After an eventful 2022, what do markets have in store for 2023?

The year 2022 was eventful for financial markets. Inflation hit its highest level in 40 years, U.S. investment-grade bonds had possibly their worst year ever, the Federal Reserve raised rates at an unprecedented clip and stocks had their worst year since the Great Recession. Growth stocks tanked after almost a decade of beating value stocks, cryptocurrencies plunged, mortgage rates surged and the U.S. Treasury yield curve was inverted for most of the year, all while unemployment remained near all-time lows and companies struggled to fill job openings.

Attempting to follow every piece of data can be overwhelming. As investors try to make sense of 2022 and examine the possibilities for 2023, these four factors may be the most important data points to consider: high inflation, rising interest rates, low unemployment, and decreased performance of stocks and bonds. Where these areas go next will set the course for 2023.

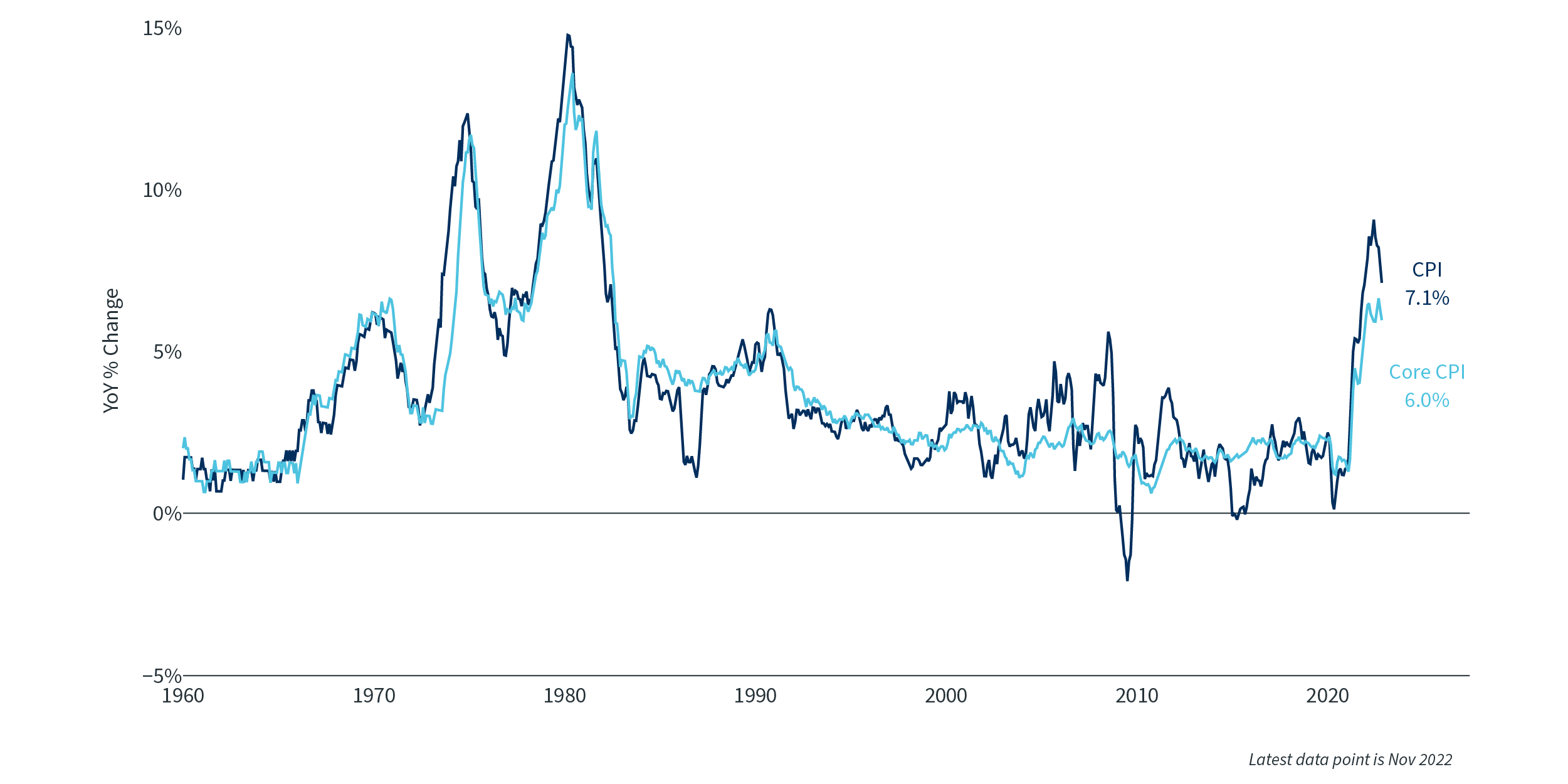

Inflation remained at its highest level in 40 years

Inflation may have been the biggest economic story of 2022. The U.S. and other developed economies haven’t dealt with inflation this strong since the 1980s. The consumer price index (CPI), the main gauge of inflation in the U.S., ended 2021 at 7%, its highest level since 1982. It continued rising in the first half of 2022, peaking at 9.1% in June. Inflation was a global phenomenon, hitting most developed economies, and in many cases the inflation rate in other countries exceeded the level in the U.S. For example, inflation in the eurozone hit a high of 10.7% in 2022 and remains above 10% to begin 2023.

Inflation, while still high, has started coming down in most countries. In the U.S., the last inflation reading of 2022 came in at 7.1%, almost the exact same level it reached a year earlier. Throughout the year, demand remained strong, supply chain issues persisted, consumers continued to spend the fiscal stimulus they received in 2020 and 2021, and the war in Ukraine affected the prices and supplies of global energy and food, all of which contributed to inflation. Given the lack of inflation over the past 40 years, it is easy to understand why the Fed and other economists thought the burst of inflation at the end of 2021 would quickly go away, but it proved much more durable than almost anyone predicted coming into 2022.

One of the biggest concerns on the minds of most economists and central bankers as we head further into 2023 is whether inflation will continue to fall and how quickly it will get back to 2%. If it remains high, requiring the Fed to raise rates even more, a mild to severe recession may be in the cards by midyear. If inflation can continue falling, reducing the need for restrictive monetary policy, then perhaps the economy can achieve the much desired “soft landing,” where unemployment barely rises even if GDP growth falls below zero.

