Where markets, rates and the economy are headed into year-end

We are now in the final quarter of 2022 and are rapidly approaching year-end. From a market perspective, it has not been a year that anyone would like to relive anytime soon, as almost every traditional asset class is down year to date. The sell-off has been significant, as major asset classes like large-cap U.S. equities and intermediate-term Treasury bonds are down 10-20% or more in the first nine months of the year, limiting the supposed benefits of a diversified portfolio.

Inflation remains very elevated, and the Fed has increased its forecast for how high it will have to raise short-term interest rates to bring inflation back down to 2%, potentially causing a recession in the next year.

Despite all the negative market news, there are some positive signs to look forward to as we move through the fourth quarter. Automobile inventories are improving, shipping times on all manner of goods are shrinking, inflation is starting to fall (albeit slowly) and the labor market remains robust. While volatility is likely to stay high through year-end, markets are starting to have some tailwinds, which could help asset returns in 2023.

The third quarter was tough for equities and bonds

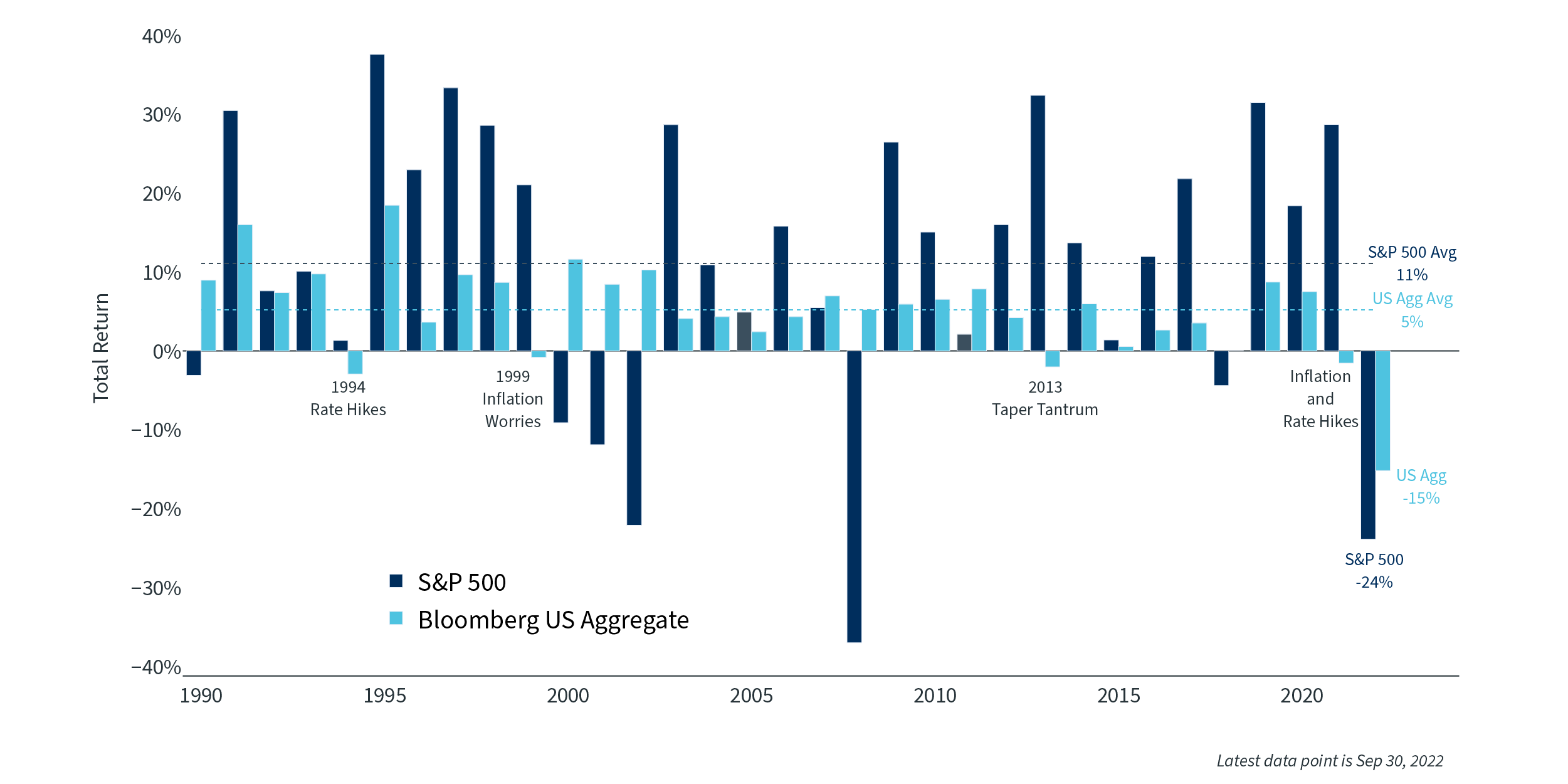

During the third quarter, the S&P 500 was down over 5%, taking year-to-date losses to almost 24%. The Bloomberg Barclays Aggregate Bond Index, a broad U.S. fixed-income benchmark, was down over 4% in the third quarter, resulting in another quarter where both stocks and bonds were down, an unusual occurrence. For the year, the Aggregate Bond Index is down almost 15%, one of its worst performances since records began in the 1970s.

