What to expect from markets in 2024

Following an eventful 2022, 2023 brought investors a new set of challenges and surprises. While 2022 was marked by high inflation, a steep rise in interest rates, and tumultuous stock and bond markets, 2023 unfolded differently. The Federal Reserve continued its campaign of rate hikes early in the year, but at a slower pace than in 2022, and didn’t alter rates at all in their last three meetings of the year. Inflation fell for most of the year while economic growth remained robust, defying expectations. The labor market softened but remained relatively strong, and equity markets had a much better year than the prior 12 months. Fixed-income investments generally produced only marginally positive returns, though it was much better than the major drawdowns most investors experienced in 2022.

As we move forward in 2024, there are many open questions that will determine how markets perform and whether the economy can avoid a recession. Four of the most important questions relate to inflation, the Fed, housing and equity markets.

Is the inflation battle over?

Inflation, which was the dominant economic narrative of 2022, continued to be important in 2023. However, while soaring inflation was the major story in 2022, the theme of 2023 was the fairly constant decline in inflation that occurred throughout the year.

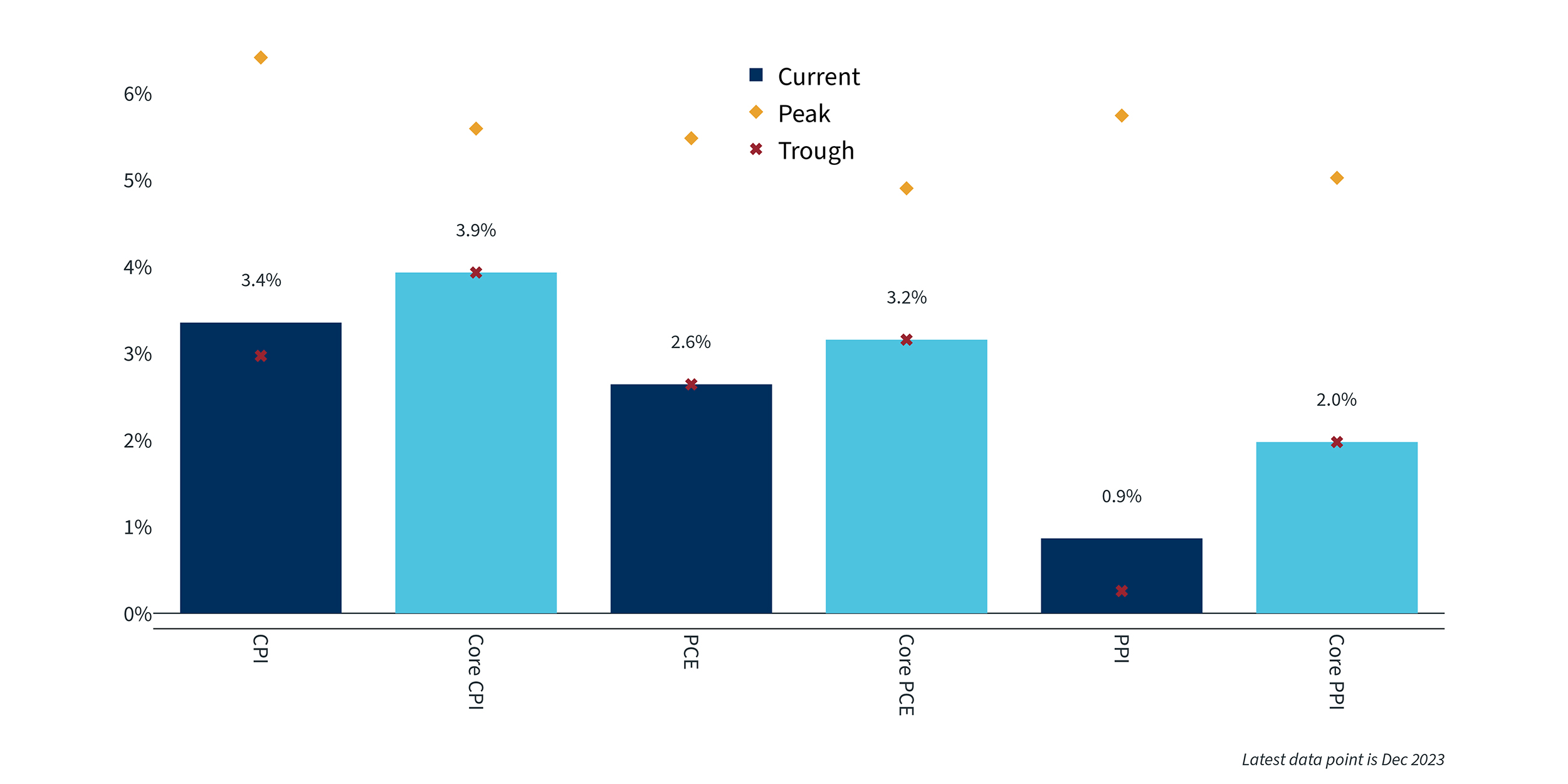

Almost all measures of inflation — the headline and core consumer price indexes (CPI), the personal consumption expenditures index (PCE), the producer price index (PPI) and others — fell during 2023 in a mostly linear fashion, reflecting the impact of tightened monetary policies and a gradual resolution of supply chain disruptions. Headline CPI fell from 6.5% to 3.1%, and core PCE, the Fed’s preferred inflation measure, fell from 4.9% to 3.2%. The peak in CPI was over 9%, which occurred back in the summer of 2022, and while core PCE never rose above 5.6%, it has proven stickier than CPI. Housing costs, which make up a large percentage of most inflation measures and are often based on rental prices, will start to pull inflation down even more as falling rents start to have an impact. However, service costs remain elevated.

The battle against inflation is not over yet, but much progress has been made. The big questions in 2024 are how quickly and effectively inflation will return to its target level of around 2%, and whether this can be achieved without triggering a recession. The trends heading into the year suggest a favorable outlook on inflation, with a gradual return to more stable economic conditions. The path to 2% is likely to be uneven, however, as inflation could go up and down from month to month over the next 12 months but is on track to ultimately be lower a year from now.

Inflation Measures1

Will the Fed cut rates, and if so, by how much?

