3 investor insights as markets stabilize in Q2

Earlier this year, we stated that it was very possible that 2022 would be more volatile than 2021. That certainly proved true in the first quarter. By mid-February, most U.S. equity indices had fallen into correction territory (a fall of more than 10 percent) and yields on bonds had risen quite dramatically. The selloff was initially caused by higher than anticipated inflation, which was proving less temporary than experts and investors predicted in 2021. Then all eyes turned to Ukraine in mid-February, when Russia invaded the country, leading to a still ongoing war. Immediately after the invasion of Ukraine, investors had to adjust to a rapidly changing environment.

Despite the turmoil and uncertainty throughout the quarter, equity markets recovered in March. By the end of the first quarter, the S&P 500 had declined just under 5 percent year-to-date. Other equity markets – such as international developed, emerging markets and small-cap U.S. stocks – fell a bit more than the S&P 500, but the difference between the S&P 500 and these other asset classes was 3 percent or less.

Yields on bonds continued to rise even as equity markets recovered, so fixed-income investors did not fare quite as well. By the end of the quarter, investment grade fixed income had one of its worst quarters in 40 years as the Fed began raising rates and made plans to reduce its enormous balance sheet. Inflation remains elevated, partly due to the crisis in Ukraine, which has affected the price of many commodities and exacerbated supply chains issues.

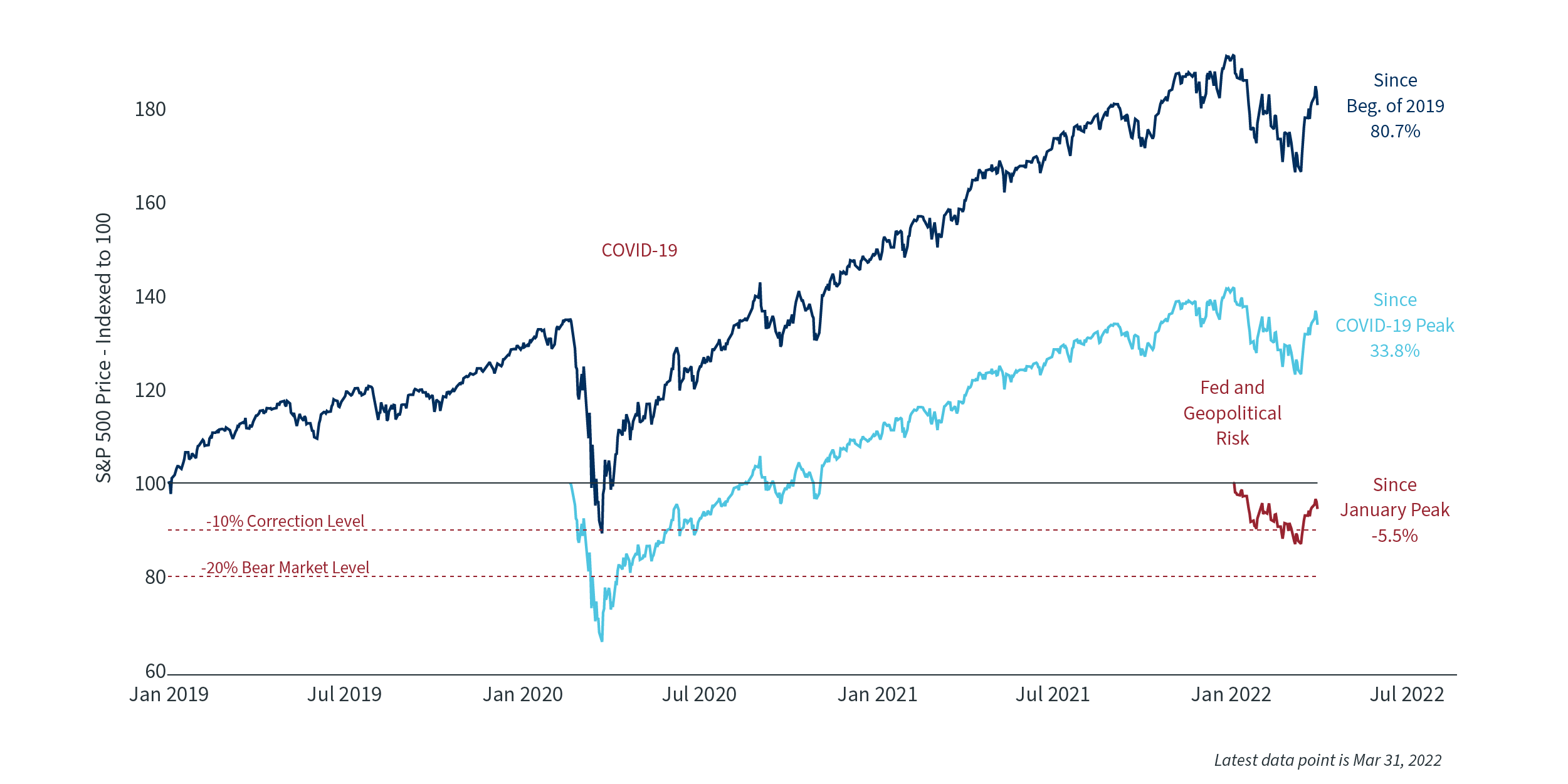

This period follows an exceptional three years of portfolio performance for diversified investors, so it is important to put the current volatility in perspective. The chart below shows that while the first quarter was volatile and almost all global equity markets experienced declines, in the context of the past two or three years, the drop is fairly small relative to the overall gains during the period.

