It was an unprecedented year for the economy on many fronts in 2023. Economic observers were not asking if we’d enter a recession, but when it would happen. Hindsight is 20/20, and even though the recession that was always 90 days away never materialized, forecasts for a looming recession influenced how we operated as consumers and business leaders.

The new year is an opportunity to reflect and learn from 2023 as business plans are developed and executed in 2024. While this process will look different for each company, important takeaways from 2023 should shape goals that are shared across businesses, such as growing and improving existing operations. In addition, market, economic and political trends impact all businesses as they plan for the future. What can we learn as we reflect on the economic path of 2023?

The economy weathered significant challenges in 2023

One year ago, inflation was well above the Federal Reserve’s 2% target, and the labor market was historically strong with unemployment at 3.4%. Many companies struggled to hire qualified workers with the number of job openings outnumbering the unemployed nearly two to one. As a result, the Fed continued to increase interest rates to slow inflation and the economy.

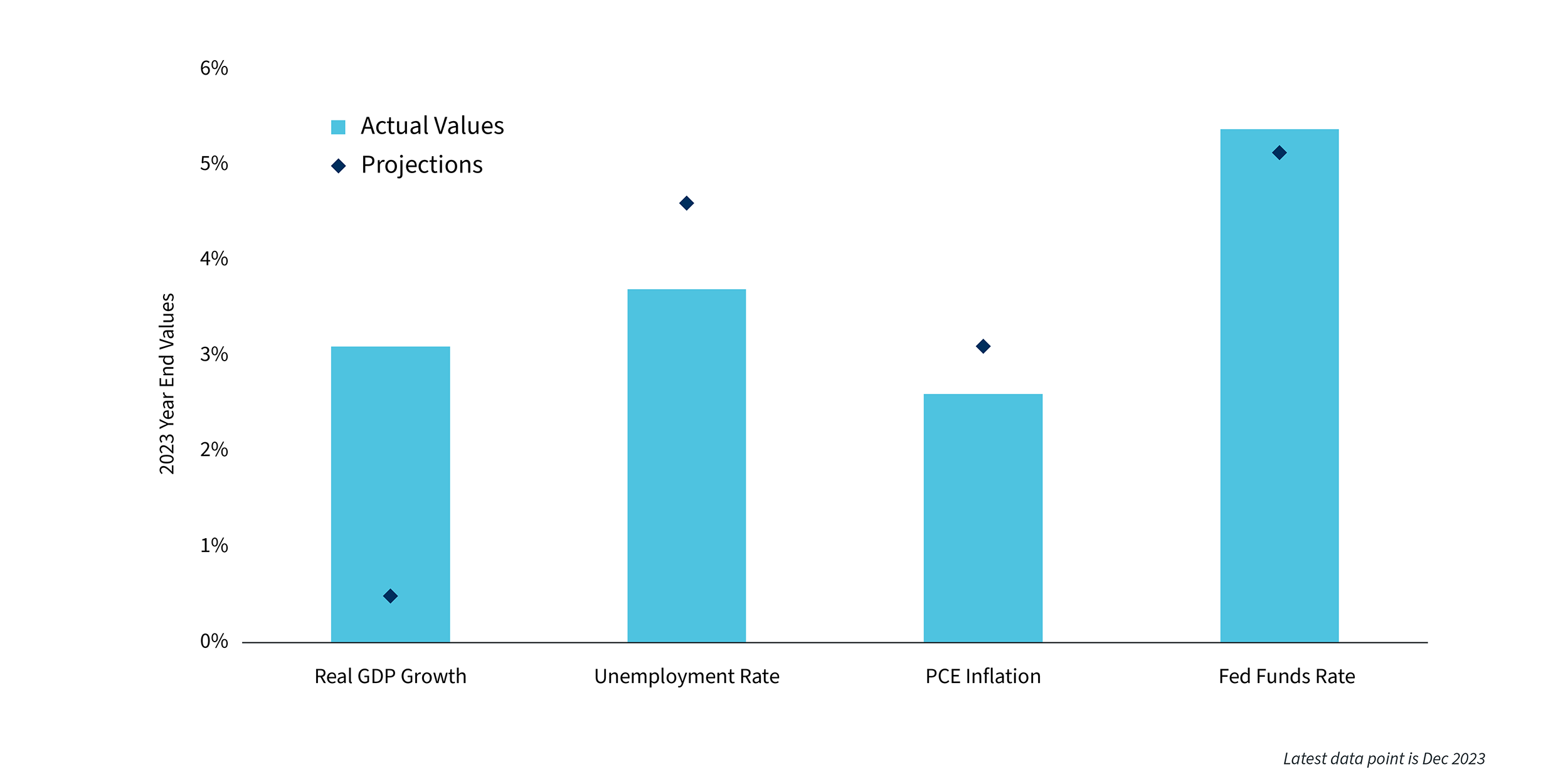

This led many economists to anticipate a recession in 2023. In the Fed’s own projections in December 2022, policymakers said they expected the unemployment rate to jump to 4.6% at the end of 2023. Policymakers also expected real GDP growth to slow to just 0.5% in 2023. These projections showed that even the Fed doubted its ability to decrease inflation without slowing growth in 2023.

2023 exceeded projections1

However, as the chart above shows, these pessimistic projections did not prove true. Growth in 2023 was much stronger than expected at 3% for the first three quarters of the year. The economy was supported by strong consumer spending throughout the year and rising private business investment as the outlook improved. While the unemployment rate did increase slightly, it finished at just 3.7%, well below Fed projections. The combination of strong growth and low unemployment suggest that the economy was far from recession.

Perhaps most importantly, inflation fell more quickly than anticipated despite the strength of the economy. Prices, as measured by the personal consumption expenditures (PCE) index, rose just 2.6% in 2023. Much to the surprise of policymakers and market forecasters, 2023 was a year of economic resilience despite significant challenges.

