4 investor lessons for 2022

Investors were bombarded with negative news in 2021. Events during the year include the attack on the U.S. Capitol, the disastrous end to the 20-year war in Afghanistan, Congressional inaction and partisanship, the extreme volatility of meme stocks and cryptocurrencies, China’s bursting housing bubble, surging inflation, supply chain disruptions, the possibility of a Russian invasion of Ukraine and a pandemic that keeps resurfacing through new variants. Given all of this there was no shortage of reasons to be pessimistic about markets and the economy.

Despite all the negative headlines in 2021 GDP growth was extremely strong, putting in the highest annual total in decades. Unemployment fell below 4% and wage growth increased, especially for the lowest paid workers. The S&P 500 gained nearly 29% (including dividends) last year, one of its best years ever, and is up 119% since the market bottom in March 2020. Even though markets may have felt choppy, based on a variety of metrics 2021 was less volatile than average for many asset classes, including US equities and fixed income.

Alongside the strong economy and equity markets, Treasury yields rose (although they remain range bound within historically low levels) and the Fed indicated it plans to tighten policy in early to mid-2022. This was a headwind to fixed income performance in 2021, especially for investment grade corporate bonds and Treasuries, though inflation protected securities and municipals managed to produce positive returns. Outside of investment grade fixed income and EM equities, which fell slightly, most asset classes produced solid to outstanding returns.

As the first month of 2022 comes to an end, we are beginning to get an idea of what may drive markets in 2022. Volatility has increased in a number of asset classes, and we have already witnessed some dramatic sell offs and recoveries within individual trading days. The Fed has become increasingly hawkish on inflation and will begin tapering bond purchases and raising interest rates soon. The past year gave investors lots of opportunities to be pessimistic, but the strong performance of stocks and the lack of market volatility amidst a lot of negative press proved that markets don’t always behave in ways that can be predicted at the start of the year. Here are four lessons investors should consider in 2022.