Stock market returns in perspective1

#1 Fed followed expected path

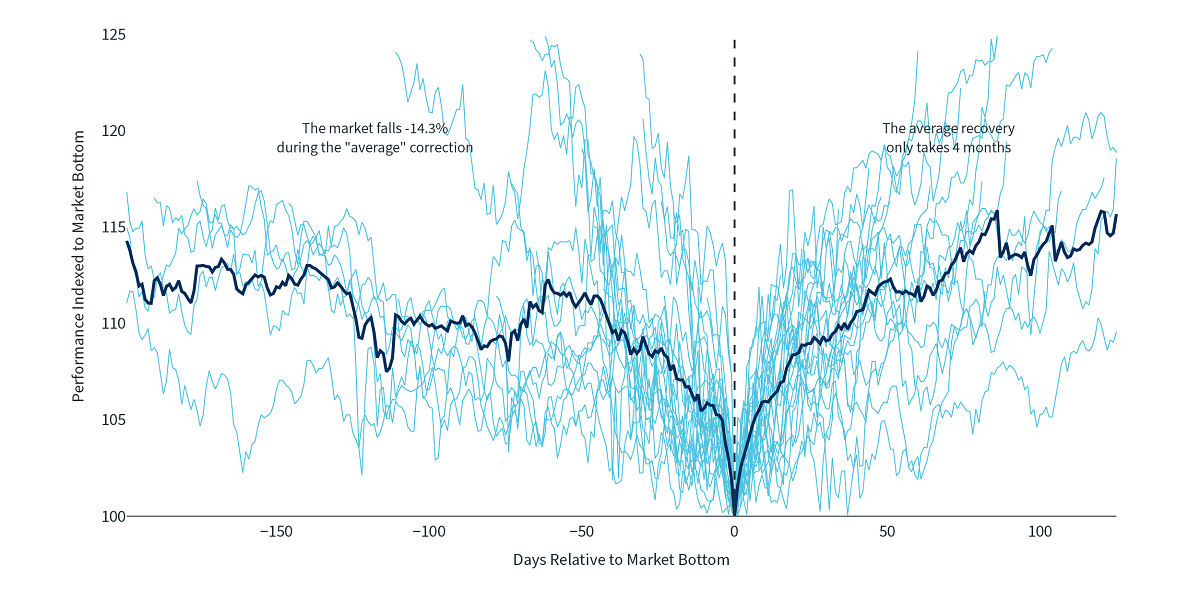

First, markets widely expected the Fed to begin raising policy rates in the first quarter and to end its asset purchase program in response to rising inflation and strong economic growth. Not only did the Fed do exactly that, but they have indicated they will likely accelerate their pace of tightening in the coming months. The Fed's last set of projections show that the federal funds rate will reach 1.75 percent by the end of the year, whereas more recent statements by Fed officials and fed funds futures show that a level of 2.5 percent is more likely. This means that 50 basis point rate hikes are possible at upcoming meetings. Equity markets recovered soon after the Fed’s decision to raise rates a quarter percent in mid-March. The S&P 500 rebounded 8.6 percent in the second half of March while the Nasdaq recovered 13 percent. Both are still negative on the year, but no longer in correction territory. This serves as a reminder that Fed rate hikes are not only normal during economic expansions, but they are justified today given the strong economy and higher prices. With so much negative news in Q1, it can be easy to forget that corporate earnings, job growth and hiring continued to be robust in the first quarter, and the unemployment rate is down to 3.6 percent. These statistics show that markets can recover as events and policy decisions reduce uncertainty.