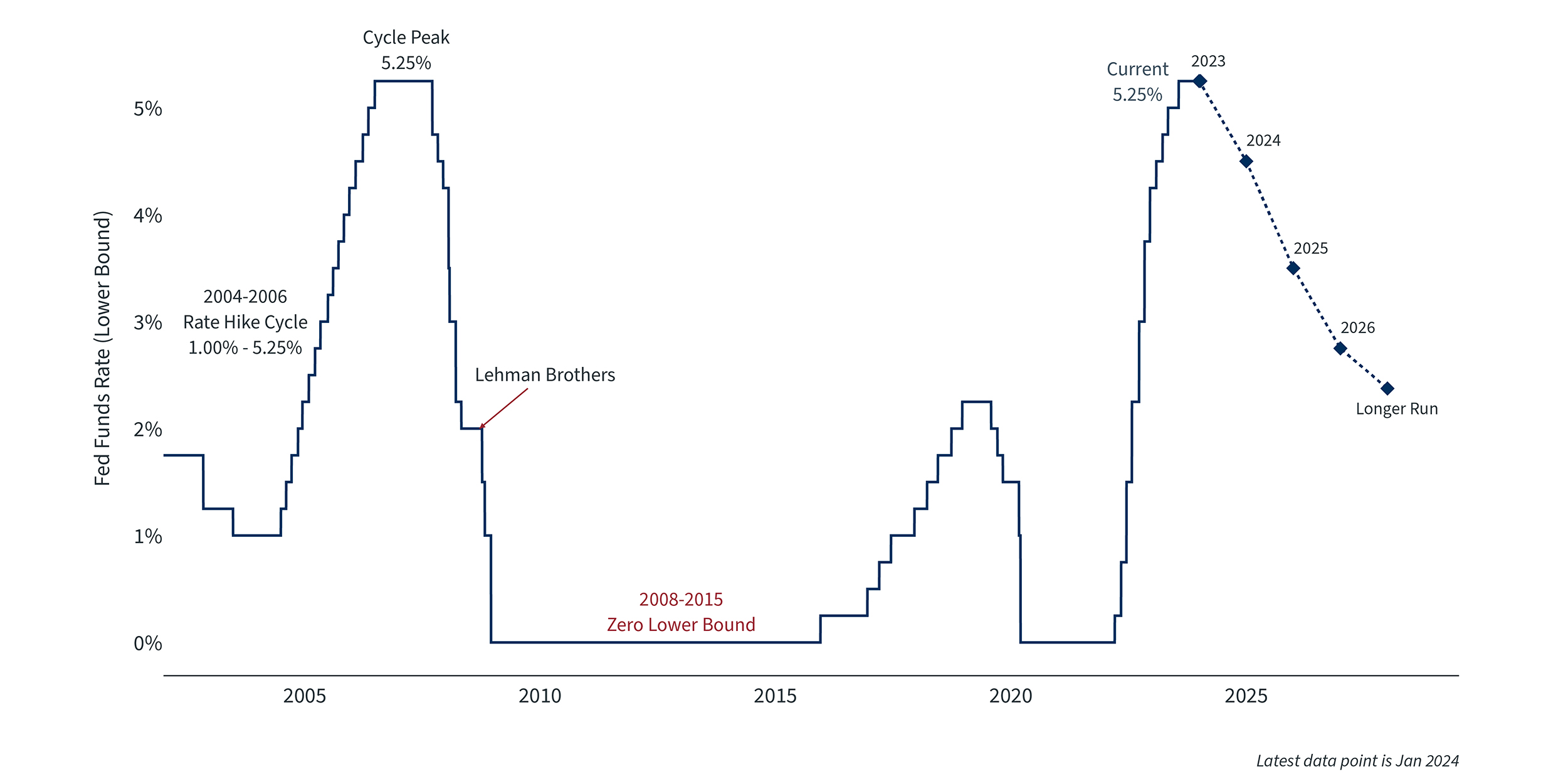

The Fed's aggressive rate hikes in 2022, which continued into the early part of 2023, had a significant cooling effect on the economy. By mid-2023, the Fed began pausing rate hikes, balancing the need to control inflation with the risk of economic contraction. As more economic data indicated that the labor market was softening and price increases were coming under control, the Fed even turned mildly dovish, indicating that they expected to cut rates up to three times in 2024.

The trajectory of the Fed's policy in 2024 will largely depend on inflation trends and the overall health of the global economy. While it appears that inflation is headed in the right direction and economic growth is positive, a rebound in inflation or a dip into recession could significantly change the Fed’s plans as they navigate the year.

Federal Funds Rate2

Will the housing market loosen up?