Consumer Price Index 1

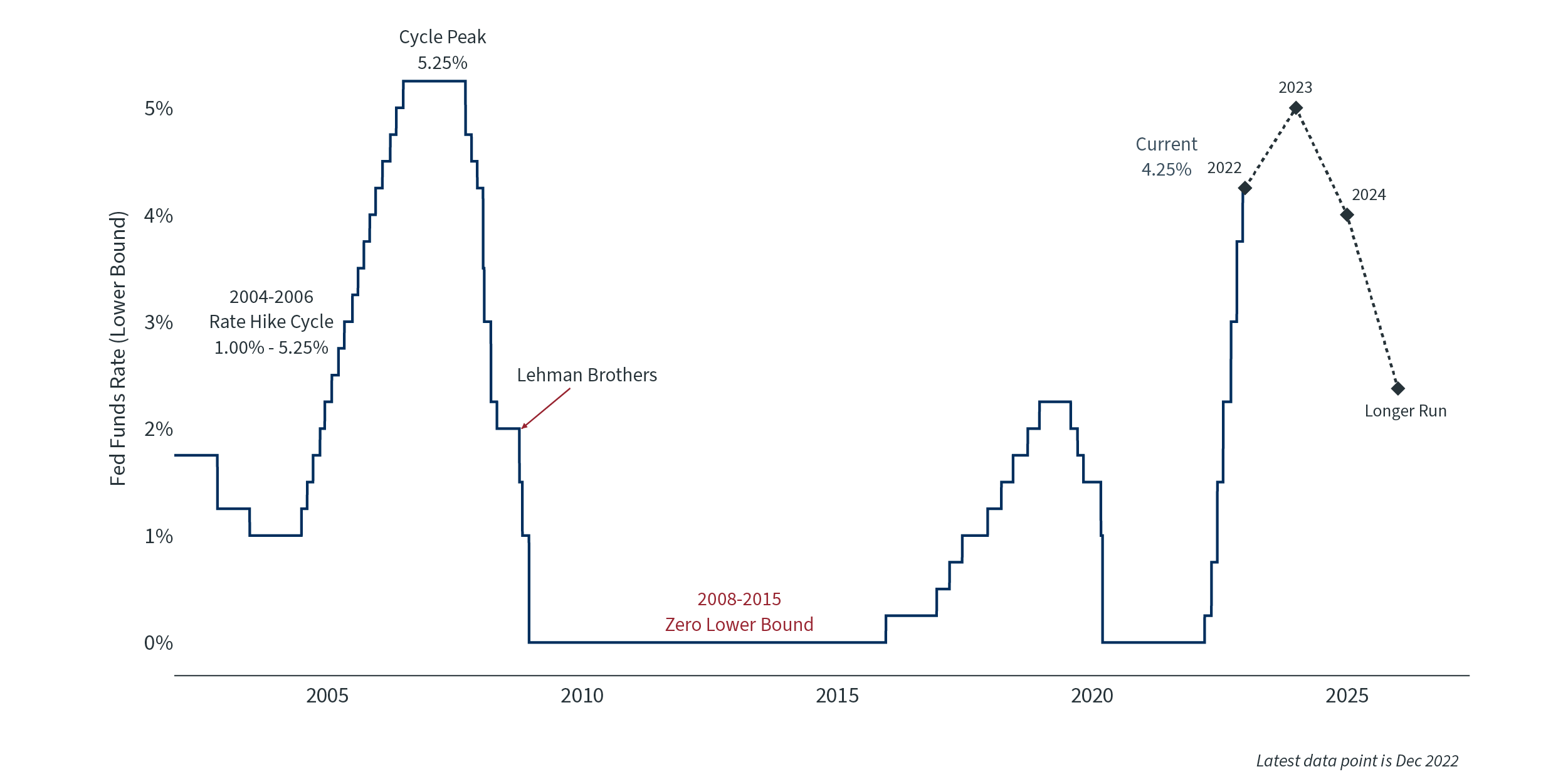

The Federal Reserve rapidly raised rates

Due to the persistence of inflation, the Federal Reserve was very much in the headlines in 2022. It is somewhat hard to believe, but the federal funds rate started the year essentially at 0%, the same level it had been at since the start of the pandemic. The Fed predicted that the rate would only climb to 2% by year-end, even with inflation at 7%, as it saw inflation as "transitory,” due solely to supply chain issues and the war in Ukraine. But inflation proved anything but transitory, which the Fed belatedly recognized. After a 25-basis point (0.25%) increase in March, the Fed raised rates six more times, including four straight 75-basis point (0.75%) moves in the summer and fall. The last increase of the year, a 50-basis point (0.50%) rise that occurred in December, brought the federal funds rate to 4.25%-4.50%, which is its highest level since 2007. Based on the Fed’s own forecasts, there is a good chance that the Fed will raise the rate even further in 2023, taking it to its highest level since 2001.

The increases in the federal funds rate in 2022 were mirrored by other central banks, especially in the latter half of the year. These rate increases affected all sorts of other bond yields and borrowing costs, including mortgage rates, which exceeded 7% at one point in the year. The increases also sent stocks and bonds tumbling.

The Fed’s course from here will be dictated primarily by how fast inflation falls, but also by any increases in the unemployment rate or a severe slowdown in economic activity. The Fed wants to bring inflation down to 2% and is willing to cause a recession in doing so, but it does have a dual mandate to maintain price stability and full employment, so it will also keep its eyes on the unemployment rate and GDP growth.