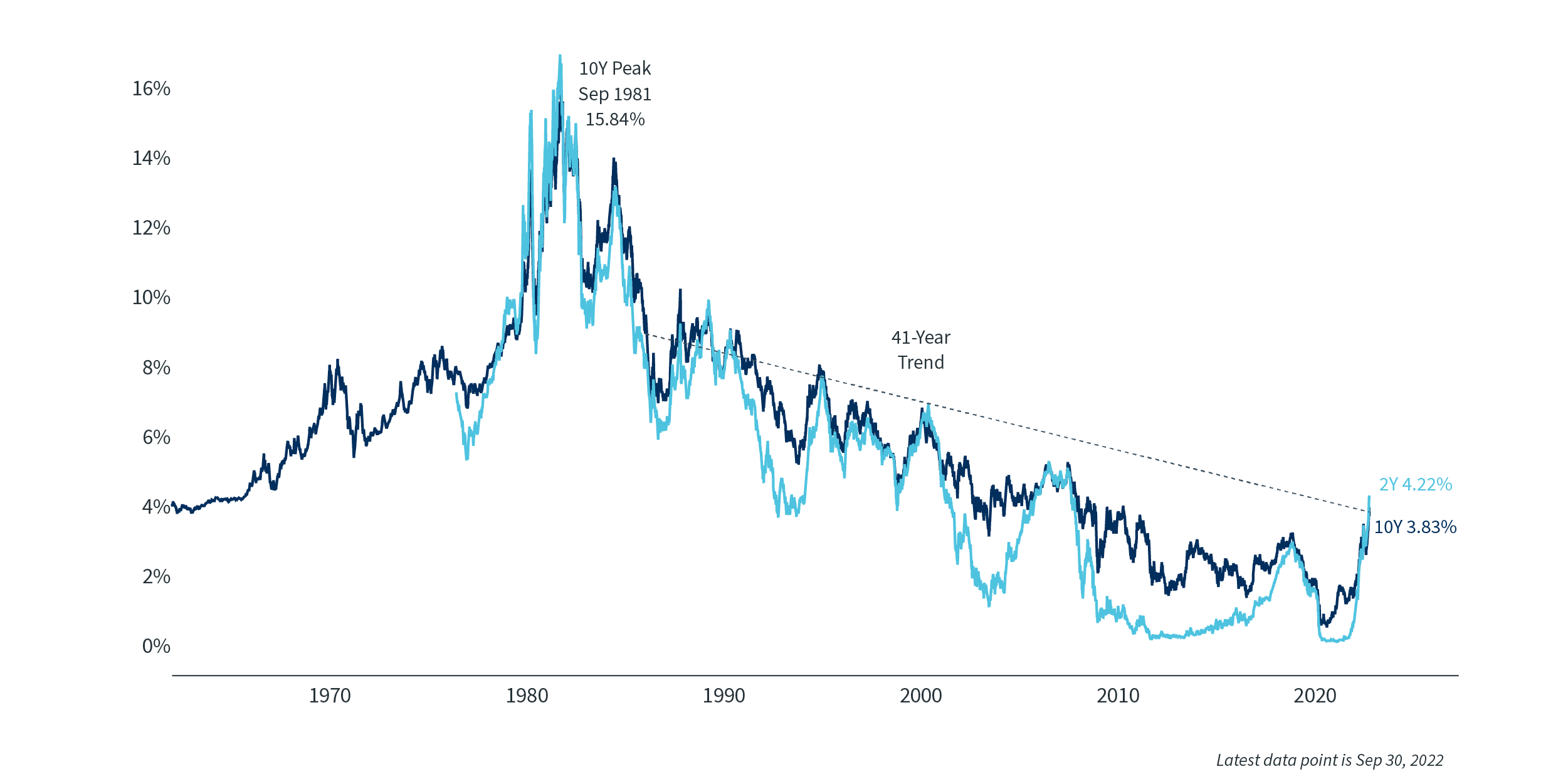

As a result, yields on bonds rose substantially in the quarter. The two-year Treasury rose 1.3%, from 2.9% to 4.2%, capping its largest yield increase to start a year since 1981. The 10-year Treasury also saw its largest yield increase since the early 1980s, though the yield curve remains very inverted as the two-year yield finished the quarter almost 0.40% higher than the 10-year yield. Many other supposedly defensive assets, such as gold, cryptocurrencies and some commodities, have not proven to be a safe haven this year, making it hard to find a place to hide other than cash.