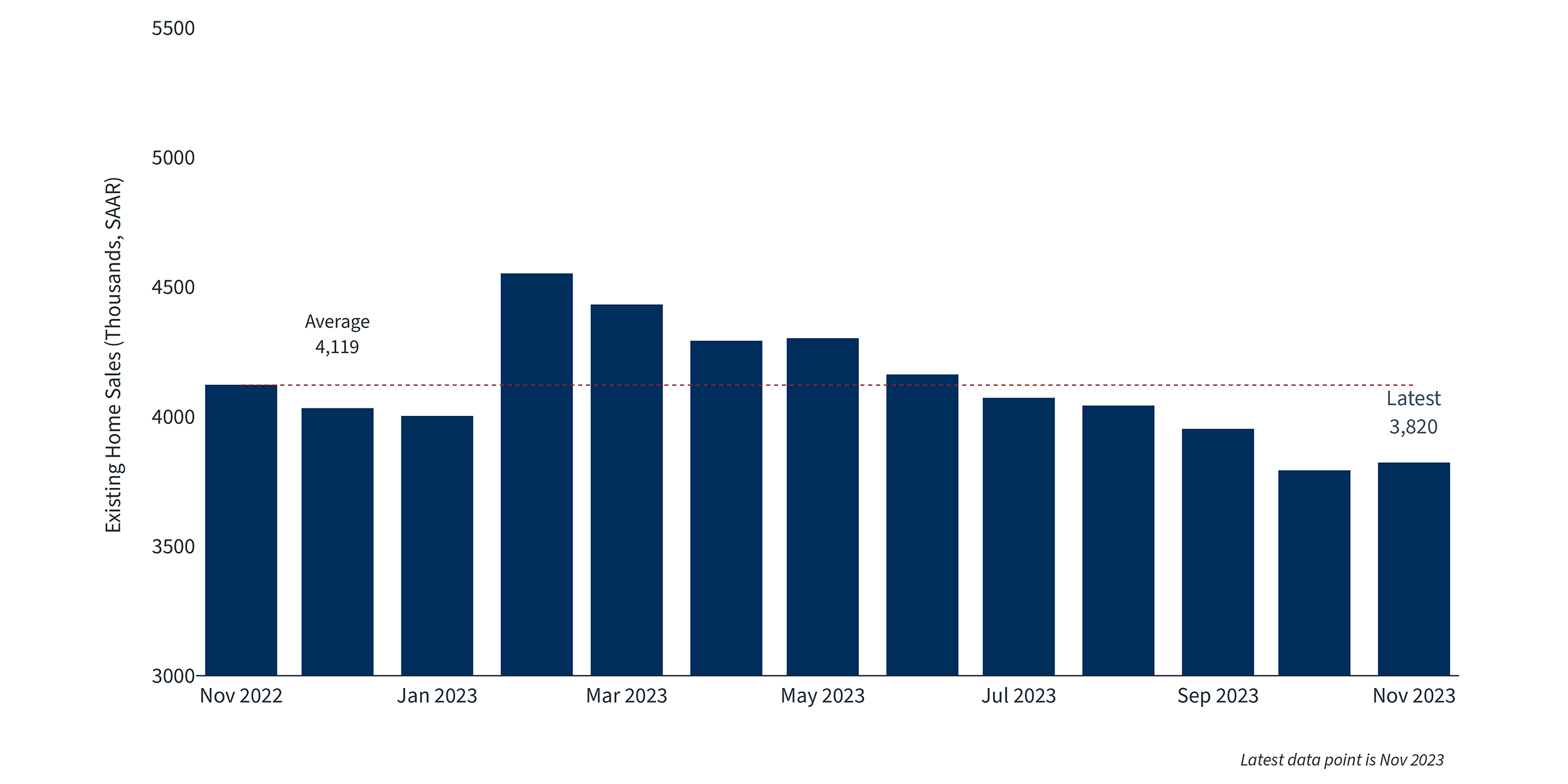

Housing was another big story in 2023. The increase in mortgage rates alongside the somewhat surprising resilience of housing prices have made homes the least affordable they have been since the mid-1980s. This has caused a challenging cycle of low mobility and high prices, as homeowners do not want to give up their low-rate mortgages and new potential homebuyers cannot afford the housing that is on the market. The result has been reduced transaction volumes and propped up prices. Fortunately, mortgage rates have fallen around a full percent from their highs in late 2023 and homebuying activity is picking up, but it may take an even bigger increase in housing starts and a continued reduction in mortgage rates to get the housing market in balance.

As mortgage rates fall from their peaks, household formation continues, and new home purchases remain an unusually large share of all home transactions, it will be interesting to see when transaction volumes for existing houses return to more normal levels. Very few forecasters envision a housing market crash like the economy experienced in 2009-2010, as robust lending standards and a strong labor market are expected to support the housing market's stability. Home prices might see modest growth after 2024, as long as mortgage rates decline and wage growth continues, though a decrease in housing prices may be needed to really get volumes back to historical averages.

Existing Home Sales3

Should we expect new leadership in equity markets?