Market corrections and recoveries2

# 2 Yield curve flattened

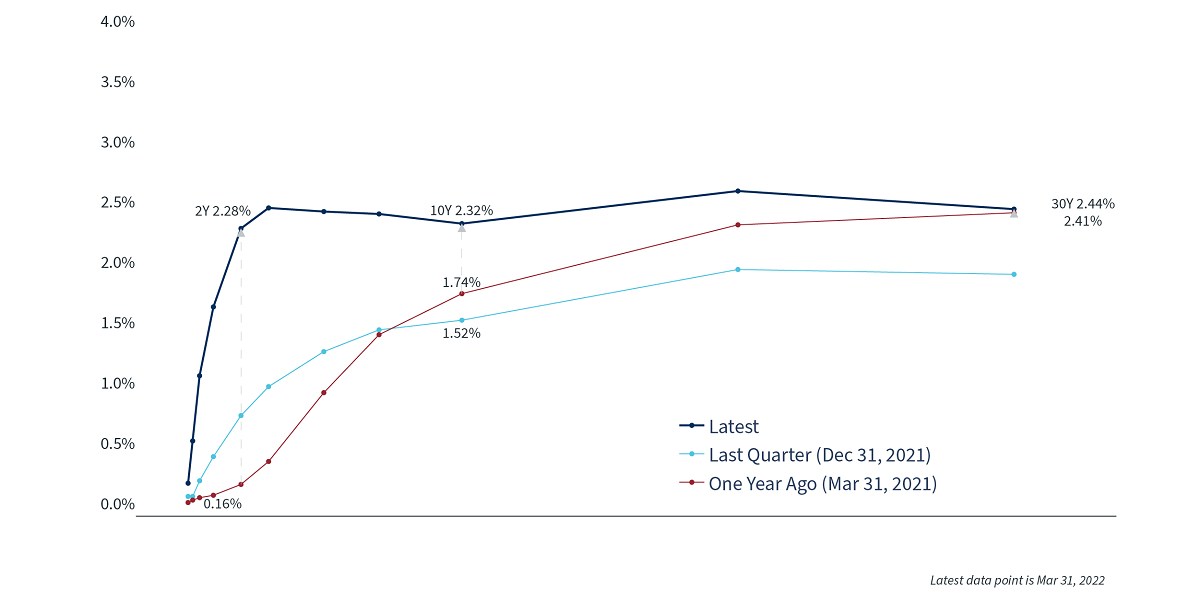

Second, perhaps the most persistent impact of the Fed's change in policy is its effect on interest rates. The 10-year Treasury yield has risen above 2 percent for the first time since before the pandemic, and the 2-year treasury, which is more sensitive to Fed policy, almost tripled in yield. As a result, much of the yield curve, from two years to 30 years, has flattened completely. The yield curve even "inverted" briefly, with the yield on the two-year Treasury exceeding the yield on the 10-year. Many economists use this as a predictor of recession, although there is often a long lead time before the economy truly decelerates. It is also important to note that the Treasury curve is still upward sloping when looking at “real” yields, which are the difference between nominal yields and expected inflation.

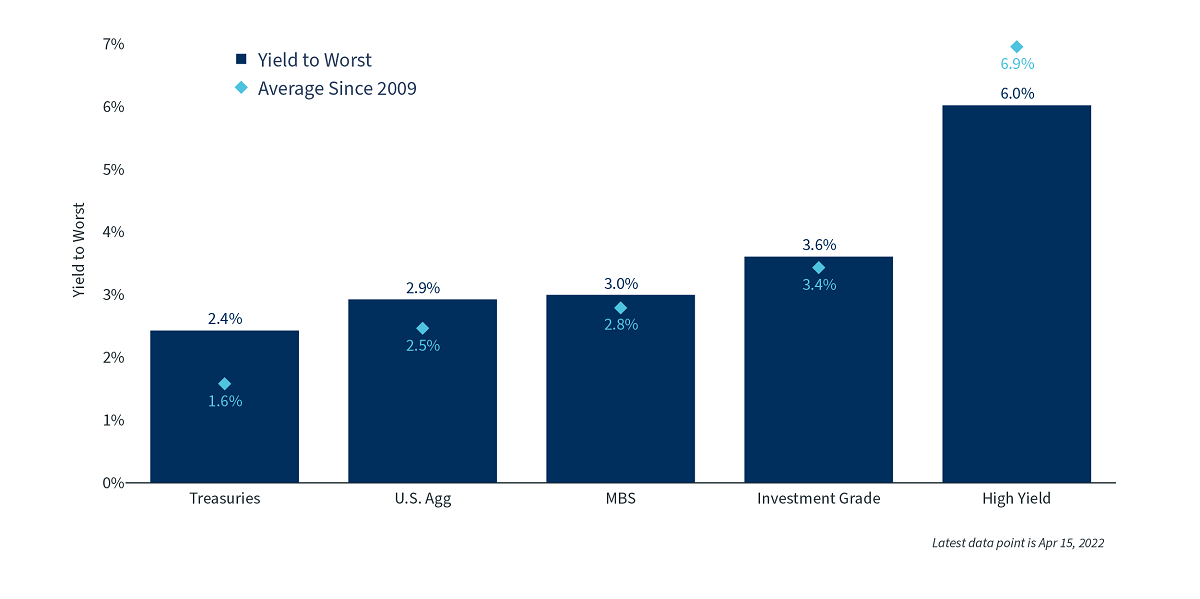

While the first quarter of 2022 was painful for fixed-income investors, a move to higher yields is welcome as it allows for future reinvestment to be done at higher rates, a boon for anyone trying to live off the income produced from their portfolio. Investors should start to see higher rates on money market funds this year, and intermediate to long-term bond funds are already priced to yield much higher income levels than they were at the end of 2021.

