Economic challenges, opportunities on the horizon in the second half of 2025

by Clearnomics

As we begin the second half of 2025, the U.S. economy presents a positive but mixed picture. The economy is healthy, unemployment remains low, inflation is moderate and consumer confidence is improving. However, government policies are changing rapidly, even if they are more certain than earlier this year.

Meanwhile, the Federal Reserve has kept policy rates on hold as it balances economic growth against inflation. Throughout all this, financial markets are adjusting their expectations as uncertainty continues around trade policy, as well as how tariffs might affect consumers and businesses.

In this environment, it’s important to stay informed on economic, political and financial market trends. Here are a few key themes that drove the economy in the first part of the year that will likely continue through the second half.

Tariff uncertainty is fading

Trade policy was the main driver of market and economic uncertainty during the first six months of the year. As negotiations with trading partners have progressed, markets have rebounded to new all-time highs. The economic impact of tariffs is still uncertain, but many forward-looking expectations have improved.

Several sectors that had previously underperformed — including industrials, communications and financials — gained momentum, which was another factor in surging market performance. Meanwhile, technology stocks continued their strong showing but were no longer the top market drivers that they were in 2023 and 2024.

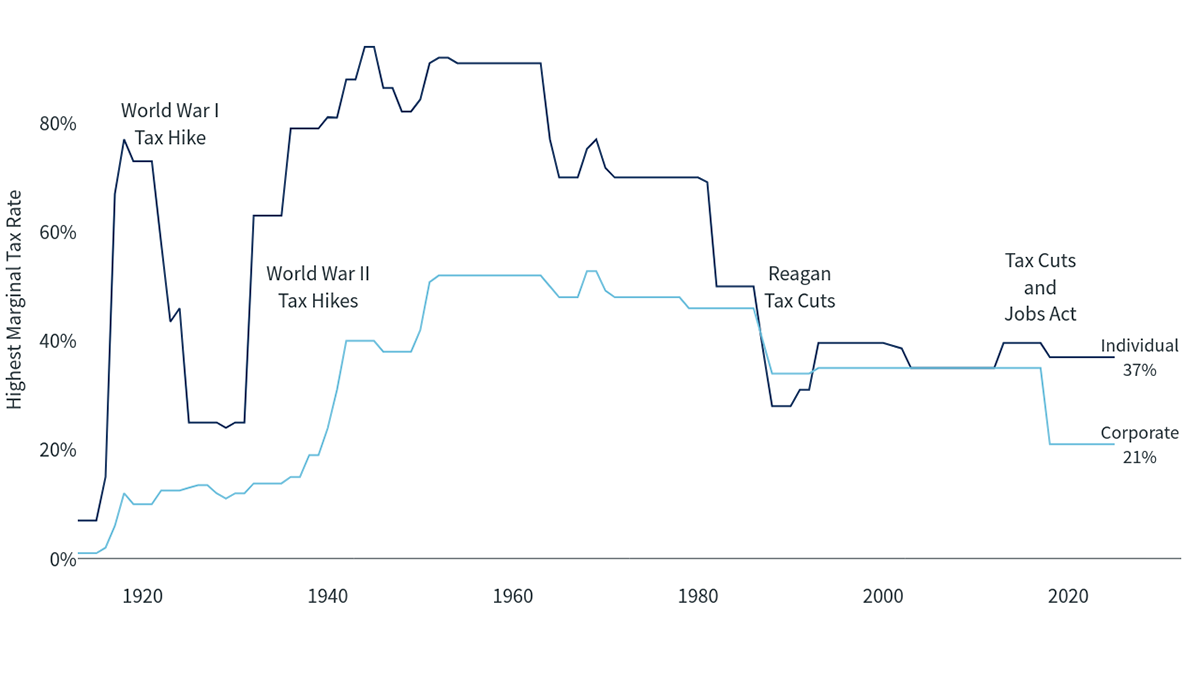

Tax policy clarity is positive for households and businesses

Individual and corporate taxes 1

A new tax and spending bill was signed into law on July 4. Tax and spending policies have been a source of political uncertainty in recent years, but the new law means that there won't be a "tax cliff" where provisions from the 2017 Tax Cuts and Jobs Act (TCJA) expire at the end of 2025. This would have made tax planning more difficult for individuals and companies.

In addition to extending TCJA tax cuts, the law increases the standard deduction, raises the child tax credit and state and local tax deduction cap, reduces taxes on tips up to a $25,000 threshold, and makes many other changes to the tax code. Notably, it also raises the federal debt ceiling by $5 trillion, so Congress won’t need to increase the borrowing limit for quite some time. Debates over the debt ceiling have impacted financial markets in recent years.