Stock and Bond Annual Returns1

Historical Interest Rates2

Inflation is starting to fall, though slowly

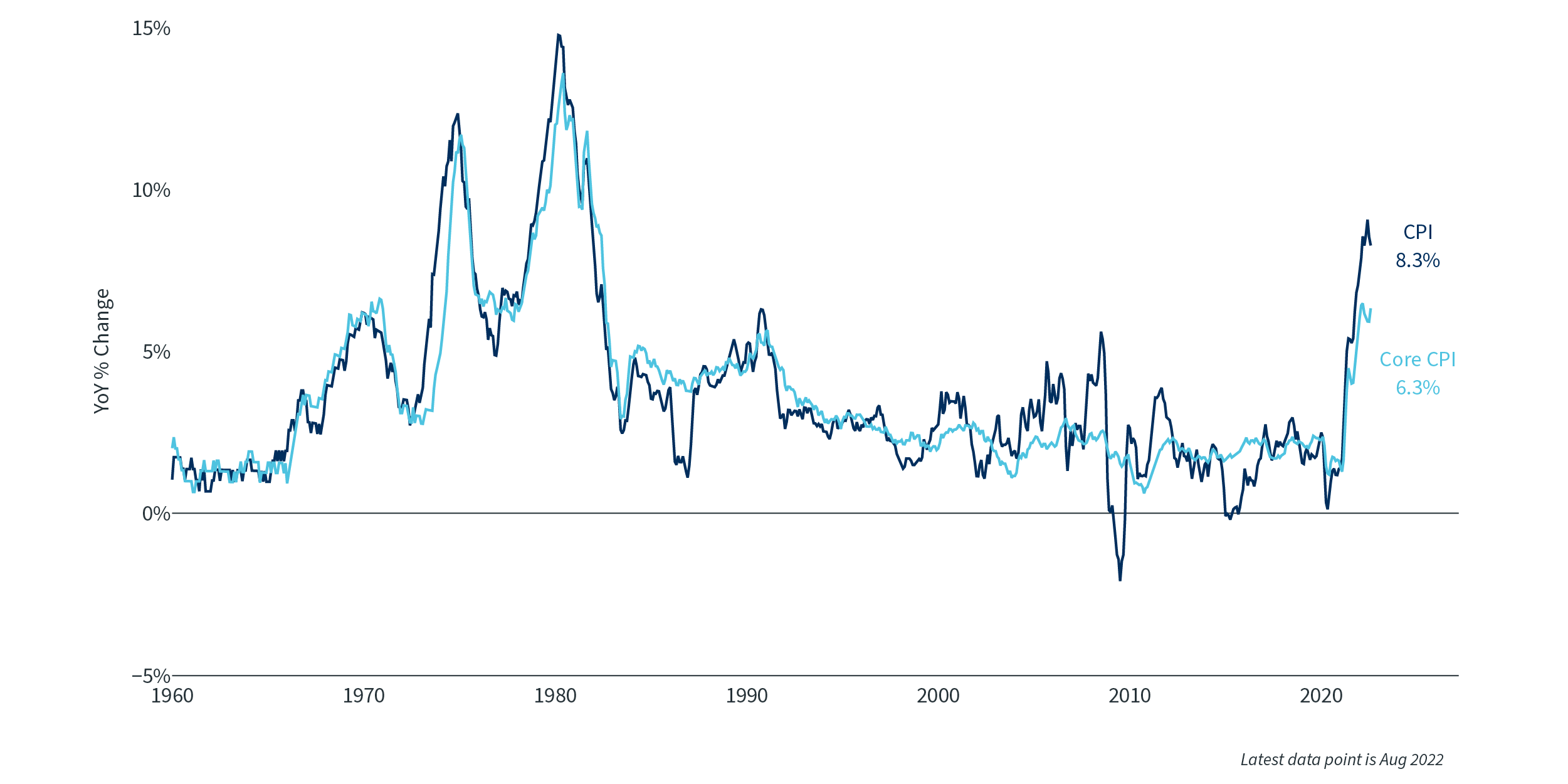

Much of the sell-off in stocks and bonds occurred after a worse-than-expected inflation reading in early August. The U.S. Consumer Price Index was expected to have fallen to 8.1% from 8.5% in July, but it only fell to 8.3% as price pressures proved more enduring than anticipated. This caused a big change in the Federal Reserve’s planned path for interest rate increases. The Fed raised rates by 0.75% in September and is on track to raise rates another 1.25% through the end of 2022.

The Fed wasn’t alone in hiking rates. In fact, July saw the most rate hikes by global central banks ever recorded. Many countries, particularly in Europe, are also facing inflationary pressure, and their central banks are raising rates to curtail demand before inflation becomes entrenched. Many of these rate hikes were of similar size to the Fed’s, though Sweden’s central bank was the most aggressive, raising rates a full 1.00% in September.