Treasury yield curve3

Traditional sources of bond yield4

#3 Ukraine conflict created more uncertainty

Finally, unlike the Fed’s decision to raise interest rates, the conflict in Ukraine was a surprise to financial markets. Unlike changes in Fed policy, it is much harder to predict the outcome and side effects of geopolitical events like the war in Ukraine, which has caused volatility in financial, agricultural and commodities markets around the world. While the humanitarian consequences are still at the forefront, the war has had a big impact on the prices of many goods, from oil and natural gas to grains and nickel, as Ukraine and Russia are large exporters of many commodities. We anticipate elevated prices and volatility in these markets to continue in Q2 as countries try to figure out a way to reduce their reliance on Russian imports.

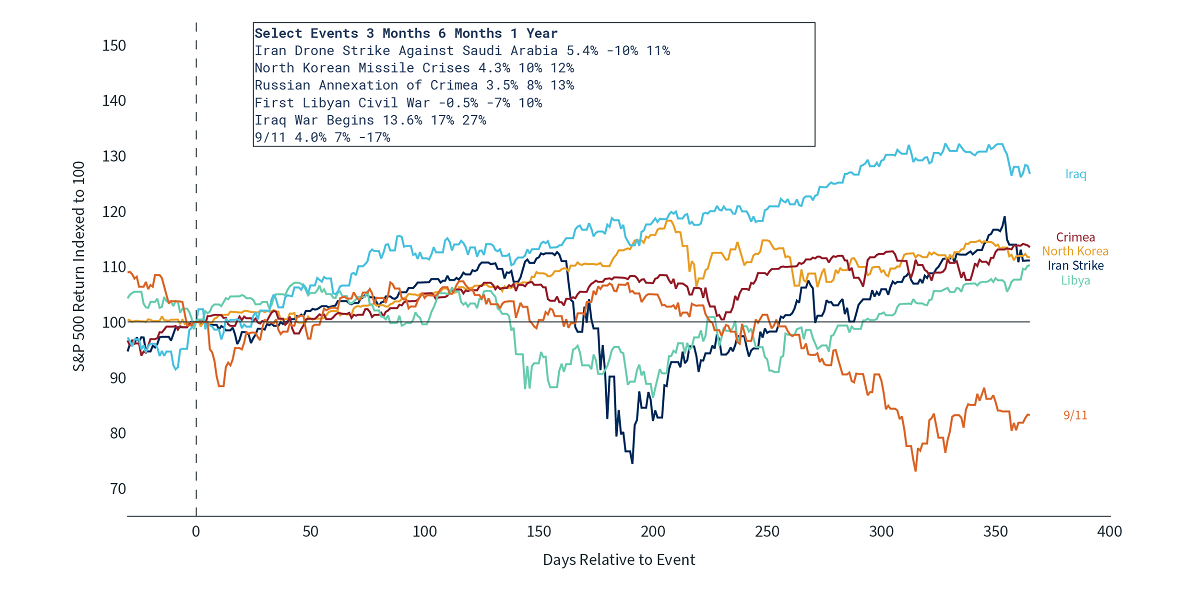

While every geopolitical crisis is different, history shows that equity markets are usually able to adjust and move forward over time. This was true during Russia's annexation of Crimea, the wars in Afghanistan and Iraq, after 9/11, etc. This was even the case during the Cold War and throughout other conflicts of the 20th century. Investors who have not overreacted to these events, regardless of the news coverage and headlines, have often been rewarded.

Stocks and geopolitical events5

Conclusion

As a result, investors ought to remain focused and disciplined throughout challenging periods in the market. The first quarter underscores that investing requires taking the good with the bad. In fact, investors are rewarded in the long run because they can stick it out in difficult times. Despite the many shocks and unexpected events in the first quarter of 2022, investors should continue to stay patient and focused as markets adjust and shift in the second quarter and beyond.

Download as PDFS&P 500 index over different time periods, reindexed. Source: Clearnomics, Standard & Poor's, New York Times.

S&P 500 total returns since World War II. Market corrections are peak-to-trough declines of 10% to 20%. The bold line is an average across all corrections. Source: Clearnomics, Standard & Poor's.

The shape of the U.S. Treasury curve last year versus today. Source: Federal Reserve.

Yield to worst and averages since 2009. Source: Clearnomics, Bloomberg.

Select events and S&P 500 total returns 3, 6 and 12 months after. Source: Clearnomics, Standard & Poor's.