For households and businesses, greater clarity around tax policy is helpful because it allows for easier financial and strategic planning in the second half of the year. It’s important to understand the many extended and expanded provisions in the new tax law to ensure that you’re properly set up for the years to come.

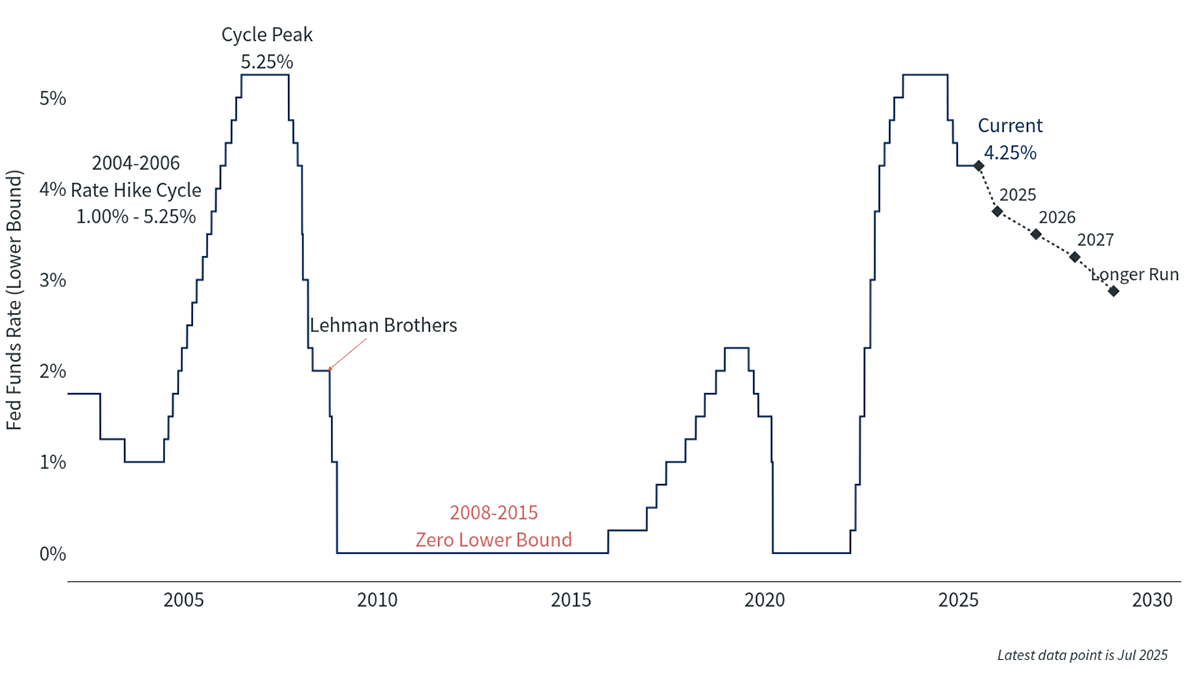

The Fed is maintaining its cautious stance

Federal funds rate 2

The Fed has been in a holding pattern as it awaits clarity around trade and tax policies. The Federal Open Markets Committee (FOMC) has kept interest rates unchanged since implementing a quarter-point reduction last December, reflecting a cautious approach to balancing economic growth against inflation.

The Fed’s June meeting provided additional insight through its latest Summary of Economic Projections, a report released by the Fed four times a year with forecasts from the members of the FOMC. The June report showed a lower forecast for GDP growth in 2025, with Fed officials now expecting the economy to grow by 1.4%, which is less than the 1.7% predicted in its previous summary. At the same time, the Fed’s forecast for inflation ticked up from 2.7% at the end of this year to 3.0%.

Market expectations for rate cuts have shifted over the past six months as economic trends have improved. The Fed typically lowers rates to stimulate growth during slow periods and raises them to cool the economy down when it shows signs of overheating. With a stronger economy, many economists and investors expect the Fed to cut rates in the second half of the year. Current market-based measures suggest two to three rate reductions for the second half of 2025, although this is always subject to change.

