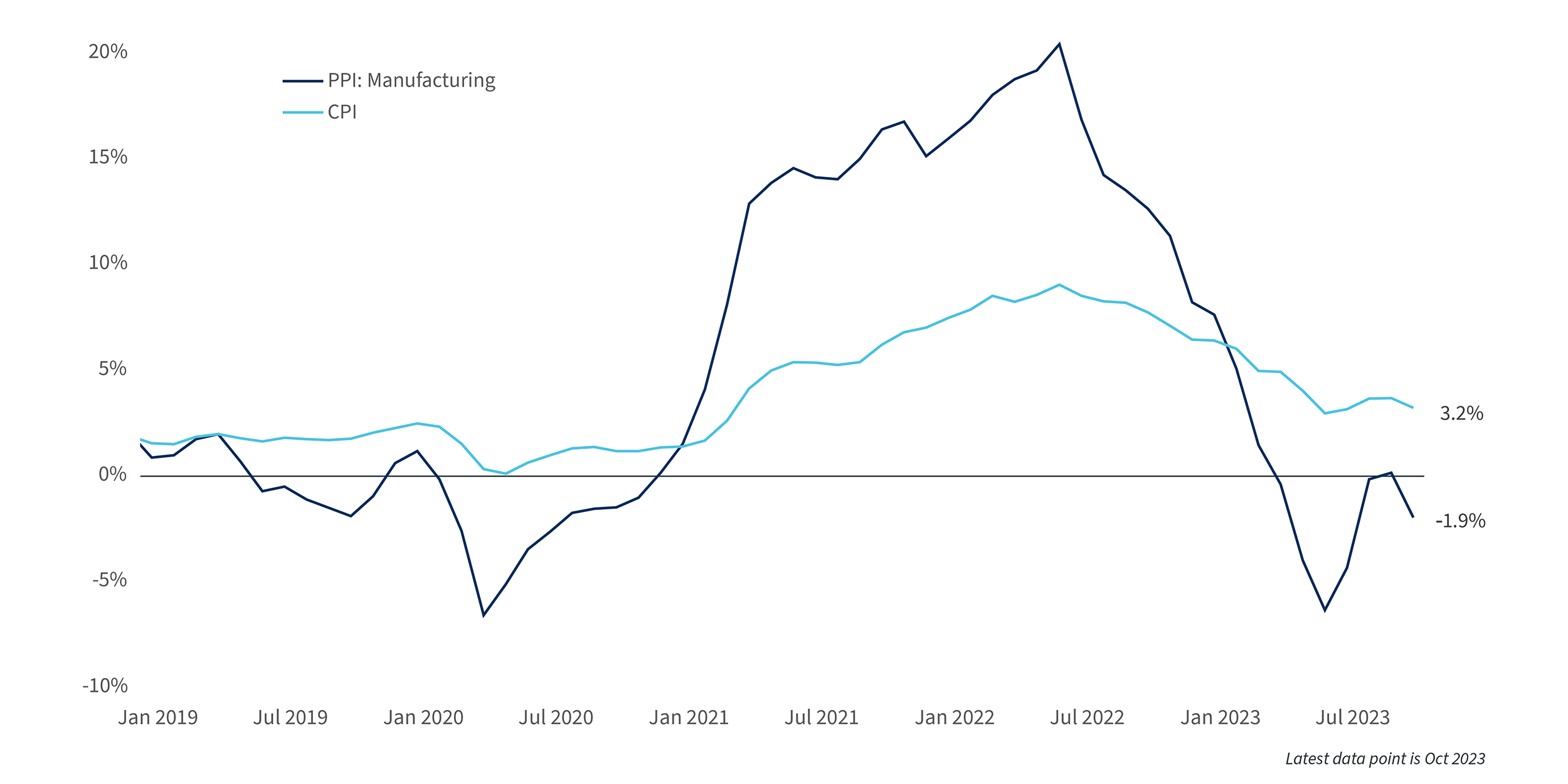

A core set of macroeconomic forces have made the environment difficult for both consumers and businesses in recent years. The consumer price index, a common measure of inflation, peaked at 9.1% in June 2022, its highest rate since the 1980s. However, the producer price index for manufacturing, a measure of manufacturing input costs, spiked by over 20% following the pandemic.

