Just like their for-profit counterparts, nonprofit organizations have navigated many complex operational, hiring and financial challenges over the past several years. However, nonprofits are often defined by the missions that drive their organizations. This means nonprofit leaders must continually position for sustainable growth to achieve their mission-related goals across markets and economic dynamics. Successfully balancing these goals can help nonprofit organizations most effectively serve their communities for many years.

Nonprofits play important roles across the nation and in their local communities. In 2022, roughly 6.5% of the U.S. workforce worked at nonprofits, according to the Bureau of Labor Statistics. That figure was even larger in Minnesota, with 14% of the state’s workforce employed at nonprofits in 2022, according to the Minnesota Council of Nonprofits.

Nonprofit revenues have struggled to keep up with costs

Nonprofits have played an especially important role in recent years, providing critical social safety nets for community members grappling with the COVID-19 pandemic, economic uncertainty and other issues, such as health-related hardships. When their lives are disrupted, people often turn to nonprofits for support across a variety of services. However, economic uncertainty has also challenged nonprofits themselves. Many organizations have faced a labor shortage and rising costs, which have cut into their capacity to provide care. This has led to increased pressure on the ability of nonprofits to operate sustainably.

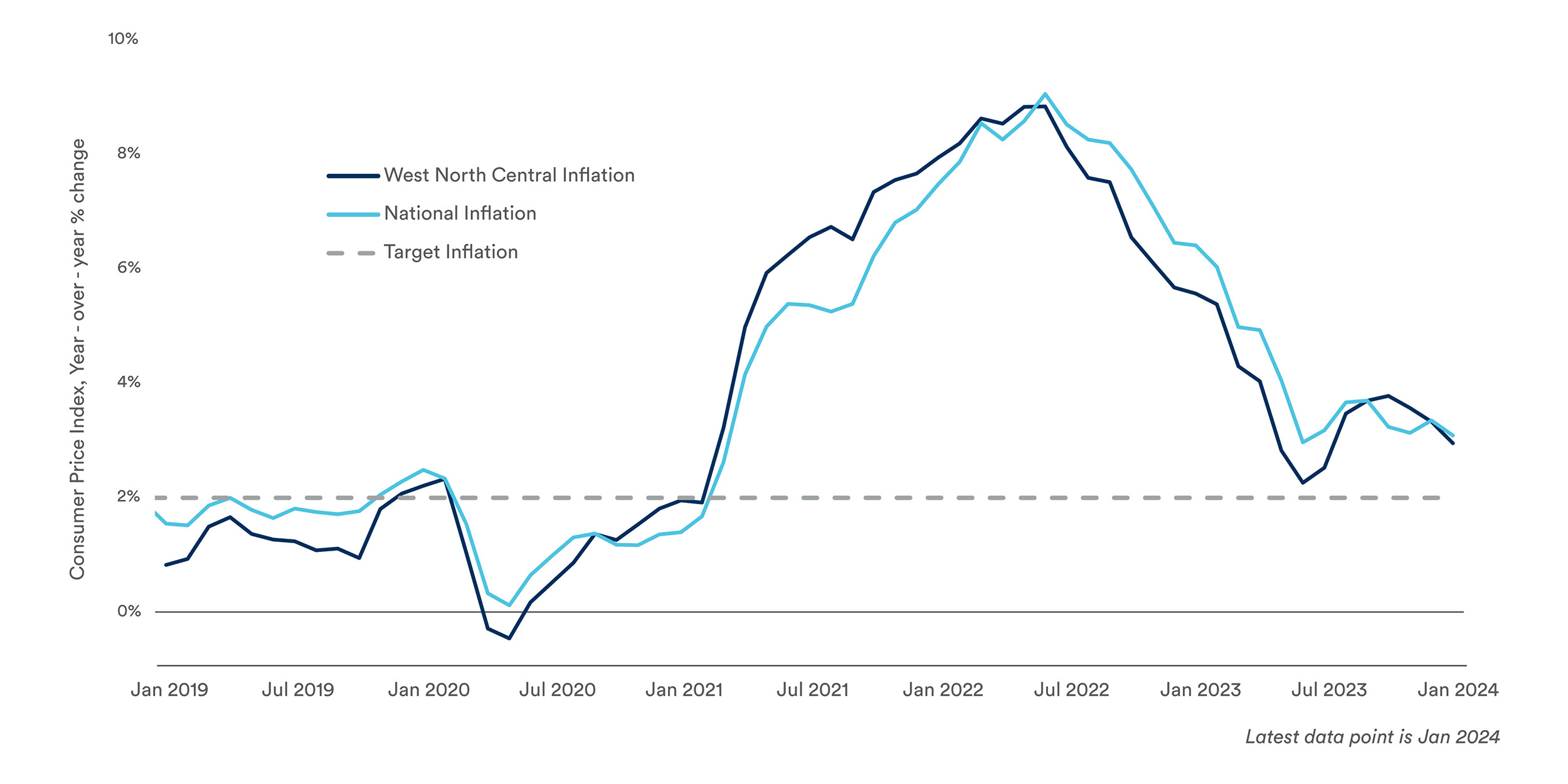

Rising costs in the Midwest1

The unique revenue structures of many nonprofits have made it challenging to keep up with inflation. While inflation has fallen significantly over the past year, price increases remain well above historical levels. The “West North Central Census Region” that includes the Upper Midwest has experienced price increases of 19.6% since the start of 2020, according to the consumer price index.

As consumer prices have risen, the cost for nonprofits to provide key services has increased as well. While many for-profits can raise prices when costs increase, nonprofits are more likely to have revenue that lags these increases in expenses. For example, a nonprofit’s payment from government contracts may only be updated periodically, so they may have to wait months or years for payments to catch up to the cost of services. When inflation is high, this can place financial pressure on nonprofit organizations.