Federal Funds Rate 2

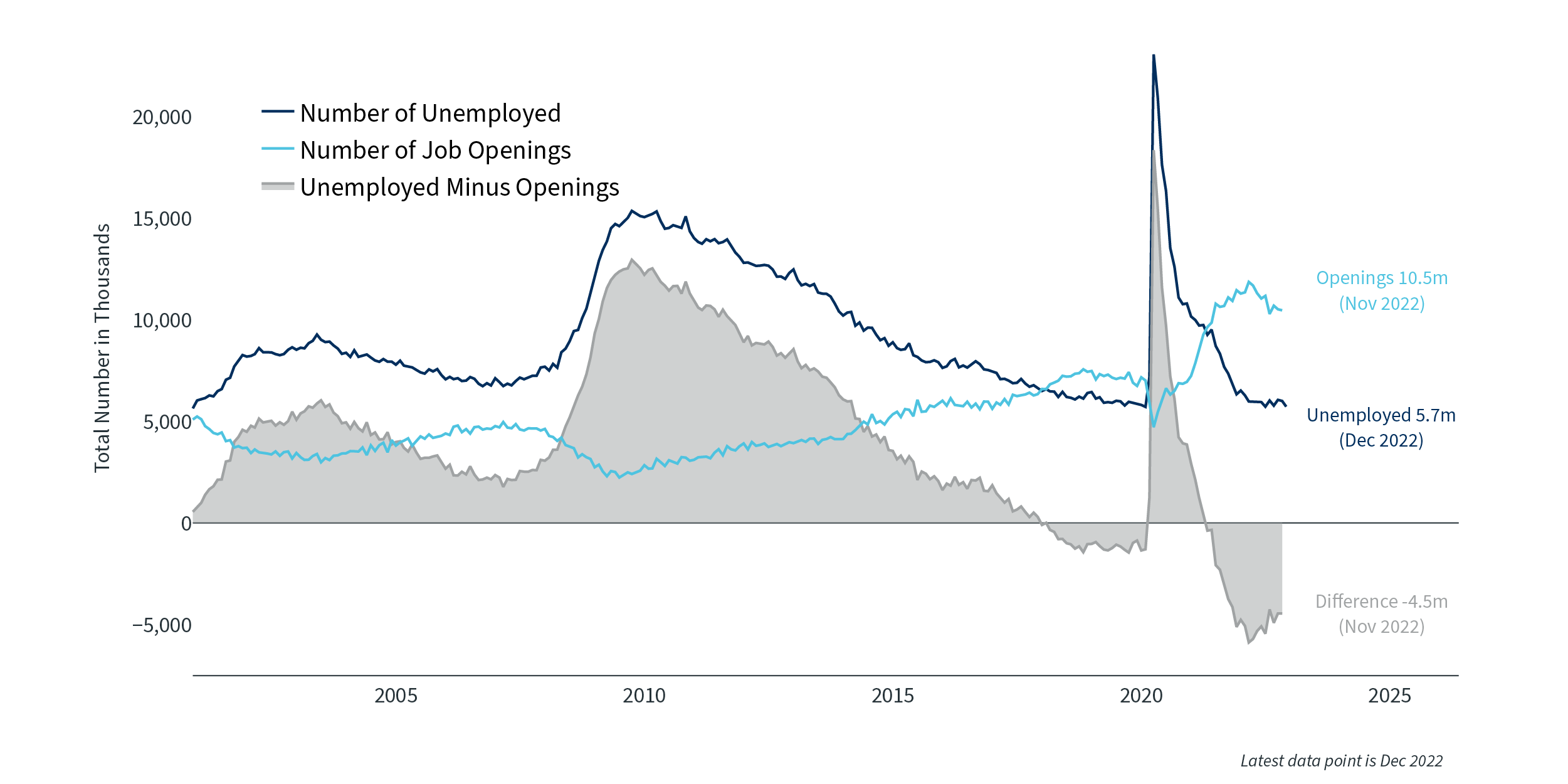

Unemployment remained very low

Despite the rise in inflation and interest rates, unemployment remained very low. Normally there are more job seekers than open positions, but in 2022, the U.S. economy experienced the extremely rare circumstance of having twice as many job openings as job seekers. Strong demand for goods and services, coupled with low population growth, reduced legal immigration numbers since 2019 and a labor force participation rate that has yet to return to 2019 levels contributed to a labor market where demand greatly exceeded supply. Wage growth has remained below inflation but is still stronger than it has been in decades.

As supply chains heal and inventories get rebuilt, inflation should continue to fall, but it is highly unlikely that inflation will reach 2% if wage growth continues to run at 5% or more. Hopefully the labor force participation rate starts to trend higher from its current level, which would help fill jobs without causing wages to spiral out of control.