While manufacturing prices have fallen slightly in recent months, there have also been large swings in prices. Since 2020, manufacturing input prices have risen nearly 30%. This longer-term sharp increase has made strategic planning and cost forecasting more challenging than ever.

Manufacturing input costs have risen faster than consumer prices1

One key cost for manufacturers that has risen over the past two years is interest expense. Although long-term interest rates have fallen from their peaks, they remain well above average levels over the past 15 years. The 10-year U.S. Treasury yield, for instance, remains around 4.2% after briefly rising to 5% a few months ago.

The capital-intensive nature of manufacturing increases the sensitivity to interest rate swings. For this reason, the aggregate interest expense across manufacturers in the U.S. has reached its highest recorded level. Fortunately, manufacturing operating income has risen as well. As a result, interest expenses as a share of operating income remain consistent with pre-pandemic levels. As fixed-rate loans expire and firms refinance debt, their interest expenses may rise. This highlights the importance of firms capitalizing on strategic opportunities to grow and increase efficiency to keep up with rising costs.

Hiring and retaining workers is likely to remain difficult

Another challenge to continued growth has been attracting and retaining qualified workers. Despite national headlines of layoffs at technology companies and worries of a recession, finding qualified labor has remained a pain point for manufacturers, especially in the Upper Midwest.

Nearly 40% of Minnesota-based manufacturing executives identified attracting and retaining a qualified workforce as one of their biggest challenges to future growth, according to the 2023 State of Manufacturing Survey from Enterprise Minnesota. This was the top issue that manufacturing executives highlighted, ranking higher than inflation, an unfavorable business climate and interest rates.

Across the Midwest, there are demographic trends that have exaggerated the already-tight labor market. According to the U.S. Census Bureau, the Midwest has suffered from a declining population in recent years. From April 2020 to July 2022, the Midwest’s population declined by 197,942 people, despite the country as a whole growing by nearly 2 million people. Minnesota and North Dakota’s populations grew by 10,680 and 170, respectively, while Wisconsin’s population shrank by 1,186 during this period.

Two primary factors are driving this decline in population. First, deaths outnumbered births in the Midwest during this period, leading to a natural decline. More significantly, domestic net migration was negative, with 395,836 people leaving the Midwest for other regions over this period. Fortunately, international migration to the Midwest did add 203,644 people. This period of declining population marks a deviation from historical patterns for the region, so it’s possible these trends are only temporary.

Whether or not these issues persist, it will be difficult for employers in the region to compete for qualified and skilled workers. Businesses need to consider how they can improve their recruiting and retain both domestic and international workers in this challenging environment. Fortunately, increased opportunities to recruit skilled labor may arise as local programs such as the Ignite Initiative Regional Workforce Training System, based in North Dakota and Minnesota, begin to operate. The program was recently funded by an Economic Development Agency grant of nearly $10 million and will partner with local educational institutions to train skilled workers for work in agriculture and food production, manufacturing, and information technology. Programs like this highlight the fact that investments in the technology and automations that enable manufacturers to become more resilient to labor market constraints will only grow in importance.

Opportunities for growth despite challenges

These challenges lead many manufacturing executives to view the current state of the economy as lackluster or worse. According to Enterprise Minnesota’s recent survey, only 16% of executives view 2023 as a year of expansion, while 45% and 33% view 2023 as flat or recessionary, respectively.

Despite these economic challenges, the national economy has avoided a recession and remains stronger than many expected. Inflation has fallen to more reasonable levels and appears to be progressing to the Federal Reserve’s 2% long-term target. Decreasing inflationary pressures have enabled the Fed to hold interest rates steady for two consecutive meetings, and financial markets now expect that the Fed may even cut rates in 2024. While this is highly uncertain, a stabilization or even decline in interest rates would be a welcome sign to many business leaders.

