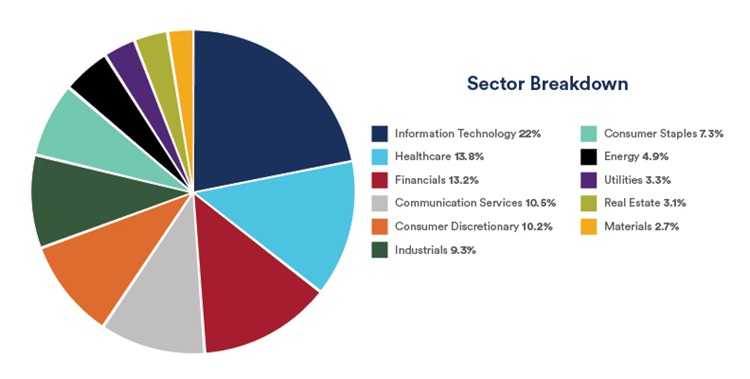

The technology sector makes up one of the 11 sectors of the S&P 500 index, which is a universally recognized benchmark for the U.S. stock market. The technology sector now makes up 21.5% of this index and is the largest sector by a good margin.

Through July 28, the tech sector return of 34.3% is the highest of all the 11 sectors. Technology stocks have been rising in recent months as their earnings growth is expected to be faster than many of the other sectors. In fact, if you read into the performance of the other top performing sectors (Consumer Discretionary and Communication Services), you could argue those sectors are being driven by very tech-like companies. For example, Amazon has driven Consumer Discretionary returns and Google and Facebook have done the same for Communication Services performance. Those companies were part of the Info tech sector until a recent rebalancing by the index.

Global and U.S. economies are growing slower. That has shifted sentiment into companies like tech stocks that rely less heavily on economic growth compared to the more cyclical sectors. Technology companies sell their products to all companies. This allows those companies to increase productivity, grow sales and ultimately increase earnings. As such, technology stocks have received a premium valuation in this current market.

The premium valuation that tech stocks now command may also be the result of a golden era of integrated information. The important thread is that any company today that competes in any industry can better compete and prosper if they can utilize and integrate technology into their business. The technology sector and their constituents are in a unique position to benefit from this trend.

The answer to my title question is—Tech is doing very well. Both from a performance and business standpoint. Despite all the positives outlined above, the economic outlook can change quickly. Technology business is not immune to a slowing or declining economy, and neither is the way the market prices those technology stocks in that environment.