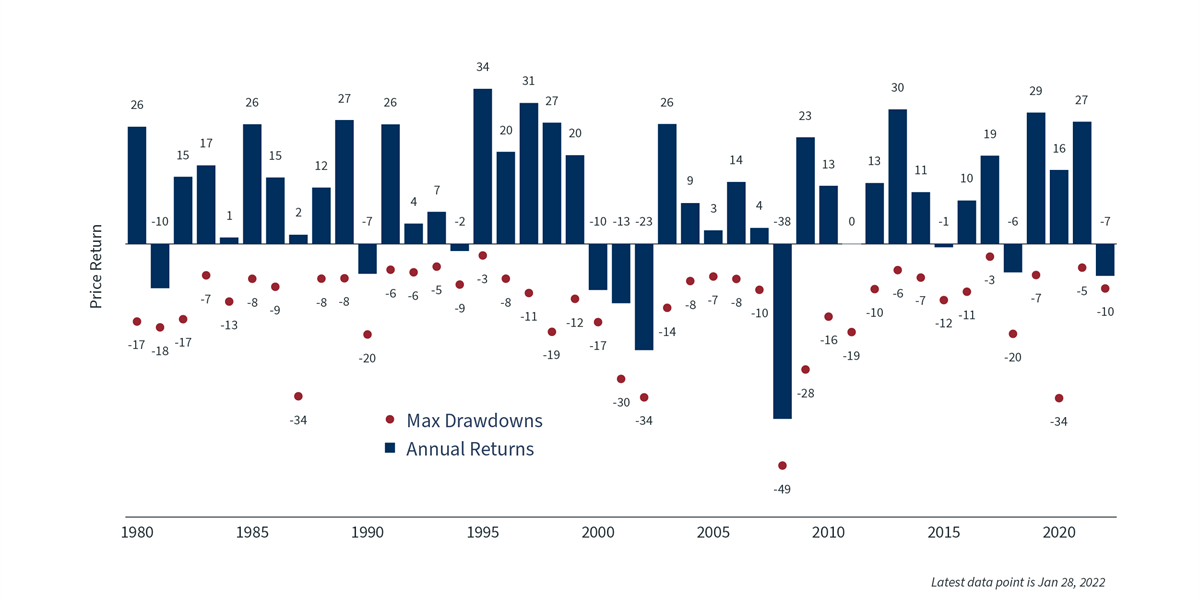

#1 Markets can do well when investors least expect it

The S&P 500 achieved 70 new record closes in 2021. This is the most since 1995, during the early stages of the dot-com boom. While it is not highly unusual for the stock market to reach some new highs during the year, the strength of the rise certainly wasn’t widely expected coming into 2021.

Many forecasters expect equities to pull back in 2022 and experience heightened levels of volatility, something we are already experiencing in the first weeks of 2022. Many are also predicting that fixed income will have a rough period if inflation remains elevated and the Fed increases short term interest rates. While this may prove true, this past year demonstrated that markets can deviate from even the most sophisticated investor’s expectations, so it does not make sense to greatly reposition portfolios out of fear of possible outcomes that may not occur.

Total returns and pullbacks1

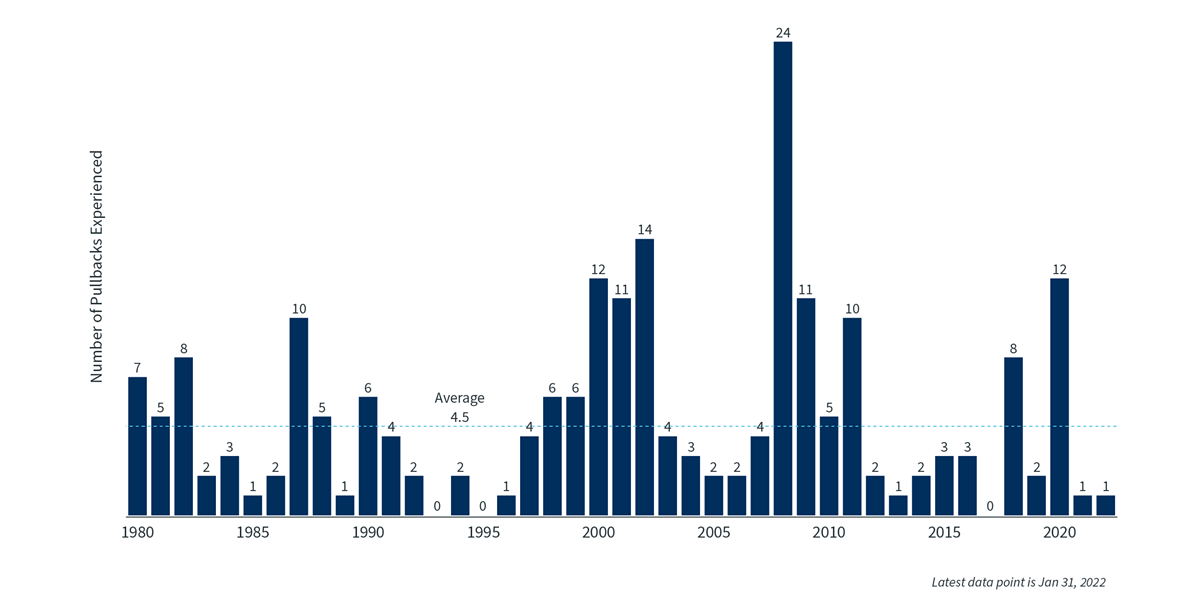

#2 Investors should expect more uncertainty but stay the course

Not only did US equities have a solid year, they exhibited lower volatility than normal with only a single 5% pullback that occurred at the end of the third quarter. There was a wide disconnect between the level of uncertainty, angst and pessimism in the economy (and society) and how markets actually performed.