Unemployment and Job Openings 3

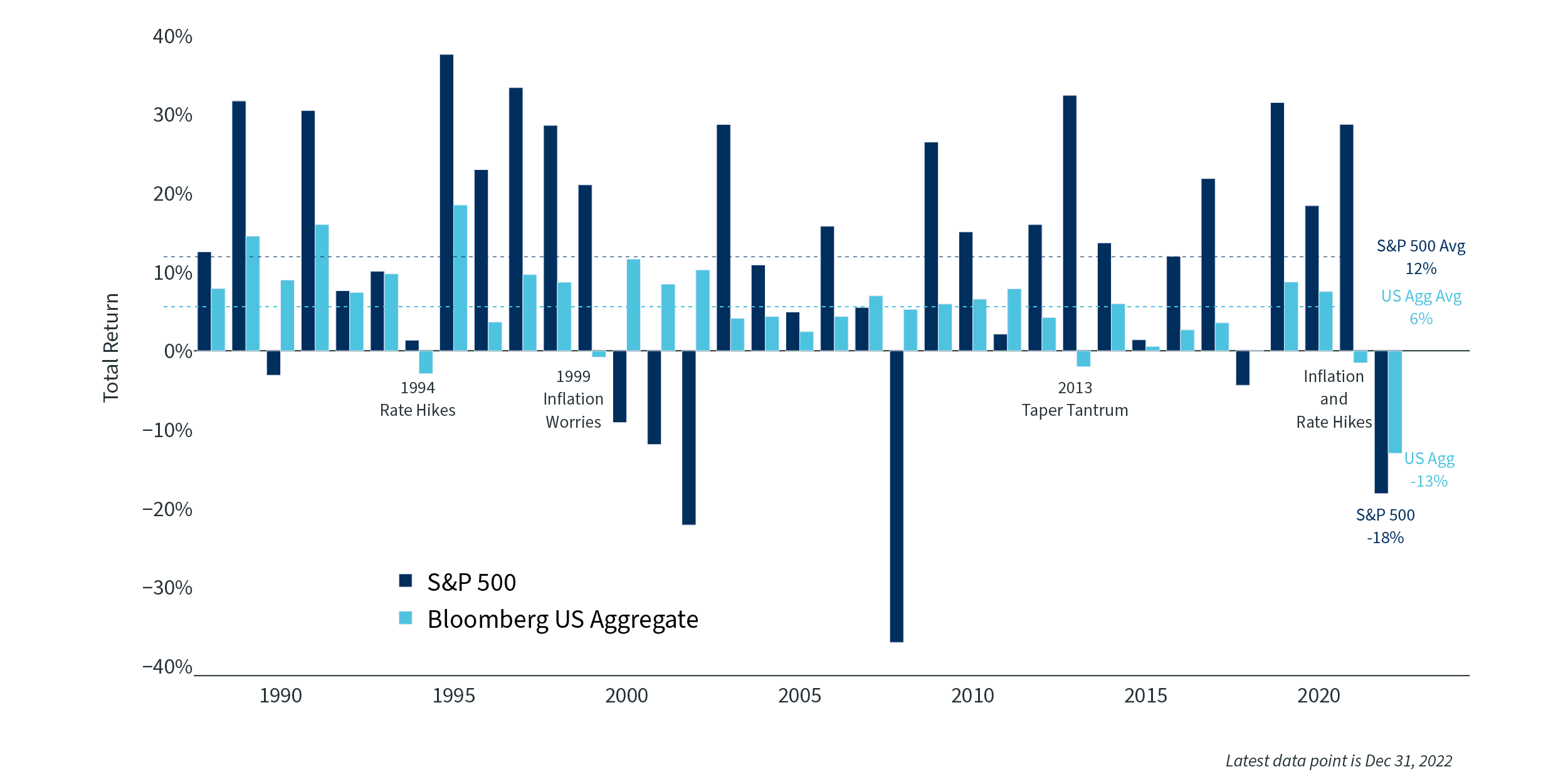

Stocks and bonds suffer a tumultuous year

With inflation raging and the Fed dramatically raising interest rates, both stocks and bonds ended the year down more than 10%, a highly unusual occurrence. Stocks and bonds did reverse course to rise in the last three months of 2022, recovering from their lows at the end of the third quarter. But a 60% equity, 40% bond portfolio still had its worst year since the late 1930s. The U.S. has not had a year when both stocks and bonds have each been down 10% or more since the Great Depression. Almost every stock index reached a bear market, defined as a decline of 20% or more, at some point in 2022.

Stock and bond valuations are much more attractive now, which lessens the chance of continued drawdowns, but with inflation still high and a recession on the horizon, there may be more volatility in the prices of both stocks and bonds in the first half of the year.

Stock and Bond Annual Returns 4

The road ahead

What does this mean for investors as we start 2023? First, no one can predict exactly how the year will play out. There are too many factors affecting an economy that can greatly alter the path of economic growth, labor markets and inflation.

The good news is that bond yields, stock valuations and interest rates on cash are all much more attractive than they were one year ago. This is especially welcome for more conservative investors or those with a shorter time horizon, as the yield on fixed-income portfolios is now back to near historic norms instead of at historic lows.

The Fed is on a path to raise rates, but at a much slower pace than 2022. Inflation should continue to fall, but until supply chain issues get figured out or there is a resolution to the war in Ukraine, it is unlikely that the inflation rate will hit the Federal Reserve’s goal of 2% anytime soon. We may encounter a recession in 2023, but the good news is that the unemployment rate is unlikely to surge.

Every year begins with potential headwinds and tailwinds. As always, the best course of action for most investors is to stay invested in a diversified portfolio that is aligned with the investor’s risk tolerance. It is also prudent to rebalance to the target asset allocation regularly and not try to time markets.

“Consumer Price Index. CPI and EX Food and Energy, YoY% Change” Sources: Bureau of Labor Statistics

“Federal Funds Rate. Target range lower limit” Sources: Federal Reserve

“Unemployment and Job Openings. U-3 unemployment compared to JOLTS job openings” Sources: Bureau of Labor Statistics

“Stock and Bond Annual Returns. S&P 500 Bloomberg U.S. Aggregate Total Returns” Sources: Clearnomics, Standard & Poor’s, Bloomberg