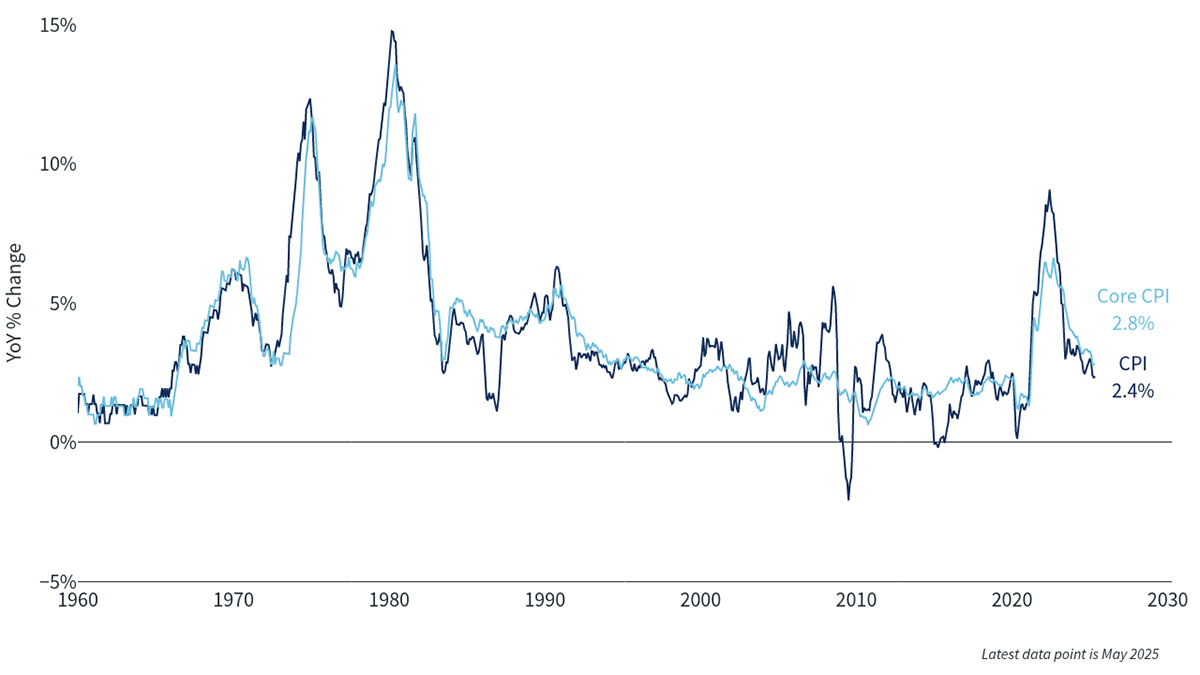

Inflation remains above target despite progress

Consumer price index 3

Over the past few years, inflation has been a significant problem for both consumers and businesses. Consumer prices have increased significantly, especially for everyday purchases like food and gas, while input costs have increased for many businesses as well. Many feared that tariffs would increase prices further.

Fortunately, inflation has moderated somewhat but continues to run above the Fed’s 2% target. It’s important to distinguish what we experience in our daily lives from what inflation tells us about the broader economy. Both the consumer price index (CPI) and personal consumption expenditures (PCE) index, the two major gauges that economists and policymakers use to measure inflation, have declined over the past six months, with the most recent price increases from a year earlier coming in at 2.4% and 2.3%, respectively. While this doesn’t mean that consumers aren’t facing higher prices today, it does show that the economy is in a more stable place.

Consumer sentiment, which measures how optimistic or pessimistic consumers feel about the overall state of the economy and their personal financial situations, worsened earlier this year due to inflation concerns. This data serves as a key indicator of future spending patterns because consumer expenditures drive economic activity. However, measures of actual consumer spending have been relatively steady, so many economists hope this can continue as sentiment improves.

The disconnect between perception and reality that we saw in recent months has become a defining characteristic of the current economic cycle. While concerns persist about tariffs potentially driving prices higher, the severe price spikes that many economists initially feared have largely not materialized.

The labor market shows continued strength

Perhaps the most important reason consumer spending has continued to grow is that the job market is strong. Unemployment, at only 4.1%, is low across most sectors, although certain areas have experienced impacts from federal spending reductions, the rise of artificial intelligence and other trends. New jobs continued to be added at a steady pace, with 147,000 created in June across the country. Wage gains have decelerated but are still stronger than average. All in all, the strong national job market continues to be the foundation of the economy.

Looking forward

The economic landscape of 2025 presents both challenges and opportunities. While tariff uncertainty and elevated inflation continue to create headwinds, the strength of the labor market and consumer spending provides underlying support for the economy. The Fed’s measured approach to monetary policy, combined with improving clarity around trade negotiations, suggests a path toward greater stability in the second half of the year. Households and businesses alike should maintain a broad perspective in this environment in order to plan accordingly.

The views and opinions represented in this message are Clearnomics’ and do not necessarily reflect the perspective of Bremer Bank, its subsidiaries or affiliates, or its employees.