At the same time, investors should not expect volatility to remain this low forever – early 2022 is already a reminder of that. After all, the willingness to take appropriate risks is why investors are rewarded in the long run. Volatility can also create opportunities to rebalance portfolios or put idle cash to work.

Both 2020 and 2021 underscore the importance of staying invested and diversified. The path of individual asset classes are difficult if not impossible to predict, even in the face of a global pandemic and increasing inflation. This will also likely be true of 2022 regardless of what transpires with future variants, rate hikes, military action or elections.

Stock market pullbacks2

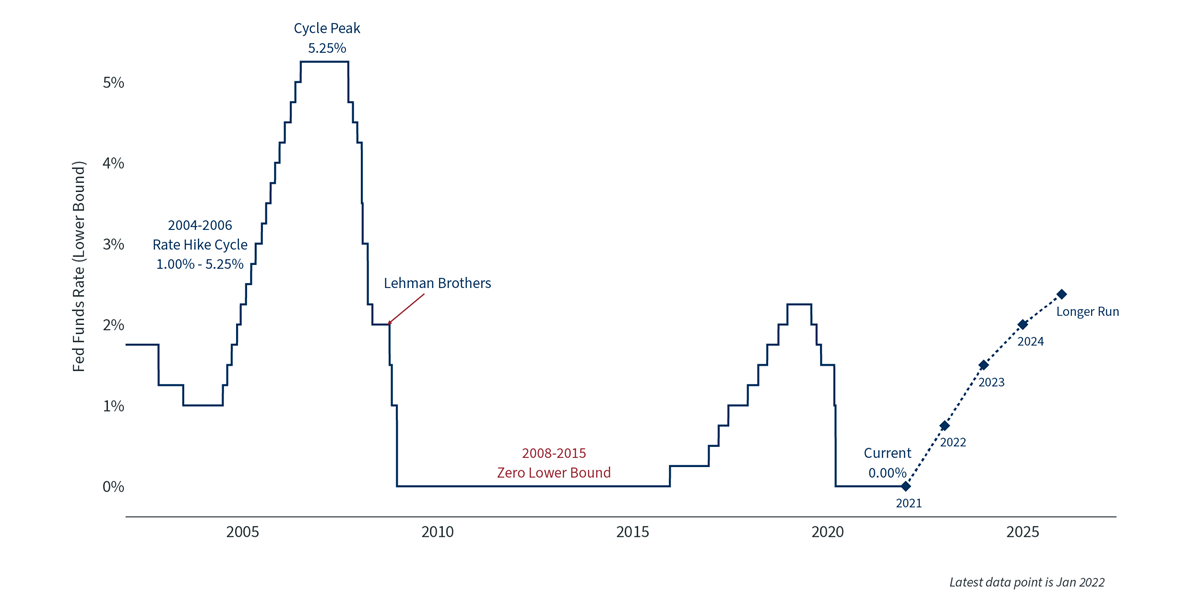

#3 Fed rate hikes are only the beginning, not the end of the cycle

The Fed has accelerated its plans to stabilize then reduce its balance sheet by decreasing and eventually eliminating the amount of bonds it purchases each month. It is also expected to raise rates in the first half of the year, followed by multiple increases throughout the year. Although this will no doubt drive market volatility in the first half of the year and possibly longer, Fed rate hikes are normal and justified if the economy is doing well, especially when coupled with above average inflation.

In times like these it can help to focus on the big picture. Although every market cycle is different, we are probably still early in this expansion. The underlying economic trends are strong with rising earnings, low default rates and employees finding better jobs and higher wages. Inflation is elevated but some of this is due to year-over-year comparisons and supply chain disruptions. High inflation could become “sticky” if supply chain issues remain or if the demand for labor remains strong without an increase in the supply of available workers. This would reduce profit margins at many businesses and erode the purchasing power of consumers, which could derail economic growth, but inflation could also begin to subside later this year if supply chain issues can get resolved quickly. As of right now inflation is expected to average 3% over the next 5 years, not far above the Fed’s target of 2%.