Looking forward in 2024

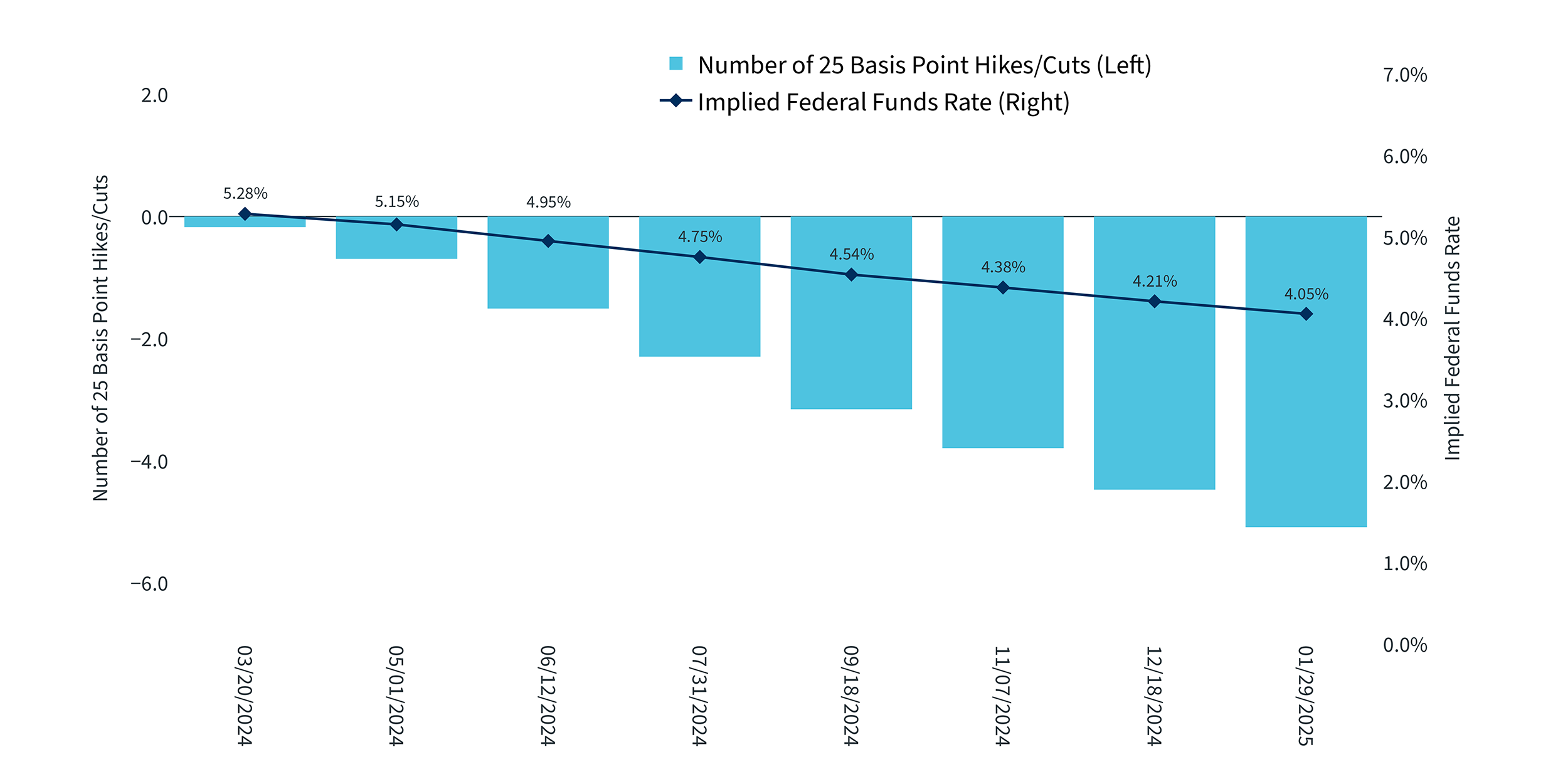

How do these positive trends impact the outlook for the rest of 2024? The most important consideration is that lower inflation has opened the door for the Fed to reduce interest rates this year. If this occurs, lower rates could once again begin to stimulate the economy, enabling increased consumer and business spending. Of course, there is disagreement on when this might occur and to what extent rates may fall. As the chart below shows, markets expect between five and six rate cuts between now and early 2025, while the Fed has projected just three.

What does this mean for business leaders looking ahead to the remainder of the year? As was the case in 2023, basing business decisions on economic forecasts and headlines alone may lead to missed opportunities as organizations attempt to get the timing perfect. In most cases, it would have been far better last year to continue investing to meet future demand and hire the best candidates. Regardless of what happens with GDP growth and the Fed in 2024, business fundamentals will remain the most important determinant of success.

Fed funds futures implied rates2

It’s worth noting that political uncertainty will also be elevated in 2024 due to the presidential election. Pundits on both sides of the aisle will forecast the dire consequences of the other party winning. However, history has taught us that the White House and Congress often have limited impact on the broad economy, especially during their terms in office. This is because policy change tends to be gradual and often works with a long delay.

While policies can directly impact specific industries, it’s important to not overreact to election results. If business leaders put off hiring necessary workers or choose to forgo investments in new equipment, they could miss important opportunities for growth in 2024.

Strategies for growth in the year ahead

At the start of 2023, economic forecasters and business leaders alike anticipated a recession in the coming year. However, last year highlighted the difficulties of predicting what might come next in the economy as well as the risks of allowing these expectations to play an outsized role in determining behavior. Economic and political factors may influence outcomes, but business fundamentals are most often the key factor in success.

Moving forward in an environment of heightened uncertainty, it pays to have a longer time horizon and anticipate future demand once the dust settles. If rates do begin to fall and the economy remains strong, investments in new projects that add capacity and efficiency can foster growth.

Specifically, if a business expansion such as an acquisition, investment in equipment or hiring new workers makes sense strategically, the macroeconomic or political environment should not be the primary consideration. In these cases, a trusted banking partner with a deep knowledge of the industry can customize terms and provide the guidance to accomplish these business goals.

With this in mind, there is no better time for business leaders to consider their goals for the rest of the year and revisit the relationships that can help accomplish them. Working alongside a trusted and experienced partner can help business leaders ensure that their operations run smoothly regardless of the economic or political environment.