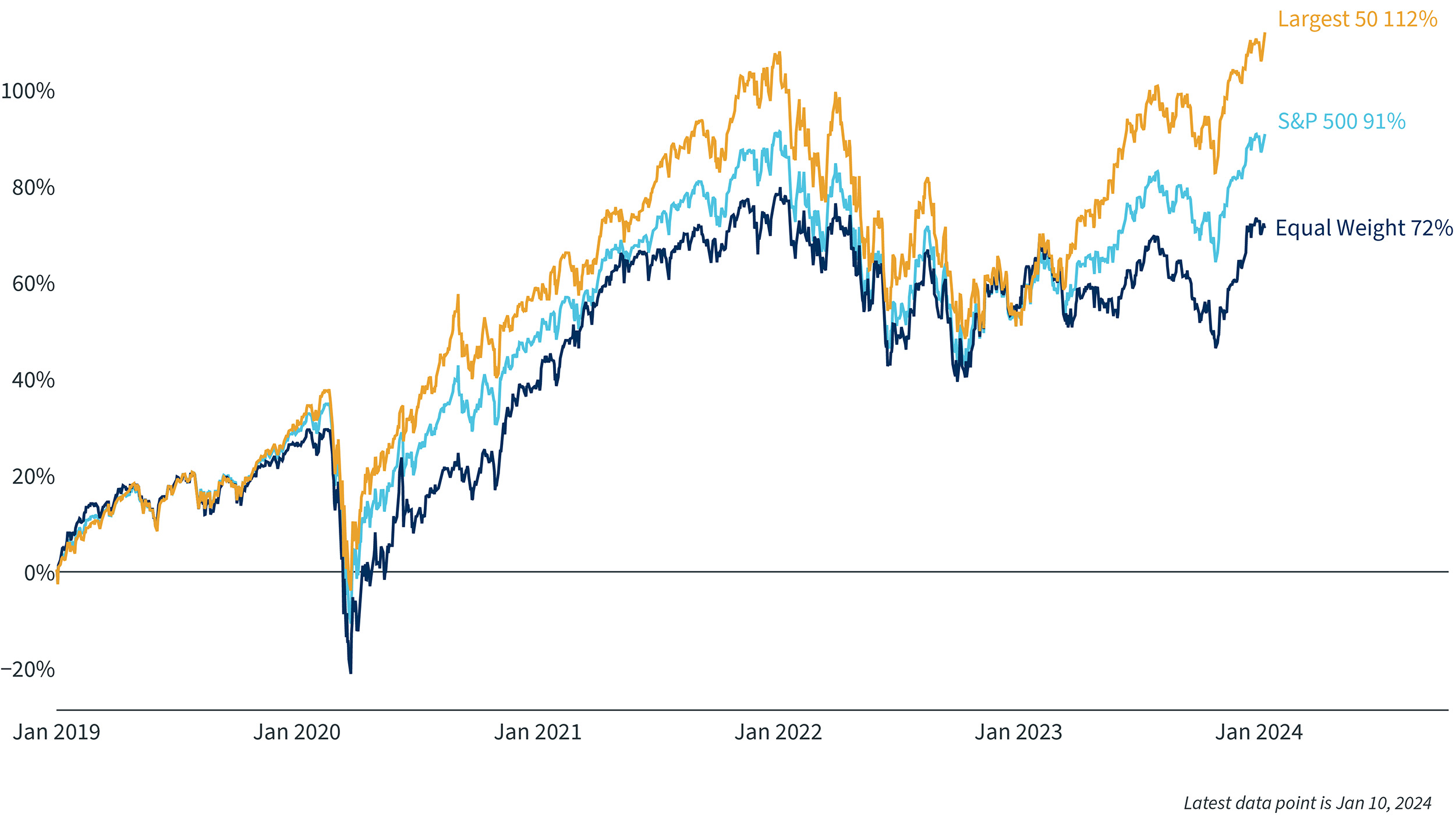

Equity and fixed-income markets, which experienced significant downturns in 2022, recovered in 2023, albeit with continued volatility. Within equities, one of the most important stories of the year was the concentration in returns. Seven names — Meta, Nvidia, Microsoft, Alphabet, Tesla, Amazon and Apple — vastly outperformed the rest of the market, especially in the first half of the year. This is particularly evident when comparing the S&P 500 market-cap weighted index with the equal-weighted index, which allocates an equal share to all constituents. The equal-weighted S&P 500 underperformed the standard market-cap weighted S&P 500 by a record amount in the first six months of 2023, and while the difference did not widen too much the rest of the year, there was still a large discrepancy between the two indexes.

Overall, roughly 72% of all stocks in the S&P 500 underperformed the index in 2023, which is a large number. The concentrated leadership in equity markets has certainly been a key driver of market performance. However, as we move through 2024, the dynamics may shift, with a potential for undervalued stocks to outperform, or at least for broader market breadth. Market performance in 2024 will depend on various factors, including corporate earnings, consumer spending and global economic conditions, but predicting exactly which assets will do the best is extremely challenging. Diversification remains essential for investors, given the uncertainties and potential shifts in market leadership.

S&P 500 Equal Weight Recent Returns4

Looking ahead

The year of 2023 proved once again that sometimes markets and economic data can surprise even the most knowledgeable forecaster or economist. Entering the year, the consensus was for a recession to happen later in 2023, for markets to have modest returns and for the Fed to have started cutting rates. Instead, GDP growth proved remarkably resilient, unemployment stayed low, the S&P 500 was up over 20%, and the Fed raised rates to their highest level in decades before pausing in the second half of the year.