Federal Funds Rate3

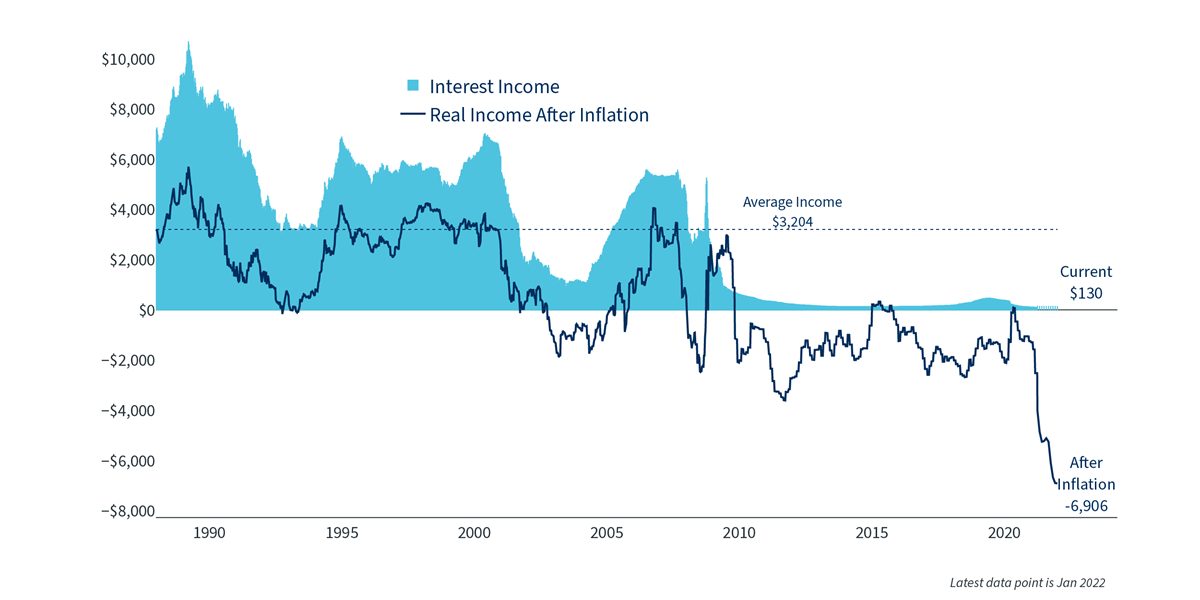

#4 The value of cash is eroded by inflation

Besides its effect on economic growth and consumer spending, rising inflation has several implications for investment portfolios. For many, the primary challenge is that inflation erodes the value of cash savings, or any security that pays a fixed rate. This underscores the need to properly invest excess cash to generate a sufficient return to preserve purchasing power over time while maintaining appropriate amounts of liquid reserves. Equities, inflation protected fixed income securities and variable rate bonds can all help protect a portfolio from the ravages of inflation.

Interest income on cash4

Conclusion

Markets can move in unusual and unexpected ways. Rather than trying to predict every outcome and incur trading costs, the best approach for most investors is to hold an appropriately diversified portfolio that can withstand these uncertainties, while benefiting from the long-term growth of markets and the economy. Doing so in a way that is aligned with broader financial goals and risk tolerances, especially with the guidance of a trusted advisor, can help investors ignore the negative headlines and day to day volatility of markets and be confident in their financial future.

Download as PDF“Total Returns and Pullbacks.” S&P 500 Index total returns. Max drawdown represents the biggest intra-year decline. Source: Clearnomics, Standard & Poor’s.

“Stock Market Pullbacks.” The number of 5% S&P 500 pullbacks experienced by investors each year. Source: Clearnomics, Standard & Poor’s.

“Federal Funds Rate.” Target range lower limit. Source: Federal Reserve.

“Interest Income on Cash.” $100k invested in 6-month CDs against inflation. Actual rates may vary. Source: FDIC.