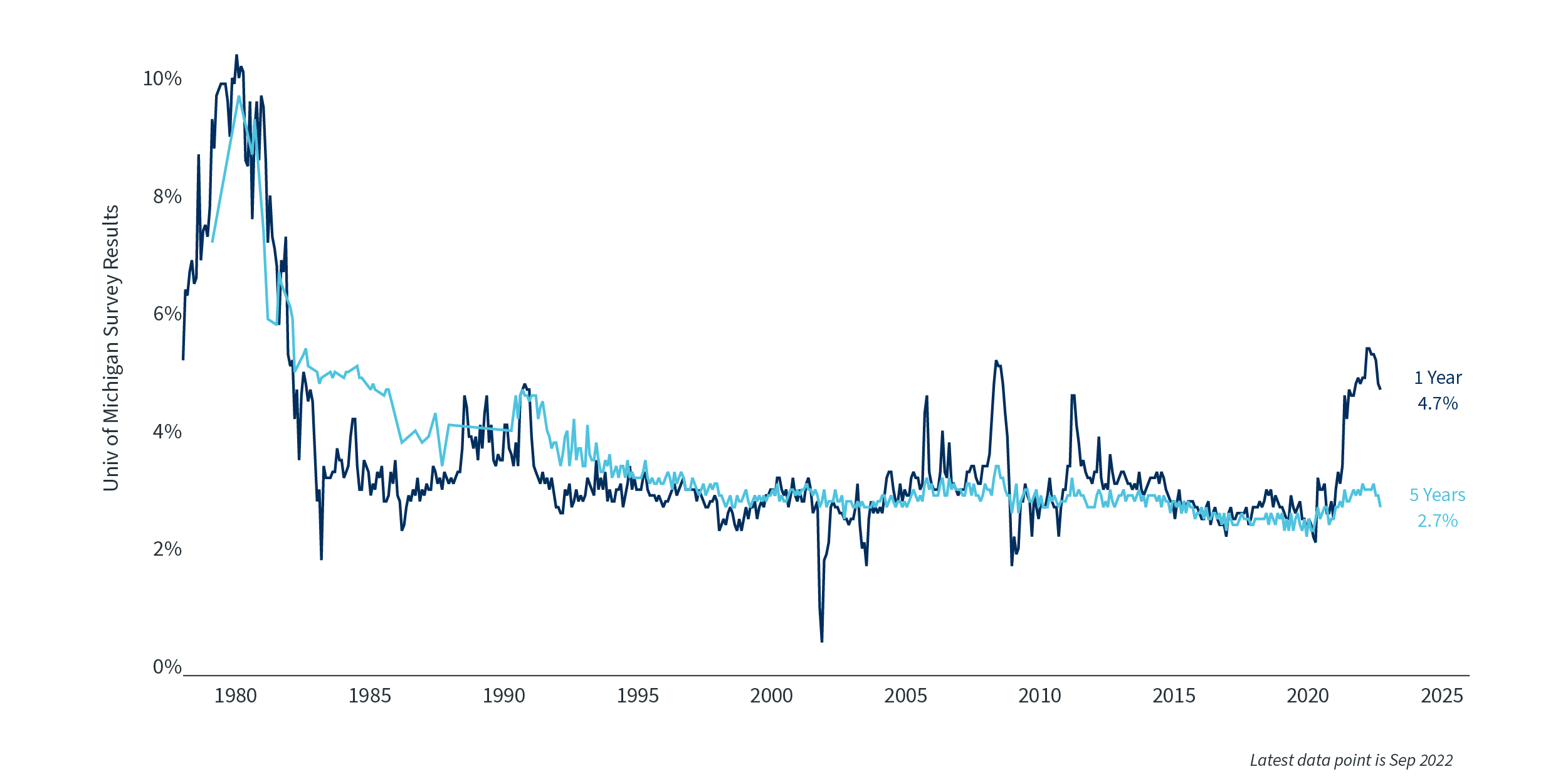

The further the Fed and other central banks hike rates, the more likely it is that the economy will enter a recession at some point in the next 18 months. Fortunately, expectations of future inflation have started to come down and are now in line with pre-pandemic levels when looking at expectations over the next five years. It is possible the Fed will not need to raise rates as much as feared to get inflation under control, especially with other central banks tightening as well, which will help reduce global demand.