As we step into 2024, the current consensus is one of cautious optimism, but there is still a lot of uncertainty about how the year will unfold. Will inflation reach the Fed’s 2% target without causing a recession? How quickly might the Fed cut rates? Will housing transactions start to pick up and how will prices be affected? Will we see continued concentration in equity markets or will returns become more broadly based? One of the many challenges to investing is that even if we knew the answers to these questions, we still would not know exactly how markets would react to the information.

For investors, the focus should remain on maintaining diversified portfolios and avoiding the temptation to time the market. The lessons learned in the tumultuous years of 2022 and 2023 will be invaluable as we navigate the uncertainties and opportunities of 2024.

The views and opinions represented in this message are my own and do not necessarily reflect the perspective of Bremer Bank, its subsidiaries or affiliates, or its employees. This message is provided for information purposes only and nothing in it constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold any security. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor.

“Inflation Measures. Current year-over-year changes and 12-month peaks and troughs.” Sources: Clearnomics, Bureau of Labor Statistics, Bureau of Economic Analysis

“Federal Funds Rate. Target range lower limit.” Sources: Clearnomics, Federal Reserve

“Existing Home Sales. Number of previously owned and occupied homes sold.” Sources: Clearnomics, National Association of Realtors

“S&P 500 Equal Weight Recent Returns. Equal weight index compared to market cap weighted and top 50 stocks. Cumulative price return since 2019.” Sources: Clearnomics, Standard & Poor’s