Outside support for nonprofits has fallen

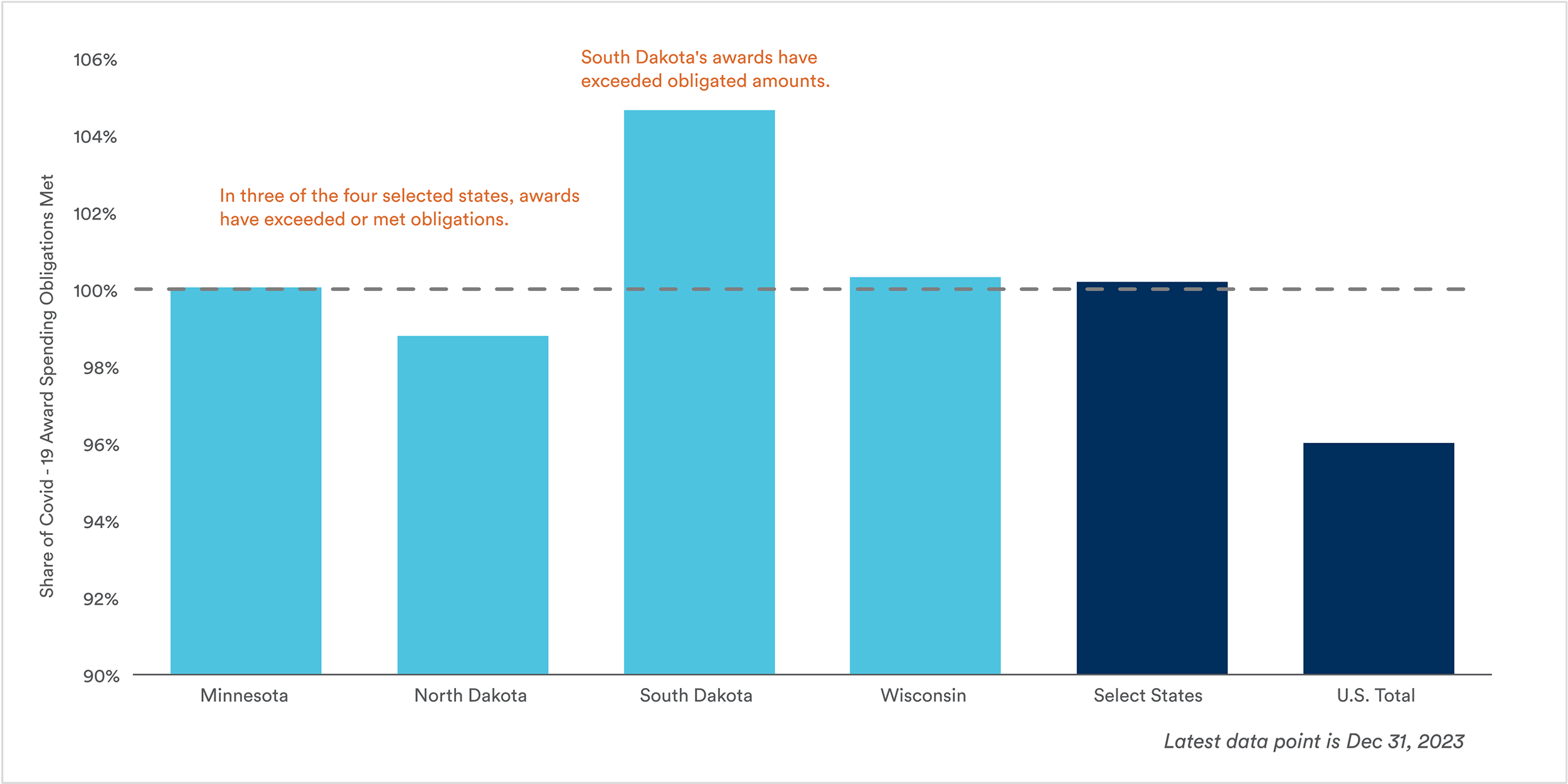

During the pandemic, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the American Rescue Plan Act and other programs benefited communities and nonprofits. These bills enabled government spending to support economic stability and strength across the country. In total, these acts allotted $2.5 trillion of contracts, loans, grants and other financial assistance to individuals, businesses and governments across the country.

Minnesota and North Dakota in particular received $205 billion and $8.3 billion, respectively, the highest per capita in the nation. This funding helped support the strong economic recovery that followed. However, as the figure below shows, this support has now receded. Thus far, $2.4 trillion, or 96%, of that funding has been disbursed and it is unlikely that government funding and support will continue at this pace.

The end of many government programs to support social services in the wake of the pandemic has placed further pressure on nonprofits. Not only did many nonprofits receive support from government programs that have since expired, but social programs that directly supported individuals have been scaled back. As a result, individuals may increasingly turn to nonprofits for needed support. These effects could add pressure to nonprofits as their expenses increase while their revenues and outside support struggle to keep up.

COVID-19 relief spending is mostly exhausted2

How nonprofits can navigate these compounding challenges

The economic volatility over the past three years has changed the economic landscape for nonprofits. To navigate this challenging environment, nonprofits must make tough decisions to prioritize programs that are both financially sustainable and support their mission. This requires nonprofit leaders to accurately project the cash flows and costs of their various programs to make the most of their resources at hand. To do so, there are two important factors to consider.

First, the unique nature of nonprofit income sources can make evaluating programs challenging. Fortunately, experienced partners can help business leaders craft program projections and evaluate their economic feasibility. While these decisions can be difficult to align with the core mission, nonprofit leaders must prioritize the sustainability of their operations to maximize their long-term impact.

Second, nonprofits should take advantage of the scale and efficiency of their financial partners. For example, nonprofit leaders should avoid spending their limited time, energy and resources managing excess cash or completing administrative tasks. Leveraging the capabilities of financial partners can help nonprofits efficiently manage their finances and free up time to focus instead on their missions.

Ultimately, nonprofit leaders have the important task of ensuring that their operations are sustainable in order to achieve long-term impact. Careful evaluation of existing programs and ongoing strategic planning can make these challenges more manageable and increase the odds of success for their customers, constituents and communities.