Consumer Price Index3

Consumer Inflation Expectations4

Economic distortions caused by COVID-19 remain

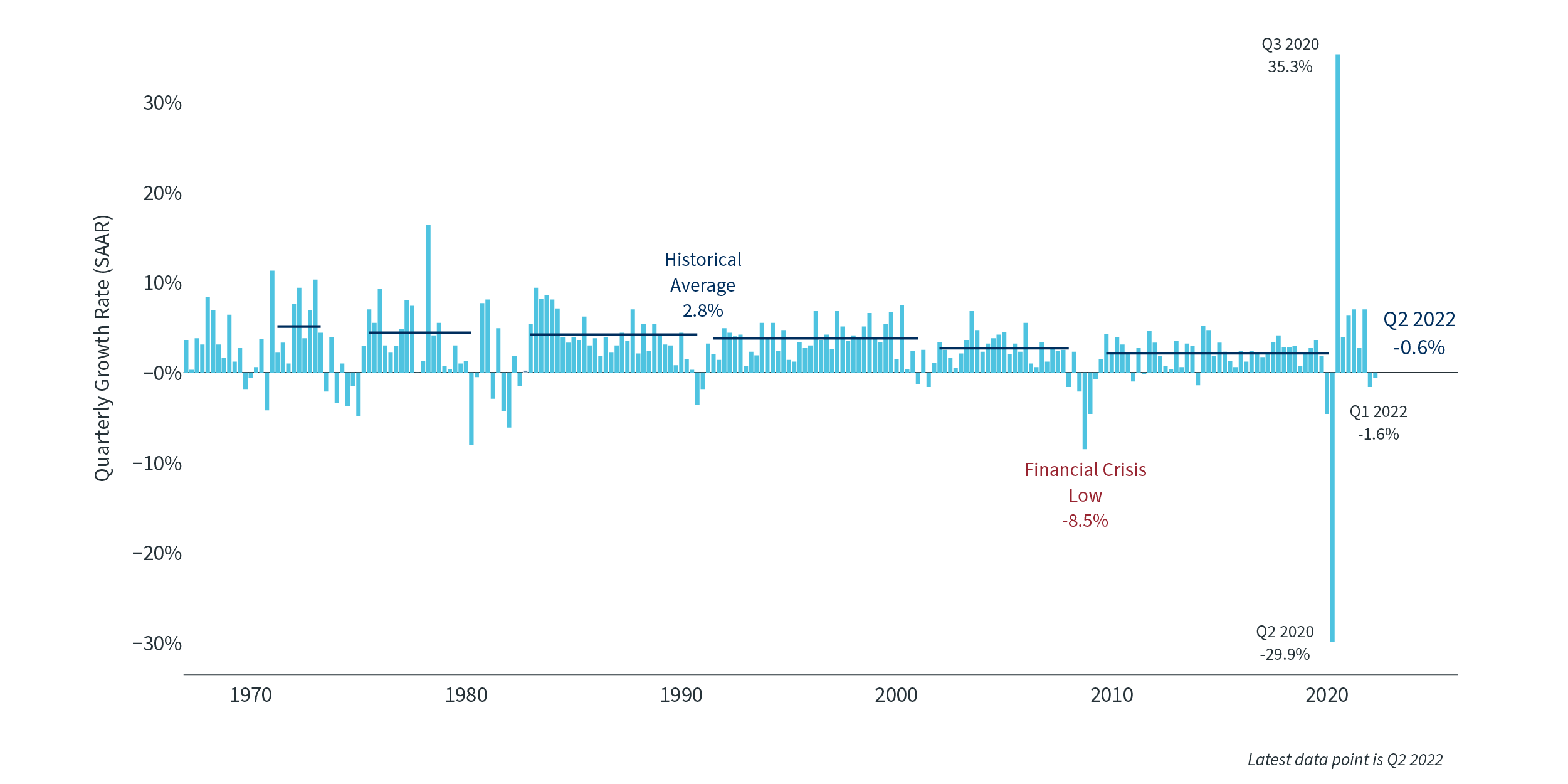

It is important to keep in mind that the fallout from the pandemic continues to affect economic data, as well as corporate earnings, inflation and global trade. It is now two years in the past, but it is worth remembering that in the second quarter of 2020, GDP went down 30%, then surged ahead 35% in the third quarter. To say these are extreme readings is an understatement as they dwarf all prior quarterly readings.

Ever since the start of the pandemic, it has been difficult to get a handle on the exact level of economic activity and whether it was growing. Consumers first showed a ravenous appetite for goods, especially during the lockdowns, then switched their demand to services like travel, dining out and going to the theater once those activities started opening up again. This meant that manufacturing companies, which faced shortages of their products early in the pandemic, were subsequently faced with excess inventory during the past six months. There are still some goods, such as automobiles, that are in short supply, but supply chains are mostly starting to recover.

The final GDP report for the second quarter of 2022 was released before the end of the third quarter, and it confirmed that GDP was negative for a second quarter in a row. GDP has been below zero mainly due to some unusual effects, from large changes in government spending and a huge trade deficit (first quarter) to a significant depletion of inventories (second quarter). These changes are related to the aftereffects of the pandemic and the stop-and-start nature of the recovery, which makes economic data more volatile and more difficult to interpret. It is also interesting to note that gross domestic income — another measure of economic activity focused on income instead of production — has been positive for both quarters. This is an unusual divergence, since both measures should result in the same reading if measured properly.