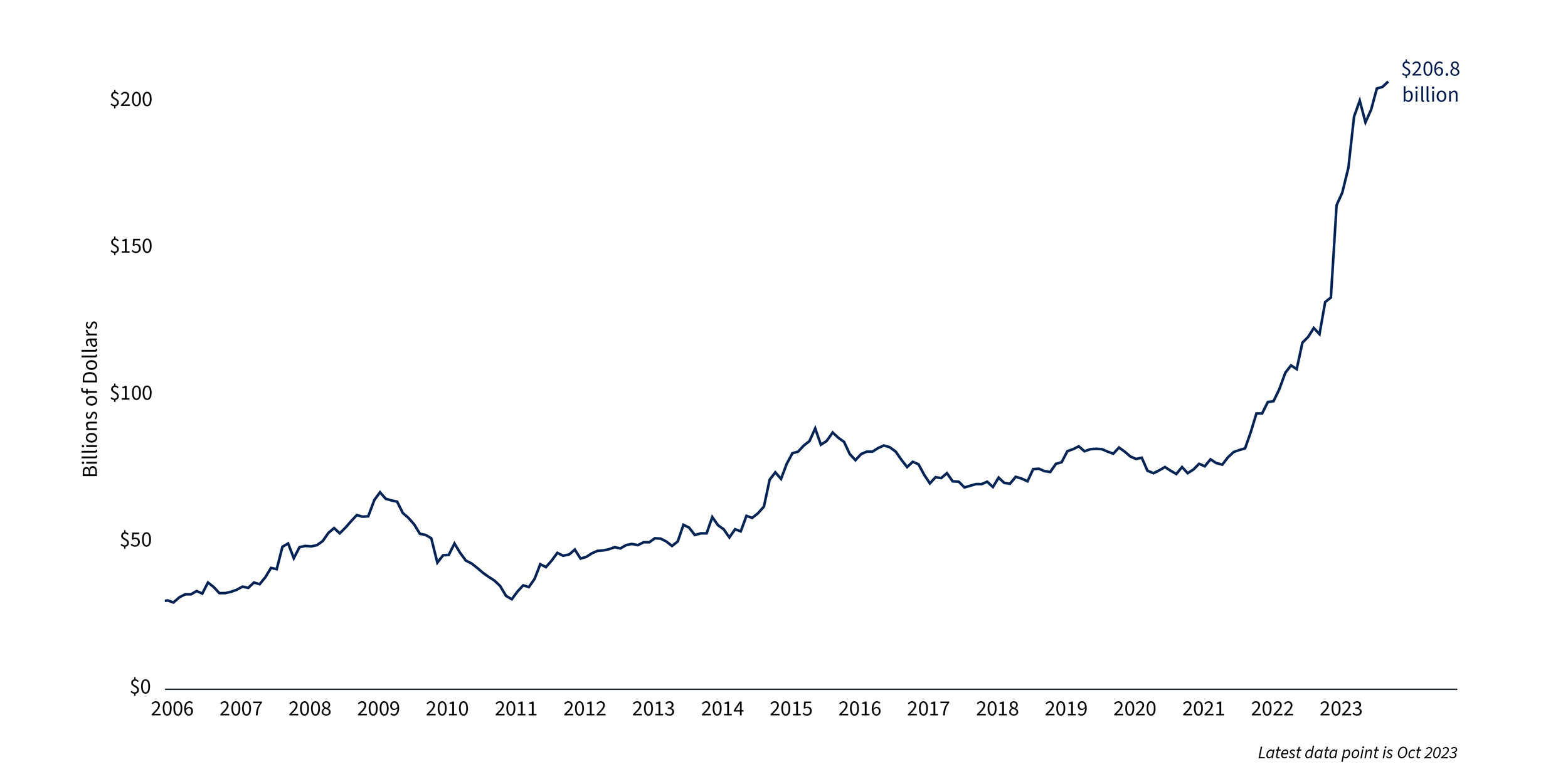

Manufacturing construction has risen dramatically since 20222

This discussion highlights the importance of continued investment by manufacturers to support long-term growth. Investing in technology, skilled labor or other business improvements can help to maintain margins during down years and prepare businesses for growth.

Federal stimulus bills including the Bipartisan Infrastructure Law, CHIPS and Science Act, and the Inflation Reduction Act could also help to spur investment in segments of the industry. For example, the Twin Cities was recently selected as a medical technology hub, and the Madison and Milwaukee areas were selected as a biohealth technology hub as part of the Department of Commerce’s Tech Hubs program that was a product of the CHIPS Act. In the coming months, technology hubs will be eligible to apply for government grants. Whether or not they receive grants, the hope is that many businesses can also indirectly benefit from the increased activity and improving infrastructure spurred by these bills.

Looking to the year ahead

While the last few years have been challenging, there are signs that the economy is stabilizing, including in the Midwest. Manufacturing leaders should continue to focus on strategic growth opportunities to overcome interest-rate challenges and a tight labor market.