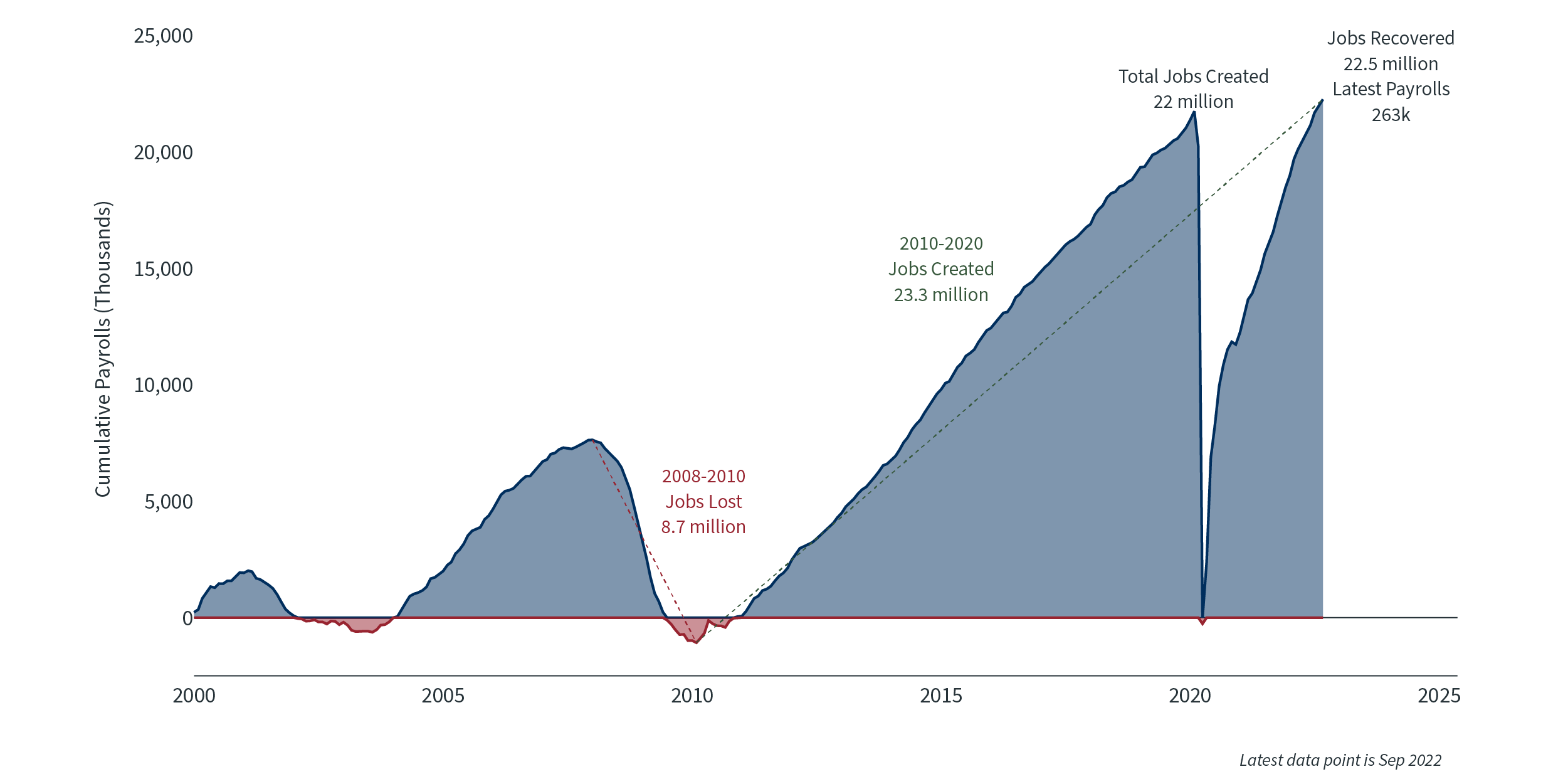

Another highly unusual feature of the pandemic can be found in the job market. The U.S. lost 22 million jobs in the span of two months, then gained them all back in two years — a remarkable recovery. Demand for labor is still very strong, as job openings are almost double the number of people seeking work. Even if the demand for labor tapers off, it shouldn’t lead to a significant rise in unemployment unless the downturn is severe.

U.S. Economic Growth5

Total Jobs Created Since 20006

High interest rates offer a silver lining

One of the third quarter’s biggest news stories was the extent to which the Fed raised interest rates and is projected to continue raising them. Higher short-term interest rates decrease demand, raise borrowing costs and increase the likelihood of a recession. But in some ways, it is actually good to have short-term interest rates over 4% or even 5%. Not that long ago, there was concern that we would enter the next recession with federal funds still around 2%(or even lower), which would limit the support the Fed could offer to combat the recession, as rates couldn’t be cut very much before they hit zero. Having a higher rate when the economy hits an inevitable recession allows the Fed to be more stimulative, cutting rates faster and farther to help boost demand. Higher federal funds and higher bond yields are also very beneficial to investors, as cash now earns a respectable return.

Summary

It is a bit crazy to think that just one year ago the federal funds rate was below 0.25% and the Fed was still actively buying longer-term bonds to stimulate the economy. A year later the Fed is on a path to raise interest rates by well over 4% in one year, and is allowing its portfolio of Treasury and mortgage-backed security holdings to mature without replacement. A lot can change in a short period of time, which is why it is prudent to avoid timing the market and to stay invested in a diversified portfolio.

“Stock and Bond Annual Returns. S&P 500 and Bloomberg U.S. Aggregate Total Returns” Sources: Clearnomics, Standard & Poor’s

“Historical Interest Rates. 10-year and 2-year yields since 1960” Sources: Clearnomics, Federal Reserve

“Consumer Price Index. CPI and Ex Food and Energy, YoY % Change” Sources: Clearnomics, Bureau of Labor Statistics

“Consumer Inflation Expectations. Inflation expectations next 12 months and 5 years, University of Michigan Surveys of Consumers” Sources: Clearnomics, University of Michigan

“U.S. Economic Growth. Quarterly GDP, seasonally adjusted annual rate” Sources: Clearnomics, U.S. BEA, NBER

“Total Jobs Created Since 2000. Cumulative change in non-farm payrolls, seasonally adjusted” Sources: Clearnomics, Bureau of Labor Statistics